Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 23, 2015

China flash PMI signals ongoing downturn but factories gain from lower oil prices

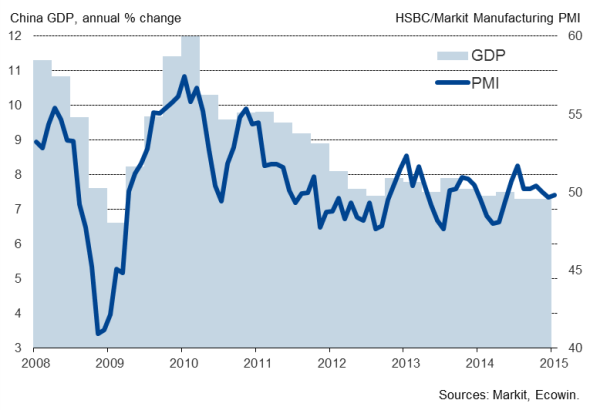

China's factories started 2015 on a flat note. At 49.8, the HSBC Manufacturing PMI mustered only a marginal rise from December's seven-month low of 49.6, according to the flash estimate produced by Markit. The sub-50 reading means manufacturing conditions deteriorated for a second successive month, signalling a continuation of the near-constant malaise that has hit the Chinese manufacturing economy since mid-2011.

Manufacturing PMI v GDP

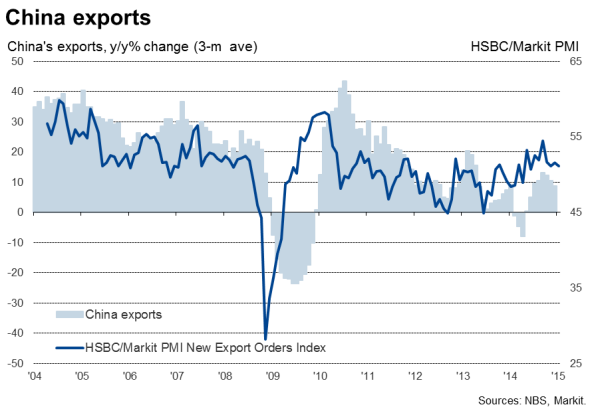

New orders rose marginally during the month, improving on the slight decline seen in December but remaining weaker than the prior six months. Export order book growth slowed marginally, down to the joint-weakest seen over the past seven months.

Factory output barely expanded as a result, continuing the trend of near-stagnation of manufacturing production that has now been seen for four months.

Headcounts were meanwhile trimmed for the fifteenth successive month, the rate of job losses accelerating slightly as companies grew increasingly cautious about future demand.

Similarly, stocks of inputs were cut to the greatest extent for over two years as companies prepared for lower production runs.

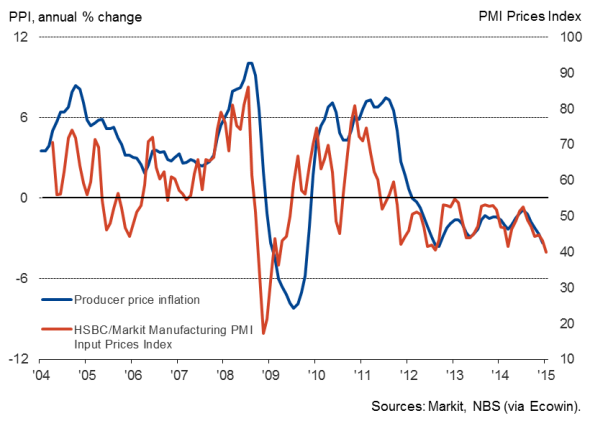

More positively, the survey data indicated that inflationary pressures continued to fall, leaving greater scope for the authorities to add more stimulus to the economy if deemed appropriate. Lower oil and other commodity prices drove average input prices down at the fastest rate since the height of the global financial crisis in March 2009. Prices charged by factories fell as a consequence of the lower input costs and the need to offer discounts to attract customers, dropping to the greatest extent since last March.

Producer prices

The flash PMI data therefore add to the sense that China's economy will slow further in 2015, with the IMF having recently downgraded their forecast for the year from 7.1% to 6.8%, and adds to growing investor disappointment in China.

Deteriorating outlook

Markit's dividend forecasting team meanwhile sees the dividend outlook remaining positive but returns are expected to grow at a weaker rate in 2015 compared to last year alongside a wider economic slowdown. Aggregate dividends of FTSE China A50 constituents are expected to have grown by 7.1% in 2014 but to increase by just 3.1% in 2015.

Although the Shanghai Composite has surged in recent weeks, the rise in share prices looks to have reflected technical factors, and notably the launch of the Shanghai-Hong Kong Stock Connect rather than a genuine increase in investor sentiment to the region's potential. Exchange Traded Funds exposed to China, for example, saw record net outflows from foreign investors in the final quarter of last year, an exodus which has continued into January so far, most likely reflecting the ability to switch to investing directing in Chinese 'A' shares due to the opening of the Connect.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-Economics-China-flash-PMI-signals-ongoing-downturn-but-factories-gain-from-lower-oil-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-Economics-China-flash-PMI-signals-ongoing-downturn-but-factories-gain-from-lower-oil-prices.html&text=China+flash+PMI+signals+ongoing+downturn+but+factories+gain+from+lower+oil+prices","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-Economics-China-flash-PMI-signals-ongoing-downturn-but-factories-gain-from-lower-oil-prices.html","enabled":true},{"name":"email","url":"?subject=China flash PMI signals ongoing downturn but factories gain from lower oil prices&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-Economics-China-flash-PMI-signals-ongoing-downturn-but-factories-gain-from-lower-oil-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+flash+PMI+signals+ongoing+downturn+but+factories+gain+from+lower+oil+prices http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-Economics-China-flash-PMI-signals-ongoing-downturn-but-factories-gain-from-lower-oil-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}