Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 20, 2015

Week Ahead Economic Overview

Updated second quarter GDP results are released in Germany, Spain and the UK, while Brazil sees its first estimate of second quarter economic growth. Meanwhile, durable goods orders numbers and flash services PMI results are published in the US, and economic sentiment data are out in the eurozone.

Healthy second quarter GDP numbers and strong labour market data suggest that the US is ready for a first rise in interest rates in September, if the economy remains robust. However, low inflation and subdued wage growth remain powerful arguments against a tightening of US monetary policy. Policy makers will therefore closely watch the release of durable goods orders data and flash services PMI results for signs that the economy continued to grow at a healthy rate in the third quarter.

New orders for durable goods rose 3.4% in June, following two months of decline. While this was a welcome relief, business survey data signal that the US goods-producing sector is struggling against various headwinds. In particular, companies reported that the strong dollar continued to hurt export competitiveness. Weak durable goods numbers would therefore not be a surprise, with economists polled by Thomson Reuters anticipating a 0.5% m/m decline.

Flash services PMI results are released on Tuesday and will give first insights into the performance of the US service sector in August. Survey data for July pointed to the US economy growing at an annualised rate of around 2.1%.

Meanwhile, a number of countries see the release of updated GDP numbers for the second quarter during the week, which, in some cases, contains a more detailed breakdown of the data.

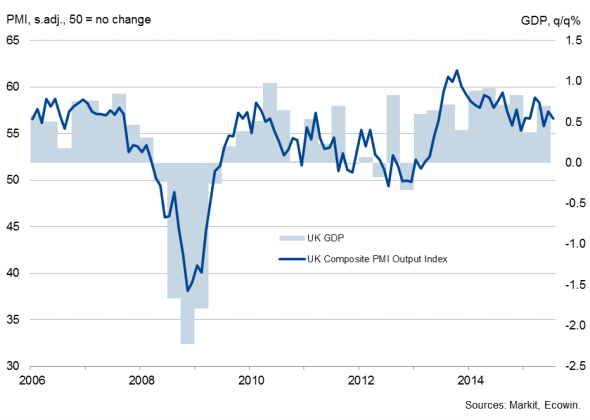

The second estimate of second quarter gross domestic product is released in the UK on Friday. Initial numbers showed that the UK economy grew by 0.7%, in line with analysts' expectations and survey data and far stronger than the 0.4% increase seen in the first quarter. Big revisions for the second quarter are therefore unlikely. However, there remains the fear that economic growth could slow again in Q3, with business survey data for July pointing to a slowdown.

UK GDP and the PMI

Germany's economy expanded 0.4% in the three months to June, following a 0.3% rise in the first quarter. The German statistics body Destatis reported that rising exports, household final expenditure and government consumption expenditure were the main drivers of economic growth, while construction output declined. A detailed breakdown of the data is released on Tuesday. Meanwhile, Ifo updates its Business Climate Index, providing data watchers with more information about the health of the German economy in the third quarter.

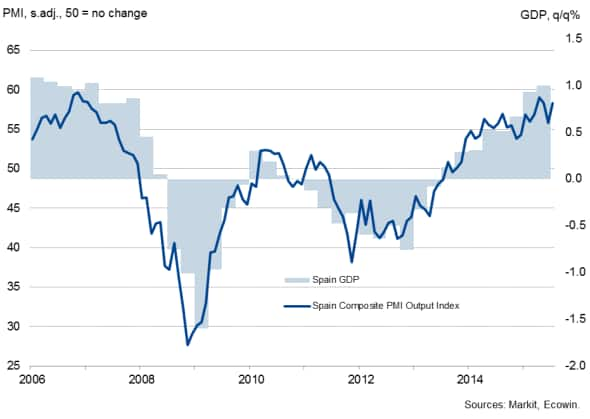

Revised GDP numbers are also published in Spain and are expected to show little-change from the strong 1.0% rise signalled by the initial release. Business survey data meanwhile suggest that the Spanish economy enjoyed a strong start to Q3.

Spain GDP and the PMI

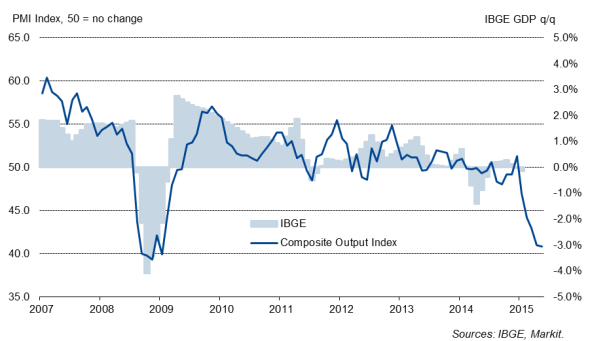

Brazil sees the first estimate of second quarter gross domestic product numbers on Friday, after the economy shrank by 0.2% in the opening quarter of the year. Business survey data signal that Brazil fell into a technical recession in the second quarter, with the average PMI reading for the three months to June the worst since the first quarter of 2009. With the country currently facing high interest rates, rising unemployment and strong inflation, the outlook remains lacklustre too. Moreover, business survey data pointed to the sharpest fall in private sector output since March 2009.

Brazil GDP and the PMI

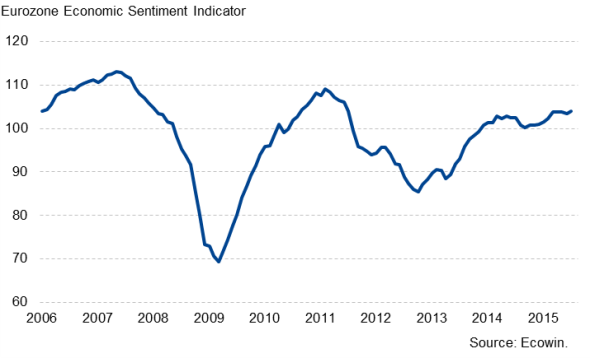

The European Commission releases economic sentiment data for the eurozone on Friday. Last month, the index reached a four-year high despite uncertainty surrounding Greece. Meanwhile, PMI data suggested that economic growth in the region barely slowed in July, suggesting that further GDP growth in the third quarter looks likely.

Eurozone Economic Sentiment Indicator

Monday 24 August

Monthly GDP numbers are issued in Russia.

The Federal Reserve Bank of Chicago updates its National Activity Index.

Tuesday 25 August

Second quarter GDP figures and mining production data are published in South Africa.

Germany sees the release of detailed GDP numbers, import prices figures and the latest Ifo Business Climate Index.

In Brazil, consumer confidence numbers are released alongside current account and foreign investment data.

The US sees the publication of house price data, consumer confidence numbers and the Markit flash US Services PMI.

Wednesday 26 August

CBI releases reported sales data for the UK.

The US sees the publication of building permit and durable goods numbers.

The OECD publishes a statistics release on quarterly national accounts GDP growth.

Thursday 27 August

In South Africa, producer price numbers are out.

Eurostat publishes M3 money supply information.

INSEE releases business confidence and investment data for France.

GDP numbers are updated in Spain.

Meanwhile, initial jobless claims figures are issued in the US.

Friday 28 August

Household spending, inflation, unemployment and retail sales data are released in Japan.

Economic sentiment numbers are issued by the European Commission for the currency union.

The Bank of Austria Manufacturing PMI is released.

In Germany and Spain, retail sales and preliminary inflation figures are out.

Meanwhile, Canada, France and Greece see the publication of producer price numbers.

Wage inflation data are issued in Italy.

In the UK, the second estimate of second quarter GDP data is issued.

GDP numbers are also updated in Brazil.

Personal income data and the Reuters/Michigan Consumer Sentiment Index are issued in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}