Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 21, 2017

Week Ahead Economic Overview

The European Central Bank (ECB) and the Bank of Japan (BOJ) announce their decisions on policy and interest rates. Meanwhile, first quarter GDP data releases for a number of countries will add official updates to what PMI surveys have indicated so far. Other key data highlights include US durable goods orders and home prices.

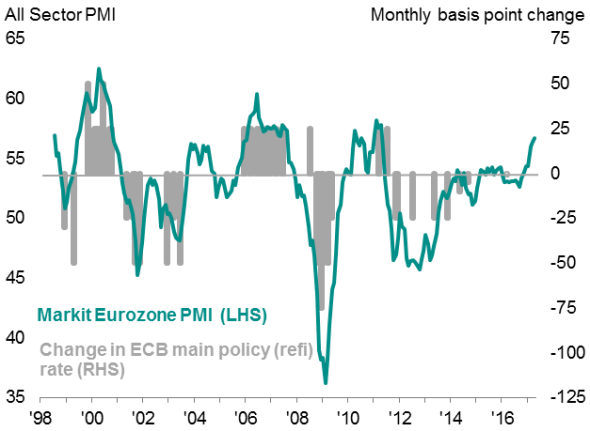

With April Flash PMI data painting a picture of sustained growth and higher prices in the eurozone economy at the start of the second quarter, attention now shifts to the ECB policy meeting next week. The PMI data should help convince, to some extent, ECB president Mario Draghi of the sustainability of the recent upturn and, notwithstanding the French elections, alleviation of downside risks.

Eurozone PMI and ECB decisions

Moreover, the PMI surveys continue to show that the data are in territory consistent with a tightening bias at the ECB, which would add to expectations for the ECB to turn increasingly hawkish in months ahead. Alongside the ECB monetary policy meeting are data releases for inflation and business confidence surveys, which will provide more clues for analysts regarding the direction of growth and future monetary policy.

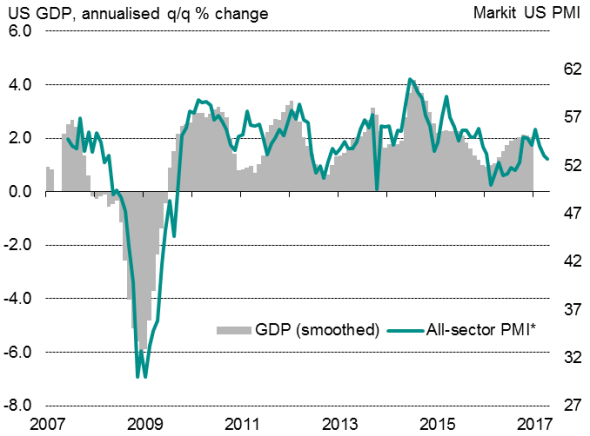

There are signs that slowdown in the US economy continued into the second quarter. Flash PMI surveys signalled the slowest expansion in output since September 2016. The surveys add to recent economic signals that have raised some doubts on the Fed's ability to raise interest rates twice more this year, especially if the slowing trend persists. Apart from first quarter GDP figures, analysts will look to data on durable goods orders, housing and several regional Fed manufacturing indexes for signs of key growth drivers.

Markit US PMI and smoothed GDP

Sources: IHS Markit, Commerce Department

Preliminary estimates of UK GDP numbers for the first quarter are released next week, where PMI data suggest a quarterly GDP growth rate of 0.4%, marking a significant slowdown in the UK economy in the opening three months of the year. Household spending, a key driver for UK growth, remains under pressure. The April Markit HFI showed that weak wage growth and rising costs of living have squeezed UK household finances by one of the greatest extents in over two-and-a-half years, while retail sales suffered the largest quarterly drop in seven years.

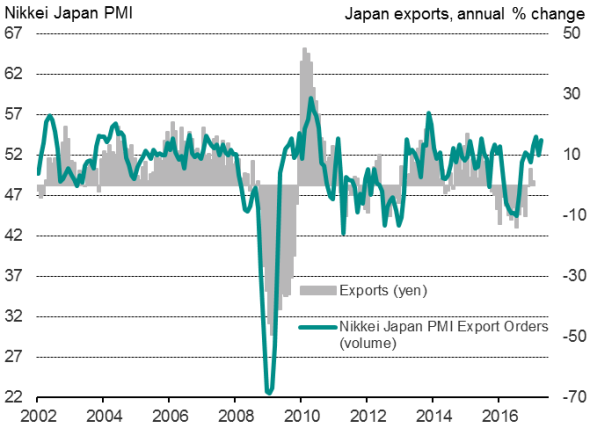

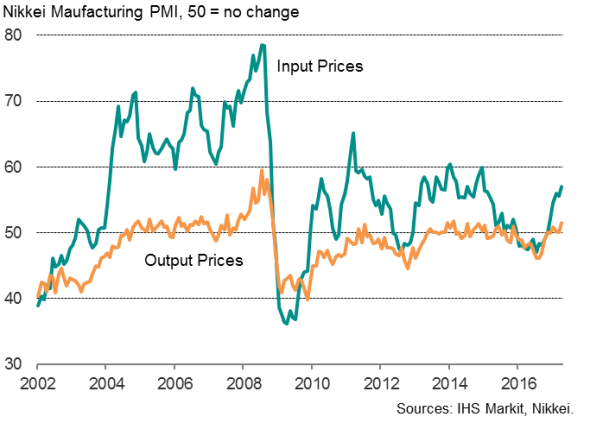

In Japan, the BOJ meeting takes place amid a strengthening economic growth and higher prices. Flash Manufacturing PMI data indicated that the robust expansion of the goods-producing sector seen in the opening quarter of 2017 has been sustained into the start of the second quarter. The news of an expanding manufacturing sector and rising prices will be welcomed by the central bank ahead of next week's policy meeting, although changes to monetary settings are not expected.

Japanese exports

Japan manufacturing prices

BOJ governor Haruhiko Kuroda has recently acknowledged brightening prospects of Japan's economy, but he noted that consumer inflation was lacking momentum, which justified maintaining an accommodative monetary policy. Other key data highlights in Japan include figures on inflation, employment and industrial production.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042017-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042017-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}