Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 21, 2014

Shorts this week: soup, cereal and Cointreau

We review how short sellers are reacting to companies due to announce earnings in the coming week.

- Packaged food products top short interest in the US and Asian markets North American shorts include cereals, rice and soup producers

- Oil and gas companies continue be shorted against low oil prices in all regions

- Remy Cointreau is a top short in Europe as China cuts back on premium spending

- UK property companies are also being targeted

North America

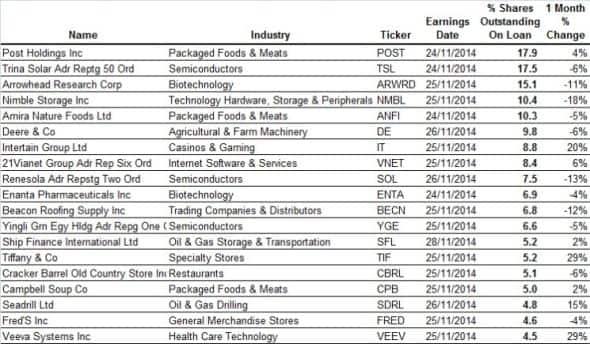

A number of packaged foods companies are amongst our most shorted this week in North America, as well as the biotech, solar and semiconductor sectors.

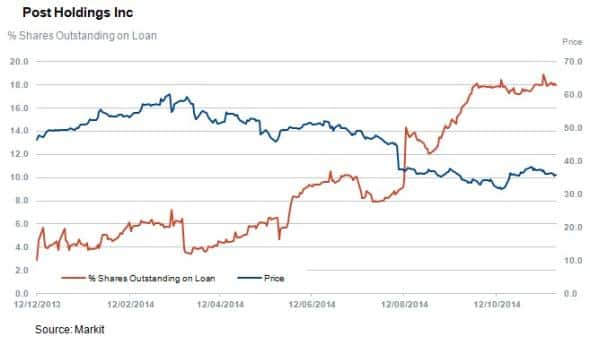

Most shorted ahead of earnings is Post Holdings with 17.9% of shares outstanding on loan. The consumer goods company's share price is down 27% year to date.

Post Holdings is best known for cereal derived products. however earlier this year they acquired Michael Foods Group to broaden their distribution and protein product range.

Amira Nature Foods, who produces and distributes predominately basmati rice to 50 countries globally currently has 10% of shares outstanding on loan.

Lastly, in the packaged foods and meats sector, Campbell Soup Co has 5% of shares outstanding on loan ahead of earnings.

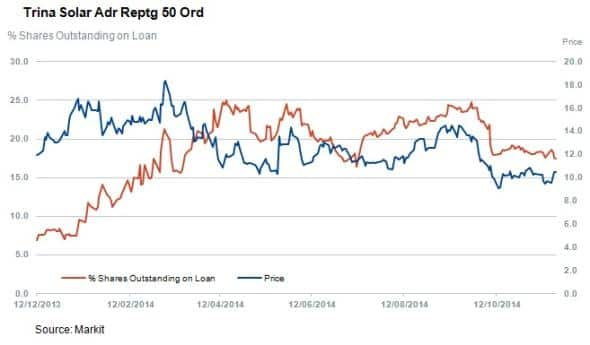

Trina Solar, China's second largest solar panel manufacturer is the second most shorted stock in the US as oil and energy prices continue to hover at multi year lows.

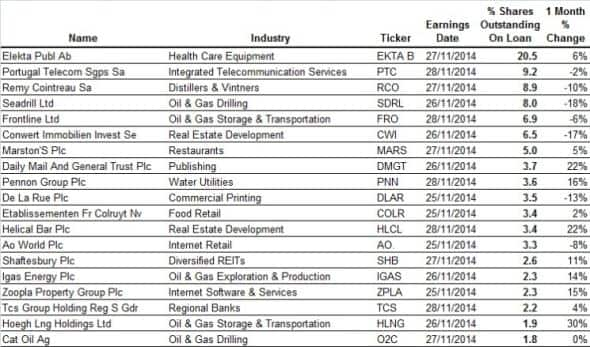

Europe

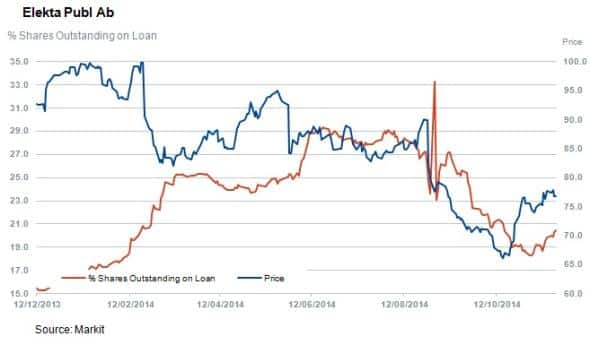

The most shorted share in the European market ahead of earnings is Elekta AB. The Swedish company produces and sells advanced medical products involved in the treatment of neurological disorders and cancers. The company currently has 20% of shares outstanding on loan, a decrease from highs of 30% reached in August. The share price is down 22% year to date.

Portugal Telecom takes second position in Europe with 9.2% shares outstanding on loan, this is however lower than the short interest of 14.7% in May. The share price is down 54% year to date. The company has been involved in protracted merger talks with Brazilian carrier Oi as the telecommunication sector in Brazil continues to consolidate.

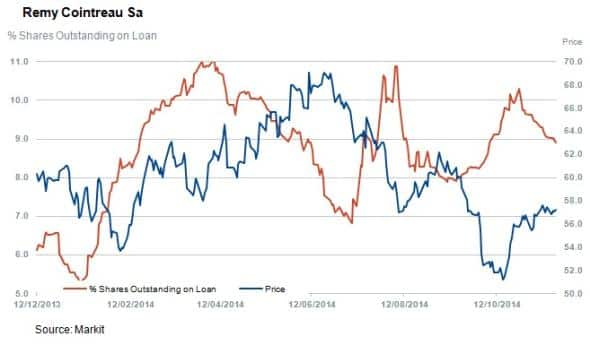

Famous Cognac and spirit producer Remy Cointreau is the third most shorted stock in Europe ahead of earnings this week with 8.9% of shares outstanding on loan.

A news report out in November revealed that the Chinese Communist Party's efforts at campaigning against lavish living are bearing fruit as impacts are being felt in French premium liquor exports with significant declines in demand of premium wines and spirits.

Other stocks in Europe this week with significant short interest include five companies engaged in the oil and gas sector as markets face declining oil prices and a strengthening dollar.

In the UK, property companies Helical Bar and Shaftsbury are in the most shorted this week and joining them is the second largest property website Zoopla with 2.3% of shares outstanding on loan. All three have seen double digit growth in short interest in the last month.

Asia Pacific

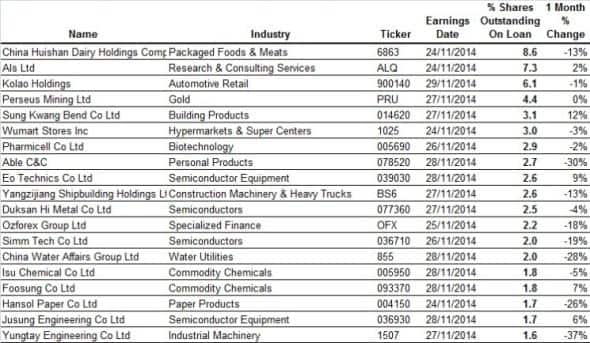

With 8.6% of shares outstanding on loan, milk producer Huishan is the most shorted stock in the region. The company has the second largest herd in China with 106,000 dairy cows. The company's IPO last year raised $1.3bn and the share price is down 40% year to date as management executes buybacks at depressed levels.

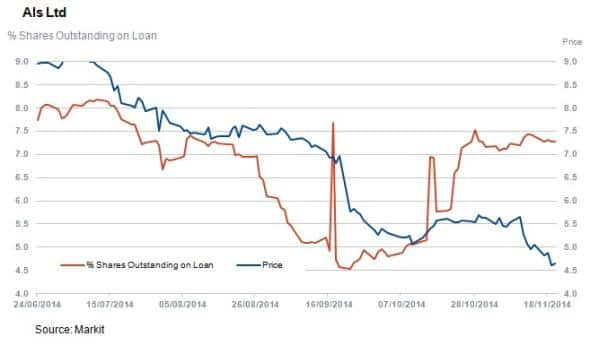

Australian commercial services company ALS is second most shorted. The firm provides services to minerals, life sciences energy and industrial sectors and is impacted by lower energy and oil prices experienced currently.

ALS currently has 7.3% of shares outstanding and the share price has declined by 47% year to date.

South Korean retailer of new and used vehicles, Koloa Holdings has seen increased short interest with 6.1% of shares outstanding on loan. Shares are down 32% year to date.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112014-Equities-Shorts-this-week-soup-cereal-and-Cointreau.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112014-Equities-Shorts-this-week-soup-cereal-and-Cointreau.html&text=Shorts+this+week%3a+soup%2c+cereal+and+Cointreau","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112014-Equities-Shorts-this-week-soup-cereal-and-Cointreau.html","enabled":true},{"name":"email","url":"?subject=Shorts this week: soup, cereal and Cointreau&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112014-Equities-Shorts-this-week-soup-cereal-and-Cointreau.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+this+week%3a+soup%2c+cereal+and+Cointreau http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112014-Equities-Shorts-this-week-soup-cereal-and-Cointreau.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}