Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 20, 2015

Week Ahead Economic Overview

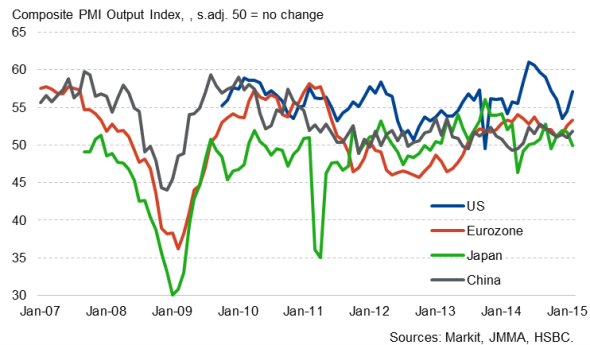

Markit releases flash PMI data for China, Japan, the eurozone and the US, all of which will provide fresh evidence on the health of the global economy at the end of the first quarter. Meanwhile, the US sees the release of final GDP numbers for the final quarter of 2014, inflation figures are updated in both the US and the UK and business and consumer sentiment data are released across the euro area.

Composite Output PMI

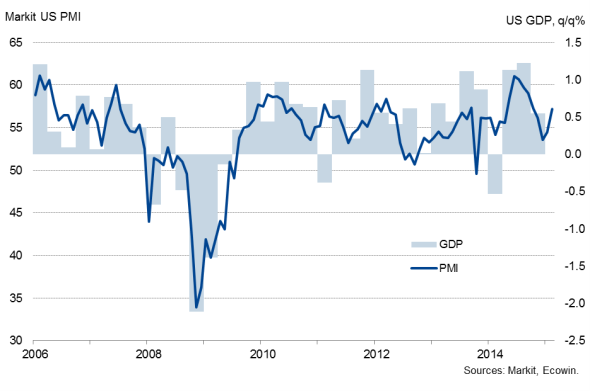

With the Fed having removed the word "patient" from its policy statement, but also stating that this "doesn't mean we're going to be impatient", the health of the US economy in the first quarter will be crucial in determining if rates might rise as early as June. Official manufacturing and retail sales data have been weak in recent months, suggesting any hikes will be delayed until later in the year, but flash manufacturing and service PMI results will be watched to see if the economy rebounded in March.

Inflation figures are also released and in the US and are expected to remain negative, having signalled a 0.1% drop in prices on the previous year in January. US prices are being hammered down by low oil prices and falling import prices, the latter resulting from the dollar's strength, but any signs of core inflation picking up will also bring forward rate hike expectations.

The Commerce Department will also publish final US GDP numbers for the fourth quarter of last year. The initial estimate of 2.6% annualised growth was revised down to 2.2%, indicating that growth more than halved compared to the third quarter's 5.0%. Any significant revisions could also affect the timing of the first rate hike.

US GDP and the PMI

In the UK, consumer price inflation is updated, and is expected to remain well below the Bank of England's target, after dropping to just 0.3% in January. Policymakers want inflation to remain low to help boost consumer spending and drive growth, but don't want low inflation to feed through to weaker wage negotiations. Markit's Household Finance Index" indicates that lower inflation has become the most important driver of household wellbeing and therefore consumer spending. Any drop in inflation could therefore exacerbate deflationary concerns, but any unexpected increase will cause worries that the recovery could stall.

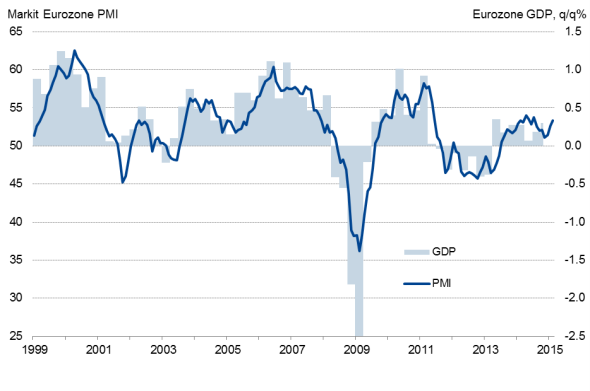

Flash PMI data are meanwhile released in the eurozone. The ECB, having kicked off its €60bn per month asset purchase programme this month, will be hoping to see business activity building on the nascent recovery evident in February. February data showed the currency bloc's manufacturing sector still struggling to show any meaningful expansion, but an upturn in service sector activity meant that the Composite Output Index hit a seven-month high. The survey data are currently signalling GDP growth of around 0.3% in the opening quarter of 2015.

Eurozone GDP and the PMI

Sources: Markit, Ecowin

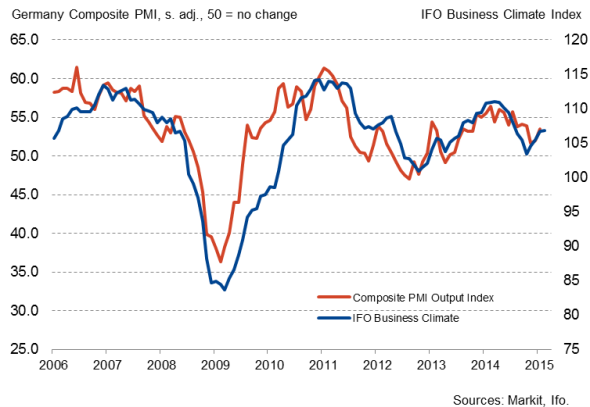

In Germany, Ifo updates its business climate data, after the index climbed to a seven-month high of 106.8 in February. Other important releases in the currency union include consumer confidence numbers for the eurozone, detailed fourth quarter GDP data in France and industrial orders and retail sales numbers in Italy.

Ifo business climate and the PMI

Having cut banks' reserve ratio requirements again in early February, policymakers will be hoping to see renewed signs of life in China's manufacturing sector. March's flash PMI survey results will give further insights into the performance of China's economy at the end of the first quarter, after February data signalled the first improvement in operating conditions in four months.

Japan's economy has pulled out of recession at the end of last year and February's manufacturing PMI signalled the strongest rise in output in nearly a year. The flash PMI survey data for March will be eagerly awaited for signs that the sector continued to expand at the end of the first quarter. Inflation data for Japan will also be eyed amid concerns that Japan is sliding back into deflation

Monday 23 March

The European Commission releases an update on consumer confidence numbers, while current account data are out in Greece.

Meanwhile, the Confederation of British Industry issues orders figures.

In the US, the National Activity Index is updated alongside the release of home sales numbers.

Tuesday 24 March

Flash PMI results for Japan, China, the eurozone and the US are released by Markit.

Import price numbers are out in Germany, while Italy sees the release of wage inflation figures.

Inflation data are updated in the UK and the US, with the latter also seeing the release of house price numbers.

Wednesday 25 March

Economic sentiment data are released in Germany by Ifo, while business confidence numbers are out in France.

In Italy, trade balance data are issued.

Brazil sees the release of consumer confidence numbers and current account data.

Durable goods data and building permit numbers are out in the US.

Thursday 26 March

The South African Reserve Bank announces its latest interest rate decision. The country also sees the release of producer price numbers.

M3 money supply data are meanwhile issued for the euro area.

Germany sees the release of Gfk consumer confidence data.

In France, detailed GDP figures for Q4 are published.

The Office for National Statistics releases retail sales numbers for the UK.

Unemployment data are out in Brazil.

Flash Services PMI numbers and initial jobless claims data are issued in the US.

Friday 27 March

Household spending data, inflation numbers and unemployment figures are all updated in Japan.

Italy sees the release of retail sales and industrial orders data.

Meanwhile, consumer confidence numbers are issued in France.

GDP data are published in Brazil.

Final fourth quarter GDP data and the Reuters/Michigan Consumer Sentiment Index are released in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}