Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 21, 2017

Appetite for emerging market bonds resurges

Investors have continued to plough money into emerging market bond ETFs, despite economic and political uncertainty.

- Emerging market bond ETFs have amassed over $5bn of inflows so far in Q1

- Both corporate and sovereign bond spreads are trading tighter on the year

- Short sellers have covered half their positions in the EMB ETF

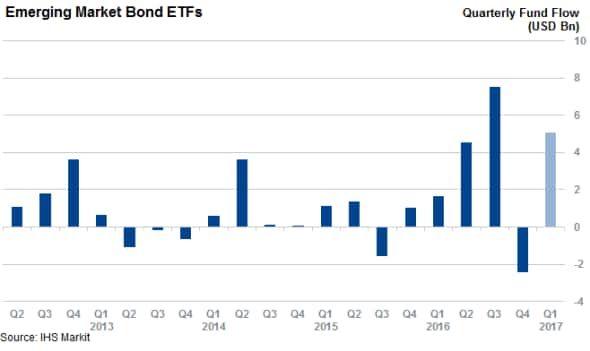

Emerging market bonds have regained favor with investors in 2017 and are on track to register the second largest quarterly inflow on record. The closing three months of last year had seen investors' faith in the asset class waiver due to US interest rate normalization and growing uncertainty stemming from the incoming administration's "America First" agenda which saw over $2bn flow out of emerging market bonds.

Global policy uncertainty is still near highly elevated; however emerging markets have proved resilient to this uncertainty as the Markit Emerging Market Composite PMI indicated that economic activity across emerging economies grew at the fastest pace in over two years over February, the first full month of the incoming US administration. The hefty $5bn of new assets that has flowed into emerging market bond ETFs this year to date indicates that the gathering economic momentum is overriding any lingering fears around policy uncertainty.

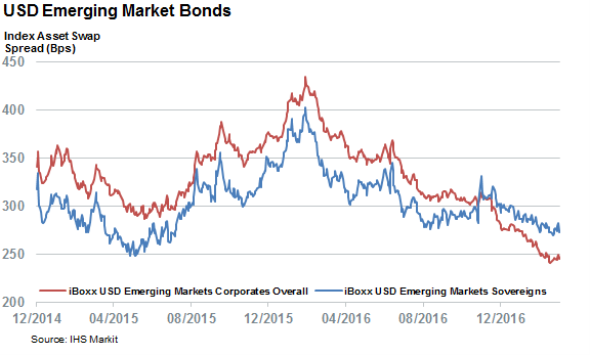

This growing consensus is also reflected by the fact that investors are now willing to receive much less yield to hold dollar denominated emerging market bonds over US treasuries than at any point over the last year. The index asset swap spreads of the Markit iBoxx USD Emerging Markets Sovereigns and Markit iBoxx USD Emerging Markets Corporates Overall indices, which tracks the level of extra yield required by investors to hold the EM sovereign and corporate bonds over treasuries, indicates that the market is now willing to accept 2.7% and 2.5% of extra yield respectively to hold these asset classes. This marks a remarkable turn as these spreads were both north of 3% as recently as three months ago.

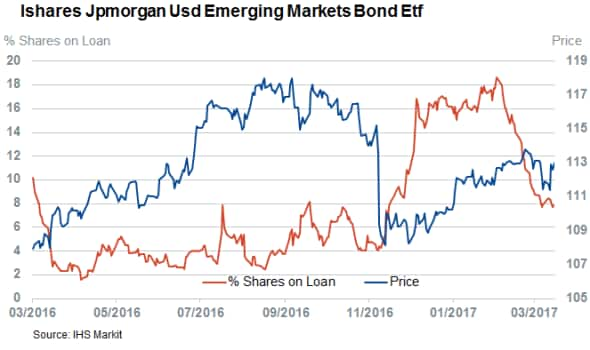

Investors have been rewarded for this faith in emerging market bonds as the iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) and the iShares Emerging Markets Corporate Bond ETF (CEMB), the largest sovereign and corporate emerging bond funds, have both outperformed the US aggregate bond index by over 2% year to date. Perhaps most surprisingly, this outperformance still holds when the event window is widened to before the US election which kicked off the worst of the recent uncertainty.

Short sellers cover

Short sellers had also been bracing for volatility in emerging market bonds as the EMB ETF saw its short interest triple in the weeks immediately following the US election, however this negative sentiment is rapidly unwinding. In fact the demand to borrow shares in the ETF have nearly halved in the last four weeks which indicates that the willingness to take the other side of the ongoing rally is melting even in the face of the recent US interest rate rise and lack of consensus on the policies that will drive markets in the immediate future.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032017-equities-appetite-for-emerging-market-bonds-resurges.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032017-equities-appetite-for-emerging-market-bonds-resurges.html&text=Appetite+for+emerging+market+bonds+resurges","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032017-equities-appetite-for-emerging-market-bonds-resurges.html","enabled":true},{"name":"email","url":"?subject=Appetite for emerging market bonds resurges&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032017-equities-appetite-for-emerging-market-bonds-resurges.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Appetite+for+emerging+market+bonds+resurges http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032017-equities-appetite-for-emerging-market-bonds-resurges.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}