Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 21, 2015

Real wage growth and household optimism hit post-crisis highs in the UK

Unemployment has sunk below 6.0% for the first time in just over six years, wage growth is rising in real terms at the fastest rate since 2008 and households are feeling the most optimistic about their finances since the recession struck.

However, with the Bank of England growing gloomier about the economic outlook and worried about low inflation, according to the minutes of the latest Monetary Policy Committee meeting, the data will do little to convince policymakers that the economy is ready for higher interest rates.

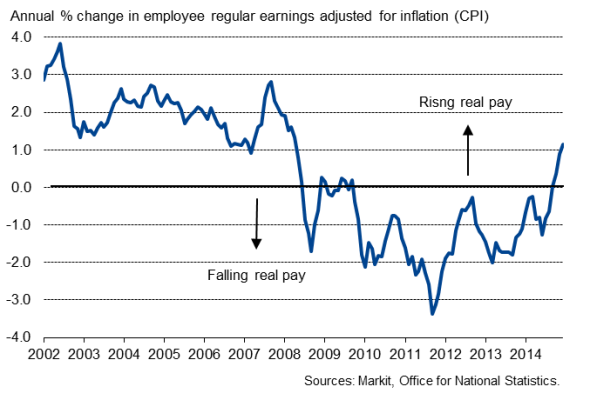

Real pay growth

Labour market improves

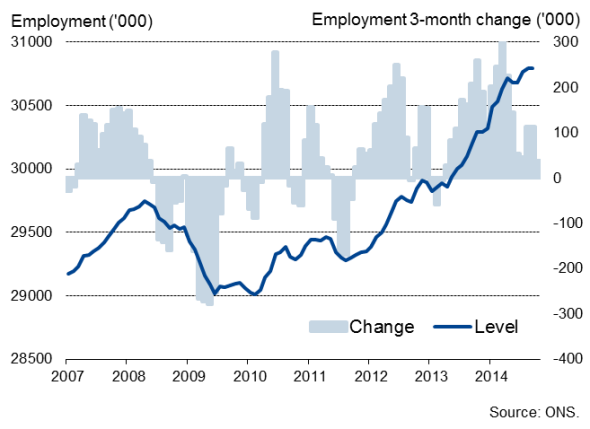

Official data showed the headline rate of unemployment dropping to 5.8% in the three months to November, its lowest since July 2008. The headline rate is a three-month moving average and digging into the monthly data shows an even more buoyant picture of joblessness, with the unemployment rate down to 5.6% in November.

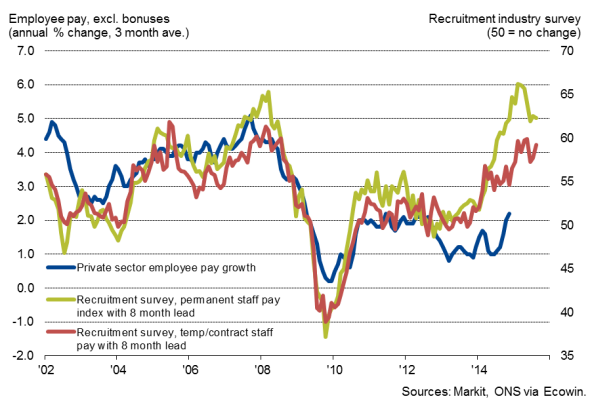

Pay growth meanwhile continued to revive. Total pay rose 1.7% on a year ago in the three months to November, up from (a downwardly revised) 1.4% in the three months to October. Regular pay growth, excluding bonuses, also accelerated, up from 1.6% to 1.8%, its highest for just over two years. The trend in private sector pay growth was even more encouraging, up from 2.0% to 2.2%, matching the previous post-crisis peak seen in the second quarter of 2011.

What's particularly important is that regular wage growth is outstripping inflation to the greatest extent since 2008. This 'real' wage growth has been the missing ingredient of the UK's economic recovery from the recession.

The data suggest that the official pay measures are finally starting to catch up with survey evidence, which has been far more buoyant over the past year, hinting strongly that pay growth could accelerate further in coming months.

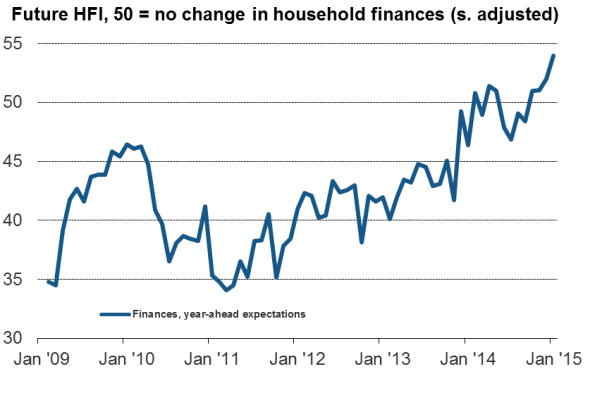

Household confidence at post-crisis high

The labour market data therefore bode well for a revival of consumer spending and household well-being in coming months: increasing numbers of people are in paid employment and wage growth is outstripping inflation, leading incomes to rise, and falling oil prices mean that a greater proportion of these incomes can be saved or spent on goods and services other than fuel.

Not surprisingly, households' views on the outlook for their finances have risen to a post-recession high in January, according to Markit's Household Finance Index, also released today.

One could argue, therefore, that households are in a better position to cope with higher interest rates than at any time over the past six years.

Household optimism on future finances

Source: Markit.

Warning lights

However, today's labour market report also contains some warning lights to justify caution over rate hikes, confirming survey signals that the economy's growth rate cooled late last year. Employment growth has slowed, highlighting increased caution among employers in relation to hiring. Although 37,000 extra jobs were created in the three months to November, that was the smallest rise since the three months to May 2013. The 58,000 drop in unemployment was meanwhile the smallest since the third quarter of 2013.

The minutes from the latest Bank of England Monetary Policy Committee meeting revealed that the likelihood of interest rates rising this year has fallen, with policymakers having grown more concerned about the economic outlook.

Survey and official pay gauges

Employment

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012015-Economics-Real-wage-growth-and-household-optimism-hit-post-crisis-highs-in-the-UK.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012015-Economics-Real-wage-growth-and-household-optimism-hit-post-crisis-highs-in-the-UK.html&text=Real+wage+growth+and+household+optimism+hit+post-crisis+highs+in+the+UK","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012015-Economics-Real-wage-growth-and-household-optimism-hit-post-crisis-highs-in-the-UK.html","enabled":true},{"name":"email","url":"?subject=Real wage growth and household optimism hit post-crisis highs in the UK&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012015-Economics-Real-wage-growth-and-household-optimism-hit-post-crisis-highs-in-the-UK.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Real+wage+growth+and+household+optimism+hit+post-crisis+highs+in+the+UK http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012015-Economics-Real-wage-growth-and-household-optimism-hit-post-crisis-highs-in-the-UK.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}