Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 23, 2018

The 2017 reflation trade

Research Signals – January 2018

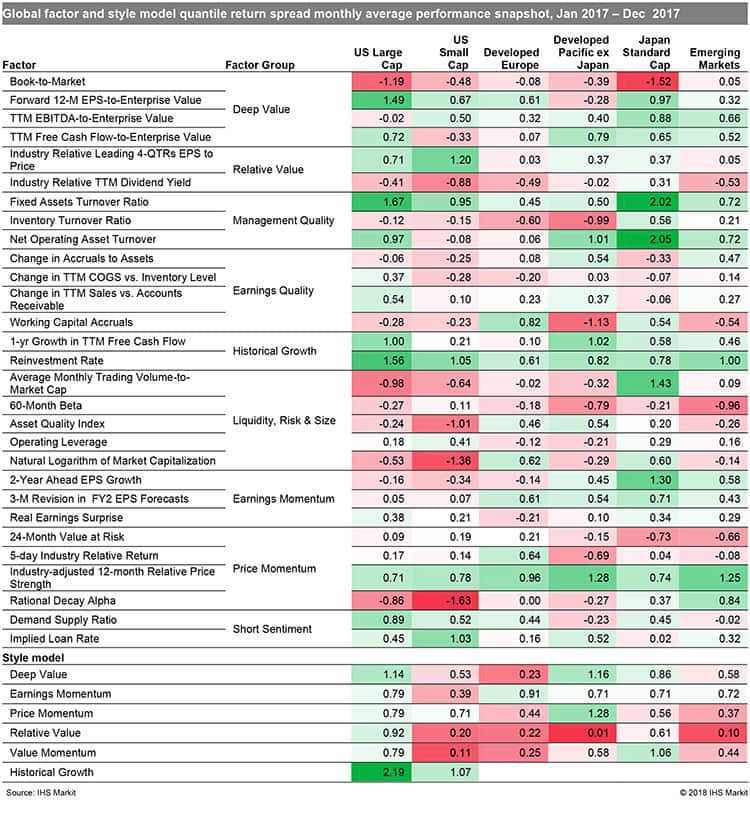

The global economic upturn extended through the end of 2017, as output growth accelerated in both the manufacturing and service sectors, with manufacturing the stronger of the two. The J.P.Morgan Global Manufacturing & Services PMI™ posted at 54.4, the highest level since March 2015, and the IHS Markit Global Sector PMI™ indicated that the technology sector was the fastest-growing sector over 2017 as a whole. With this economic backdrop, we review factor and model performance in 2017 (Table 1).

- US: Growth factors outperformed (reported) value factors, as demonstrated by Reinvestment Rate and Book-to-Market, respectively, and contributed to the Historical Growth model’s superior results among our style models

- Developed Europe: Industry-adjusted 12-month Relative Price Strength posted strong performance, suggesting that investors preferred stocks that participated in the best annual stock market gains since 2013

- Developed Pacific: Japanese investors rewarded a broad spectrum of style factors, including Net Operating Asset Turnover, 2-Year Ahead EPS Growth and Forward 12-M EPS-to-Enterprise Value, and this positive trend was captured by the Value Momentum model’s multi-style construction

- Emerging markets: 3-M Revision in FY2 EPS Forecasts was one of several Earnings Momentum factors that performed well over the course of 2017, while the corresponding style model consistently outperformed over the past five years with positive montly performance in 82% of months

Heading into 2018, IHS Markit expects sustained solid global growth in the world economy, matching the growth rate of 2017 and well above 2016. The global expansion is now stronger and more synchronized, particularly driven by the US, eurozone and Japanese economies, and with low probability of risks. The reflation trade, that helped push global stocks to lofty heights in 2017, is expected to face three additional US Federal Reserve rate hikes in 2018, followed by three more in 2019. In addition, IHS Markit expects upward pressure on the US dollar as the Fed is well ahead of most other central banks in its tightening cycle.

Table 1

Posted 23 January 2018

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f2017-reflation-trade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f2017-reflation-trade.html&text=The+2017+reflation+trade","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f2017-reflation-trade.html","enabled":true},{"name":"email","url":"?subject=The 2017 reflation trade&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f2017-reflation-trade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+2017+reflation+trade http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f2017-reflation-trade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}