Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 20, 2014

Week Ahead Economic Overview

The highlights of the week come from the US, where an update on GDP data for the third quarter and Flash US Services PMI data are released alongside durable goods numbers. Germany and the UK also see updates on third quarter GDP data, while unemployment and inflation numbers are issued for the eurozone. Industrial output, unemployment and inflation data are meanwhile released in Japan.

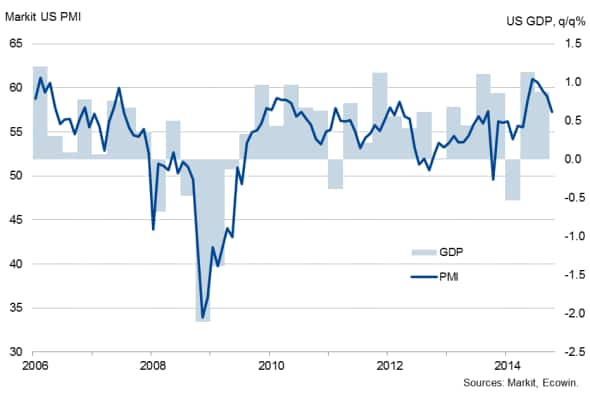

Third quarter GDP numbers are updated in the US, after a first estimate showed the US economy expanding at an annualised rate of 3.5%. Any downward revision has the potential to worry policymakers, especially as growth looks set to weaken in the fourth quarter. Markit's PMI surveys had signalled a weaker expansion in October, and a disappointing flash manufacturing PMI for November alongside the advent of extreme weather suggests the pace of economic growth could slow significantly in the fourth quarter. More insight will be provided by Markit's flash services PMI release for November as well as updates to consumer confidence numbers, which hit a seven-year high in October, and durable goods orders.

US GDP and the PMI

In the eurozone, flash inflation and unemployment numbers are published. In October, inflation edged up slightly to 0.4% from September's five-year low of just 0.3%, but fears persist that the currency union is moving closer to deflation. Unemployment was stable at 11.5% in September, with the jobless rates in Southern Europe remaining well above the region's average. Flash PMI data for November meanwhile suggest that the region is going through another weak spot of low inflation and stagnating employment levels, adding pressure for the ECB to do more to boost the economy.

Other important releases for the euro area include business climate data from Ifo plus detailed GDP statistics for Germany, after a first release showed the region's largest economy marginally avoiding recession. There's also an update on Spanish GDP and sentiment data for a number of countries.

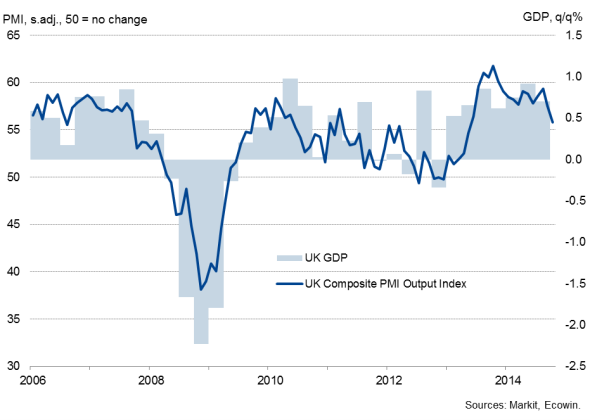

A second estimate of third quarter GDP for the UK is meanwhile provided by the Office for National Statistics, after an initial estimate showed the economy growing by 0.7%. The updated estimate is likely to be revised higher, reflecting upbeat business survey data. However, PMI data point to a sharp slowing in UK economic growth at the start of the fourth quarter, as service sector activity increased at the slowest pace since May last year.

UK GDP and the PMI

In Japan, a preliminary estimate of industrial output numbers for October will give insight into fourth quarter GDP growth, after the Japanese economy fell back into recession in the three months to September. Japan's Manufacturing PMI" hit a seven-month high in October and remained positive in November, suggesting that the official production data should continue to show positive signs, having indicated a 2.7% rise in September. Japan's inflation numbers will also be closely watched for indications as to whether the government is succeeding in defeating deflation. Prices rose 3.2% on a year ago in September, though partly as a result of April's sales tax hike.

Monday 24 November

The week kicks off with the release of trade data and current account numbers in India.

House price data are meanwhile released by Nationwide in the UK.

Ifo release their latest business climate numbers for Germany, while trade data are out in Italy.

In Brazil, consumer confidence numbers and current account data are issued.

Flash US Services PMI data for November are released by Markit.

Tuesday 25 November

Detailed GDP data for the third quarter, import price numbers and retail sales figures are all released in Germany.

INSEE issue business confidence data in France, while ISTAT publish retail sales numbers in Italy.

In the eurozone, Eurostat publish the first estimate of its quarterly balance of payments for the third quarter.

Third quarter GDP numbers are meanwhile released in South Africa.

Canada sees the publication of retail sales numbers.

The S&P/Case-Shiller Home Price Index is released in the US alongside consumer confidence data and an update on third quarter GDP numbers.

The OECD publishes an updated economic outlook.

Wednesday 26 November

In India, M3 money supply information are released.

Consumer confidence data are meanwhile out in France and Italy.

The second estimate of third quarter GDP is released by the Office for National Statistics in the UK.

Building permits numbers, durable goods data and initial jobless claims are all out in the US.

Thursday 27 November

Producer price data are out in South Africa.

The Bank Austria Manufacturing PMI for November is released by Markit.

In Germany, unemployment and inflation numbers are published alongside an update on consumer confidence.

Business sentiment numbers and M3 money supply data are meanwhile released for the eurozone.

The final estimate of third quarter GDP is issued in Spain, followed by inflation figures.

Business confidence data are out in Italy.

In Canada, current account numbers are published.

The OECD publishes a statistics release on international trade.

Friday 28 November

Third quarter GDP data are released in India.

Inflation and retail sales numbers, unemployment data and industrial output figures are published in Japan.

In the eurozone, unemployment and inflation data are out.

Consumer spending data and producer price numbers are meanwhile released in France.

Greece sees the release of revised third quarter GDP numbers, while producer price and retail sales data are also issued.

In Spain, current account numbers and retail sales figures are published.

Brazil and Canada see updates on gross domestic product numbers, with the latter also seeing the release of producer price data.

Gfk publish consumer confidence data for the UK.

In South Africa, trade balance numbers are issued.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}