Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 19, 2017

Week ahead: flash PMI surveys

A number of countries see updated first quarter GDP numbers, but the flash May PMI surveys will provide all-important steers of second quarter growth and inflation trends for the US, Eurozone and Japan.

A key take-away from the initial first quarter GDP releases was the waning of growth in both the US and the UK, contrasting with strong performances in the Eurozone; a pattern which is expected to be confirmed by the revised estimates.

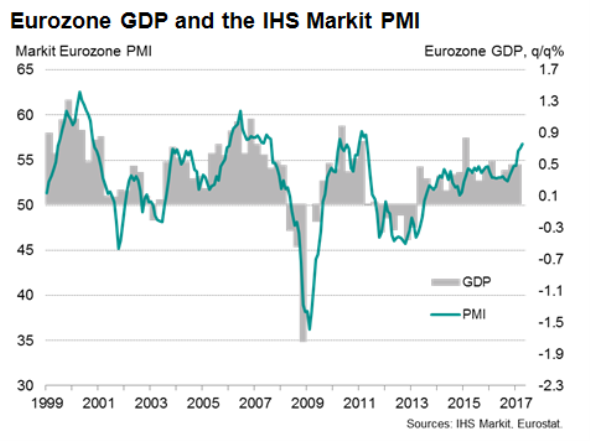

Although flash Eurozone PMI surveys are set to show the upturn lost a little momentum in May, according to a Reuters poll, analysts generally expect growth to remain close to a six-year high. If confirmed, such strong data will likely add to speculation that the ECB will signal its intention to start tapering its stimulus later in the year, most likely extending its asset purchases into 2018 but at a reduced rate.

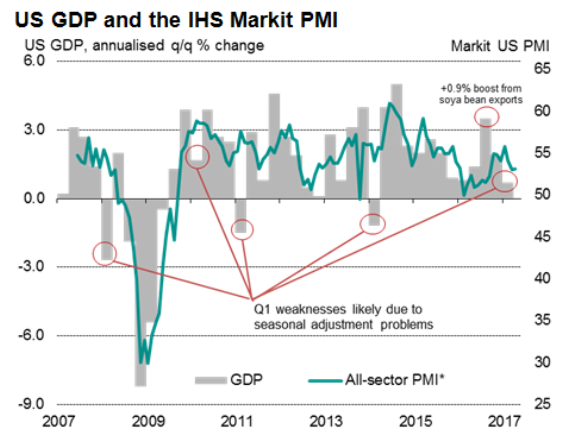

Analysts are also keen to see if the weak first quarter in the US was due merely to GDP not fully accounting for seasonality, as has been the case in recent years. If so, growth should rebound strongly in the second quarter. IHS Markit's PMI numbers do not suffer the same seasonal distortions as GDP, and showed a stronger first quarter. While the April PMI surveys picked up some momentum, it's the flash May PMI data that will play the critical role in estimating the health of the economy in the second quarter. Analysts polled by Reuters are expecting to see further moderate growth in both services and manufacturing.

Durable goods orders, new and existing home sales and the University of Michigan consumer sentiment index will also be gleaned for indications of the US economy's health at the start of the second quarter.

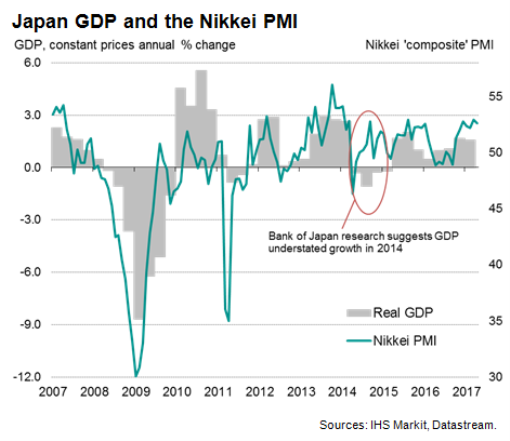

In Japan, the Nikkei flash manufacturing PMI for May will likewise provide an important lead as to second quarter GDP. At 0.5% (2.2% annualised). Japan's first quarter GDP growth took analysts by surprise, but such a solid expansion had been flagged well in advance by the PMI. April's data had also been encouragingly resilient. Japan also sees CPI data, which are expected to show inflation perking up.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052017-economics-week-ahead-flash-pmi-surveys.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052017-economics-week-ahead-flash-pmi-surveys.html&text=Week+ahead%3a+flash+PMI+surveys","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052017-economics-week-ahead-flash-pmi-surveys.html","enabled":true},{"name":"email","url":"?subject=Week ahead: flash PMI surveys&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052017-economics-week-ahead-flash-pmi-surveys.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+ahead%3a+flash+PMI+surveys http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052017-economics-week-ahead-flash-pmi-surveys.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}