Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 19, 2015

Social stocks crowding out returns

Disappointing results from social network companies in April sent investors scrambling as doubts emerge about the sector’s increasingly lofty valuations.

- Yelp is currently the most shorted social firm, but Groupon the worst performer in 2015

- Twitter has seen short interest triple after disappointing earnings

- Larger networks Facebook and China’s Tencent have continued to see their stock rise

The fickle crowd’s social pullback

The current growth-hungry stock market has seen investors flock to social media shares; pushing prices and valuations ever higher. The sector’s growth story seems to have come unstuck this quarter however, with a number of single names having seen significant share price declines.

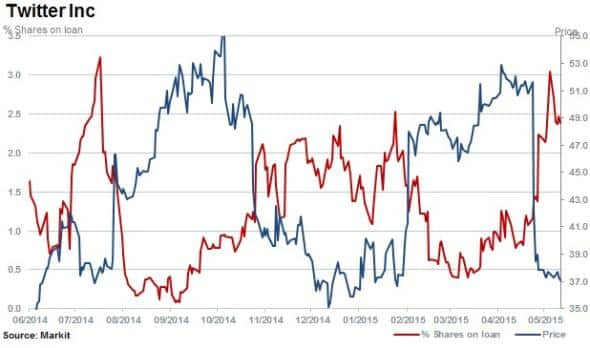

Shares in Twitter collapsed after disappointing earnings were accidently leaked last April. The numbers let down investors who subsequently bid shares lower by a third after falling a staggering 18% on the day. Investors are concerned that without high levels of continued growth, social investments could unravel.

Twitter’s reported revenue missed consensus expectations despite sales growing by an impressive 74%; the $21m miss saw more than $6bn shaved off the company’s market capitalisation. Despite the recent tumble, TWTR’s shares are now flat for the year, which highlights the volatility in this mercurial sector.

The proportion of Twitter’s shares outstanding on loan has more than tripled in the wake of this disappointing news.

Short sellers had been actively covering in the runup to earnings; not wanting to be caught on the wrong side of possible M&A as rumours on a potential acquisition by Google were stoked by TWTR’s decision to partner with the search company and make tweets searchable online.

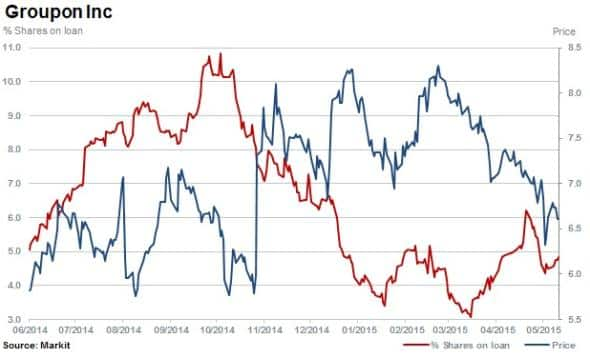

Groupon has also disappointed investors of late, with the group couponing service’s shares having declined by 21% since the end of February. Short interest has also surged in the wake of the recent underperformance with shares outs on loan increasing by one tenth to 4.75% of shares outstanding.

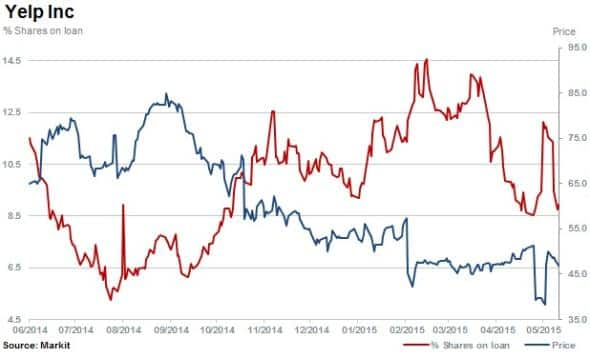

The next worst performing ‘social’ stock of 2015 to date and currently seeing the highest short interest is Yelp. The review site uses the public to review and research local businesses, and also delivered lower than expected results in the first quarter. Shares have continued to decline by 15% ytd.

Despite the recent underperformance, Yelp has seen short sellers retreat from their post earnings high after rumours of a possible sale of the company surfaced. Despite declining over the last couple of weeks, short interest remains relatively high at 8.9% of shares outstanding.

Investing in social ETFs

Despite the recent spate of bad earnings, the social media sector has continued to advance, as gauged by the Global X Social Media ETF (SOCL) which invests in stocks whose main business focus is social networks. While the fund has seen its relatively niche uptake relatively low with AUM of $100m, SOCL is up 14% ytd. This has been largely influenced by its two largest constituents, Tencent and Facebook at ~10% respectively.

Shenzhen based Tencent is a Chinese social network platform that has delivered over five years of compound average sales growth of 48% which is reflected in CAGR share price increases of 33% over the same period. There seems to be little doubt in Tencent’s continued rise as shares are up by 28% in last six months and there are currently negligible levels of short interest (<1%).

Relatively smaller players like Twitter and Yelp have continued efforts to grow user bases and revenues to reach critical mass, however shortcomings in either of these areas should have investors concerned. Short sellers are currently being kept at bay with potential M&A deals in the pipeline, which could attach enough value to justify some very healthy valuations.

Meanwhile larger companies such as Tencent and Facebook are seeing the network effects of their social networks as they outperform market peers and the overall market in 2015.

Relte Stephen Schutte | Analyst, IHS Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052015-equities-social-stocks-crowding-out-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052015-equities-social-stocks-crowding-out-returns.html&text=Social+stocks+crowding+out+returns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052015-equities-social-stocks-crowding-out-returns.html","enabled":true},{"name":"email","url":"?subject=Social stocks crowding out returns&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052015-equities-social-stocks-crowding-out-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Social+stocks+crowding+out+returns http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052015-equities-social-stocks-crowding-out-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}