Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 21, 2016

European govies feel ECB squeeze

The European Central Bank's ongoing asset purchases have pushed the cost to borrow high quality collateral to a new multi-year high.

- Fees to borrow eurozone sovereign bonds have jumped to 46% since Jan 2015

- German and French bonds have utilisation rates above 30%

- IG EUR corporate bonds have seen fees increase since QE was expanded

One of the fears around the ongoing European Central Bank (ECB) quantitative easing (QE) program is that it essentially removes a large portion of the high quality liquid assets that the industry needs to meet HQLA collateral requirements, which made the talk of an impending collateral shortage the hot industry topic of the last 18 months. While the collateral doomsday scenarios didn't materialize, the onset of QE has coincided with a steady increase in the cost to borrow high quality eurozone sovereign bonds. The steadily increasing fees commanded by these high quality assets would indicate that relentless pace of asset purchases is having some impact on the supply and demand dynamics for investors looking to source them.

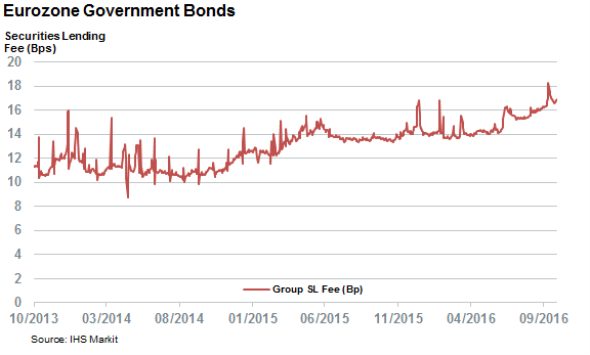

The latest weighted average fee for eurozone sovereign bonds now stands at 16.9bps, a material 46% increase on the levels seen on the eve of the onset of QE back in January of last year. The trend also shows no signs of slowing down as the closing days of September saw the fee spike to its highest level in over four years.

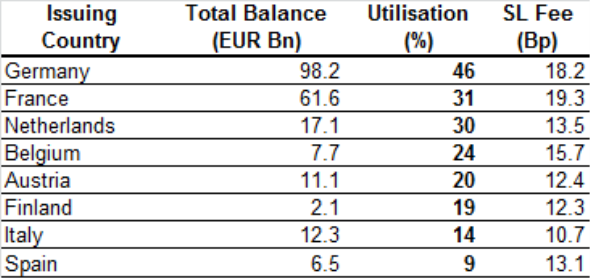

French and German sovereign bonds are the driving force behind the trend. Bonds issued by the two countries, which make up 75% of the current eurozone sovereign borrow, cost 18.2bps and 19.3bps to borrow on average which is over 5bps than the 12.9bps weighted fee commanded by the rest of the eurozone pack. Utilisation rates across both countries are also much higher with over 30% of French and a massive 45% of German sovereign bonds siting in lending programs now out on loan.

Relatively riskier Italian and Spanish bonds see much less relative demand to borrow with utilisation rates of 14.4 and 9% respectively.

Corporate rates also hit

Investment grade, euro denominated corporate bonds have also experienced the same trend as the fees required to borrow the asset class have surged to 29bps in the weeks since ECB decided to expand bond purchases to high quality corporate bonds.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102016-Credit-European-govies-feel-ECB-squeeze.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102016-Credit-European-govies-feel-ECB-squeeze.html&text=European+govies+feel+ECB+squeeze","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102016-Credit-European-govies-feel-ECB-squeeze.html","enabled":true},{"name":"email","url":"?subject=European govies feel ECB squeeze&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102016-Credit-European-govies-feel-ECB-squeeze.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+govies+feel+ECB+squeeze http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102016-Credit-European-govies-feel-ECB-squeeze.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}