Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 19, 2018

Week Ahead Economic Preview

- Flash PMI surveys for the US, eurozone and Japan

- Q4 GDP estimates for the US, UK, South Korea and the Philippines

- ECB, BOJ and BNM to set monetary policy

- UK unemployment rate and earnings

A number of countries see fourth quarter GDP numbers for 2017, but the flash January PMI releases will provide all-important, more up-to-date, steers of global economic growth and price trends at the start of 2018.

The European Central Bank and the Bank of Japan announce their decisions on policy and interest rates. UK jobs and wage data will provide insights into consumption patterns. Other key data highlights include US durable goods orders and home prices, China’s industrial profits, and Japan’s trade and inflation.

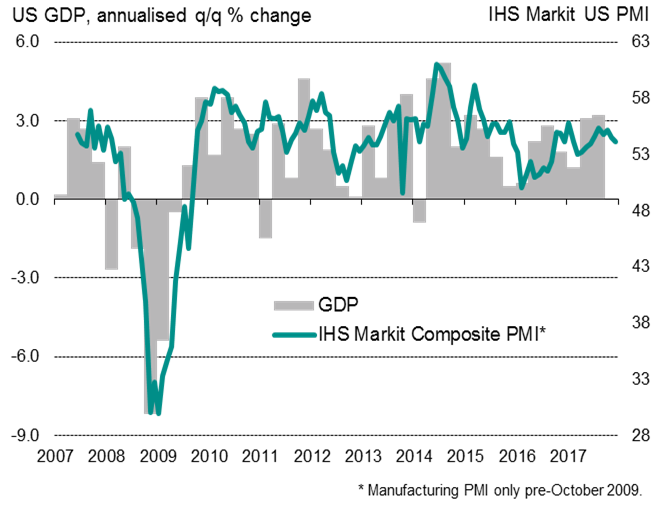

US GDP

Analysts are keen to see if the US economy maintained a steady pace of growth in the fourth quarter as the Fed expects three more rate hikes this year, with the next one possibly as soon as March. The consensus estimate for fourth quarter GDP growth is 3.0%, down from 3.2% in the third quarter, but the wide range of projections (from as low as 2.6% to as high as 4.4%) suggests there is significant room for a surprise. IHS Markit’s PMI surveys pointed to the US economy growing at an annualised rate of around 2.5% in the closing quarter of 2017.

US economic growth and PMI

However, it’s the flash January PMI data that will play a critical role in estimating the health of the economy at the start of 2018, and will thereby provide important signals as to future Fed policy.

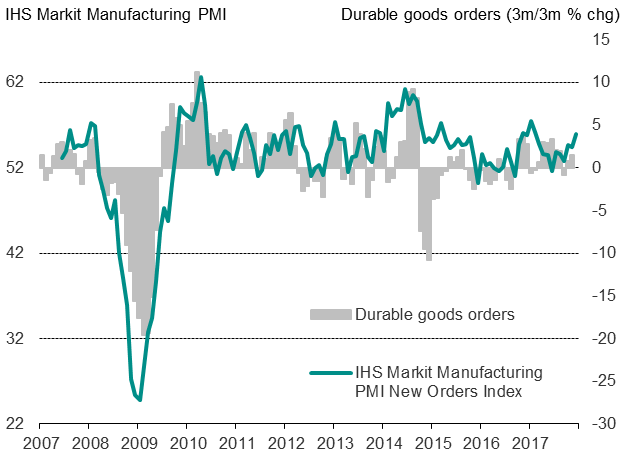

Durable goods orders, as well as new and existing home sales, will also be gleaned for indications of the US economy’s health at the end of 2017. IHS Markit US Manufacturing PMI’s gauge of new orders exhibits a 76% correlation with durable goods orders, with December’s survey data pointing to a pick-up in growth.

IHS Markit PMI Orders v durable goods orders

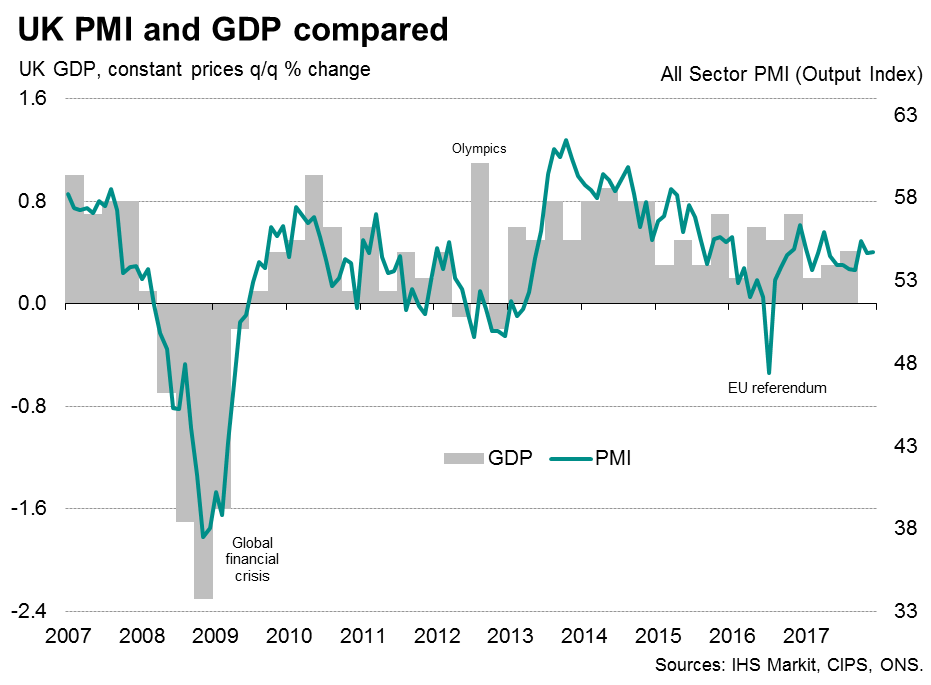

UK growth

Preliminary estimates of UK GDP for the fourth quarter are eagerly awaited for confirmation that the economy continues to show resilience on the face of Brexit uncertainty. PMI data suggest a quarterly rate of 0.4-0.5%, holding broadly steady from the previous quarter. More worryingly, however, was that the survey data also indicated an uncertain outlook, with inflows of new business showing the second-smallest monthly rise since the immediate aftermath of the Brexit vote. Hiring also slowed in December, linked to an air of caution over the outlook.

A strong GDP number will naturally keep the Bank of England on course to meet current market expectations of up to two rate hikes in 2018 (the swaps market is pricing in rates to have risen from 0.5% to 0.8% by the end of the year). However, the near-term path of UK interest rates will probably be more influenced by the week’s labour market update from the ONS, and notably the latest average earnings data. With policymakers divided on the outlook for the economy and inflation, pay growth will be a big influencer on decision-making at the next MPC meeting.

Europe and Japan set monetary policy

With the eurozone economy ending 2017 on a high, attention now shifts to whether such strong growth can be sustained in 2018. Although market consensus expects the flash Eurozone PMI surveys to show the upturn losing a little momentum in January, analysts generally expect growth to remain close to a seven-year high1.

While recent PMI gauges for growth and prices are firmly in territory historically associated with a tightening of monetary policy, the ECB policy meeting next week is widely anticipated to be a non-event. The central bank sounded somewhat dovish in its December meeting, saying interest rates will remain unchanged until well beyond the asset purchase programme has finished. However, recent strong growth has boosted speculation that the ECB could soon change its guidance on future policy.

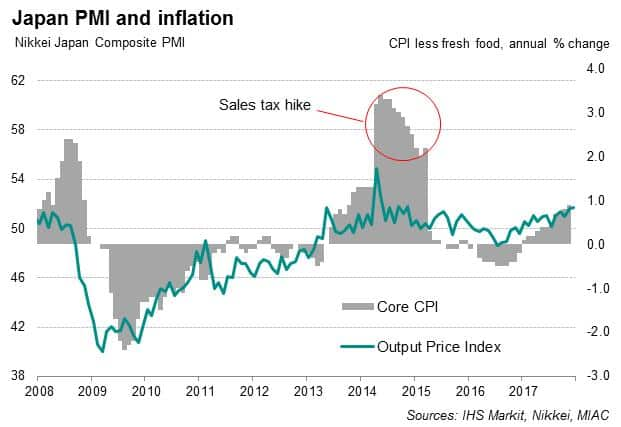

In Japan, the Nikkei flash manufacturing PMI for January will likewise provide an important lead as to first quarter GDP. In the same week, the latest Bank of Japan meeting takes place amid solid economic growth and higher prices. PMI data showed Japanese economic growth maintaining solid momentum at the end of 2017, with an encouraging trend of steadily rising selling prices.

Although signs of increasing price pressures are welcomed by the Bank of Japan, changes to monetary settings are not expected. Nevertheless, eyes will be on the quarterly review for changes to the central bank’s inflation forecasts. Other key data highlights in Japan include updates on inflation and trade.

1 see tradingeconomics.com for market consensus

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012018-week-ahead-economic-preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012018-week-ahead-economic-preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012018-week-ahead-economic-preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012018-week-ahead-economic-preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012018-week-ahead-economic-preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}