Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 21, 2017

Rising incomes help ease pressure on UK household finances

Household finances continued to deteriorate in August, according to survey data, though the rate of decline moderated from July's three-year peak. Views on future finances remained firmly negative, however, suggesting sluggish consumer spending could continue to weigh on economic growth in coming months. The survey did nevertheless bring some tentative good news on incomes.

Deteriorating finances as prices rise

The IHS Markit Household Finance Index provides the first insight into consumer finances and confidence each month, based on interviews with 1,500 British households. The headline index, which measures the degree to which households' overall finances have changed from the month before, showed a continuing deterioration of finances in August, albeit with the decline not as severe as the drop seen in July.

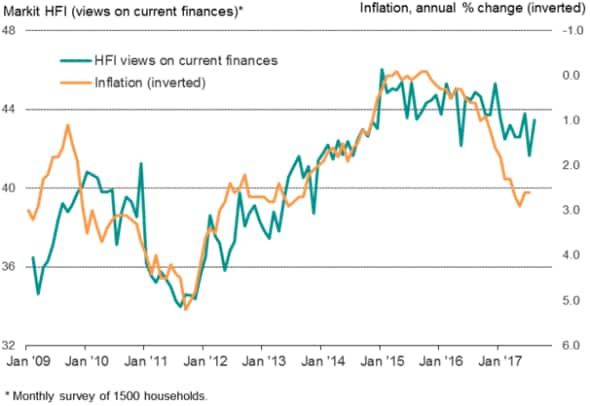

Much of the downward pressure on finances has come from rising prices, with inflation running at 2.6% in recent months while employee earnings growth has been just 2.1%, indicating a 0.5% annual drop in real earnings.

Household finances and inflation

Rising incomes

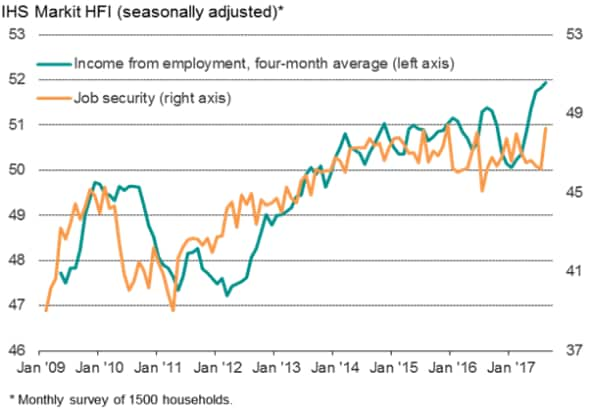

The correlation between higher inflation and deteriorating household finances is clear (see chart). However, finances have in fact not dropped by as much as might be expected, given the extent of the recent rise in inflation. This is likely to be because incomes (which take into account the amount worked, not just pay rates) have been rising. Recent months have seen the largest increase in income from employment recorded since the global financial crisis.

Income from employment and job security

Busier workplaces bode well for economy

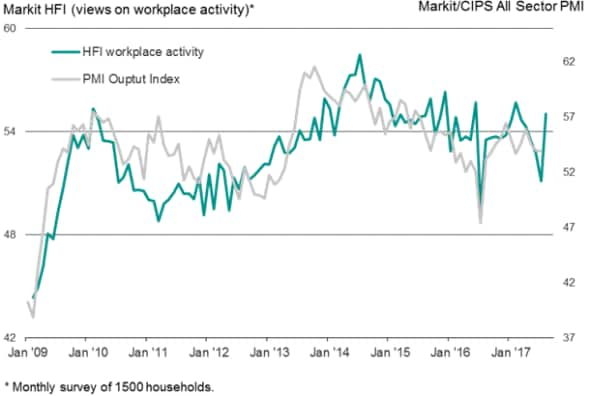

The upturn in income in part reflects people being busier at work. The survey's index of workplace activity spiked higher in August after having slumped in July to one of the lowest levels seen in the past five years. The rise in the index, which can act as a guide to the PMI output index, suggests business activity has perked up since an election-related slowdown.

Construction employees reported that activity growth picked up after slowing sharply in July, retail activity stabilised after three months of decline, manufacturing activity growth hit a 14-month high and financial & business services activity showed the largest rise since February.

Job insecurity eased, presumably in response to people being busier in work. The overall extent to which job security deteriorated was the smallest for 20 months, but the survey clearly highlights how the number of people feeling less secure in their jobs continued to outnumber those feeling more secure.

Workplace activity

Spending remains under pressure

The increase in incomes should help to support consumer spending in coming months, and it was notable that the survey's gauge of whether now is a good time to make major purchases rose to its highest so far this year.

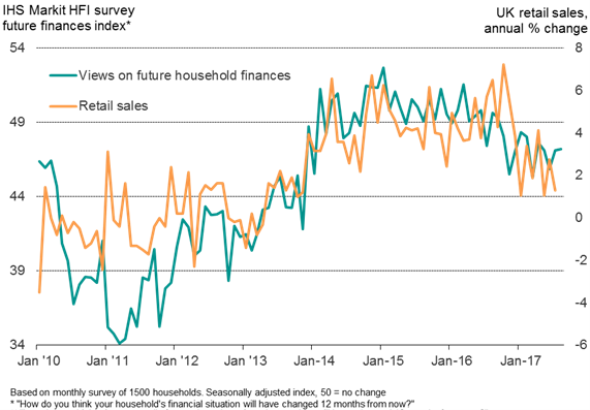

However, other factors may dominate spending decisions: worries about future finances suggest households will remain cautious. The index measuring households' view on their finances over the coming year edged up only very modestly from July.

Future finances and retail sales

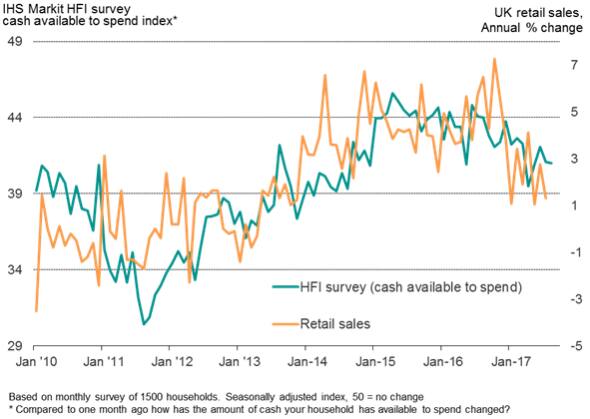

Furthermore, the index measuring the amount of cash that households have available to spend also remained firmly in negative territory, highlighting how spending power continued to be squeezed.

On balance, the survey therefore points to some support to consumer spending from higher incomes, linked to busier workplaces, but worries about future finances and the squeeze on spending power from high inflation mean any spending growth is likely to remain somewhat subdued.

With consumers having provided the main thrust to economic expansion in recent years, the survey data therefore add to signs that the pace of economic growth could remain lacklustre in the third quarter and beyond.

Cash available to spend and retail sales

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082017-Economics-Rising-incomes-help-ease-pressure-on-UK-household-finances.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082017-Economics-Rising-incomes-help-ease-pressure-on-UK-household-finances.html&text=Rising+incomes+help+ease+pressure+on+UK+household+finances","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082017-Economics-Rising-incomes-help-ease-pressure-on-UK-household-finances.html","enabled":true},{"name":"email","url":"?subject=Rising incomes help ease pressure on UK household finances&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082017-Economics-Rising-incomes-help-ease-pressure-on-UK-household-finances.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Rising+incomes+help+ease+pressure+on+UK+household+finances http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082017-Economics-Rising-incomes-help-ease-pressure-on-UK-household-finances.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}