Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 20, 2014

Digesting dim sum bonds

Demand for offshore RMB bonds have exploded in the last three years, with the market clamouring for exposure to China and its currency; to mark the launch of the launch of the Hang Seng Markit iBoxx Offshore Bond Index family (HSM iBoxx), we look at the dynamics driving the market for "dim sum" bonds.

- The value of Dim Sum bonds tracked by the Markit the HSM iBoxx Overall Bond Index has jumped by 785% since the start of 2011

- Strong investor demand for Chinese exposure and the appreciating RMB has seen these bonds return 13.7% since Q1 2011

- Investment grade Chinese firms trade roughly in line with their investment grade peers in the offshore RMB market

- Chinese bonds have proved popular in recent years as their AMU has grown to over $1bn, up from $10M at the end of 2011

To receive a copy of the white paper which explores the offshore RMB market, please email comms@markit.com.

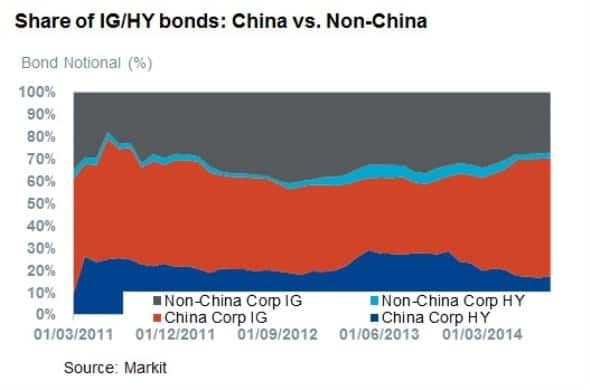

Over the last three years since the opening to non-Chinese issuers, the market for "dim sum" offshore RMB bonds has jumped to over RMB 300bn. While the current size of the market pales in relation to the size of established markets, it has still managed to double in each of the last three years, and has evolved to see a growing list of multinational companies line up list bonds in Chinese currency. International issuers now make up one third of the notional value of HSM iBoxx.

The market also affords a unique opportunity to gain exposure to China, which recently overtook the US as the largest global economy in terms of purchasing power parity.

Attractive yields for both sides

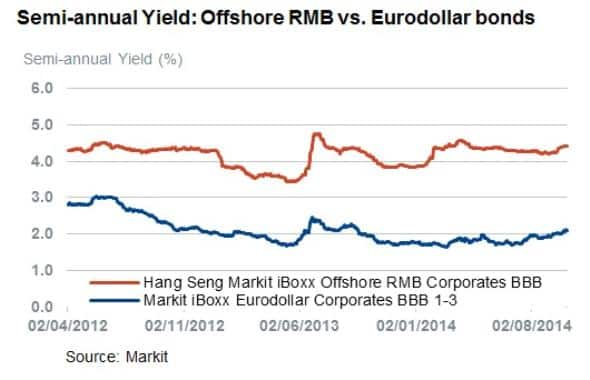

The international quest for yield driven by the current low rate environment makes RMB bonds a relatively attractive investment as BBB rated issuers tracked by the HSM iBoxx currently yield about 2% more than their similar rated Eurodollar peers. This spread has been relatively stable in the last few years.

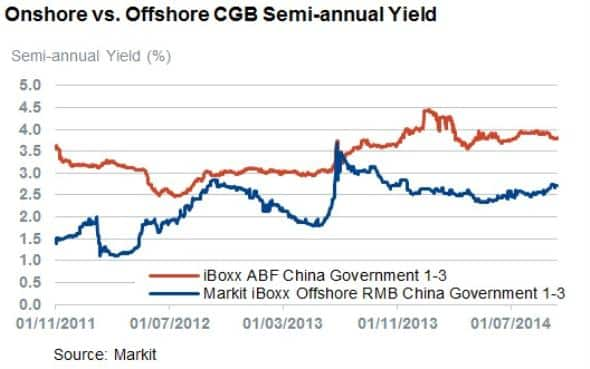

Chinese issuers on the other hand benefit from lower yields afforded by the offshore market. For instance, Chinese government bonds within HSM iBoxx have consistently traded at a lower yield than similar onshore issues of the same maturity.

The appreciating value of the RMB has also contributed to strong returns over the last three years as the HSM iBoxx has returned 13.7% in dollar terms since the start of the year while its RMB performance has been a respectable 6.6%.

Ratings

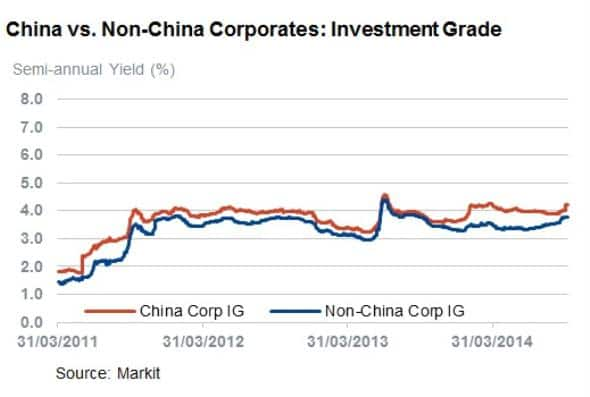

Chinese companies command a higher yield than non-Chinese issuers within the index due to a greater prevalence of unrated bond issuance, which is reflected in the index methodology. Unrated bonds are assigned at 50% of their nominal value and their credit spread is taken into account when assigning a high yield classification.

On a like for like basis, Chinese companies rated investment grade, command only a slightly higher yield than non-Chinese companies.

ETF investors appetite

While the offshore RMB market is still young, ETF issuers have been actively broadening their product offering to satiate the thirst for Chinese fixed income exposure. There are currently over $1.8bn of assets managed by the 11 Chinese exposed fixed income ETFs, a number that has grown from $11m at the end of 2011.

This surge shows no signs of slowing as four new funds have launched in the last 10 months as the asset class gets set for record inflows this year after investors added $158m of exposure to the asset class.

The clarity provided by the HSM iBoxx index will no doubt see increased interest from institutional investors keen to embrace this fast growing market.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102014-equities-digesting-dim-sum-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102014-equities-digesting-dim-sum-bonds.html&text=Digesting+dim+sum+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102014-equities-digesting-dim-sum-bonds.html","enabled":true},{"name":"email","url":"?subject=Digesting dim sum bonds&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102014-equities-digesting-dim-sum-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Digesting+dim+sum+bonds http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102014-equities-digesting-dim-sum-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}