Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 23, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

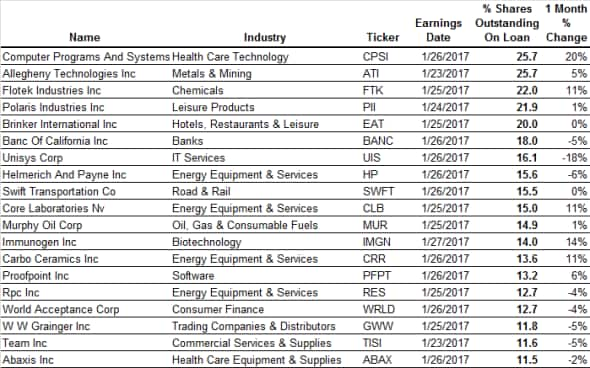

- Computer Programs and Systems is most shorted worldwide with 26% of its shares lent ahead of earnings

- Kone sees short sellers cover as earnings expectations brighten

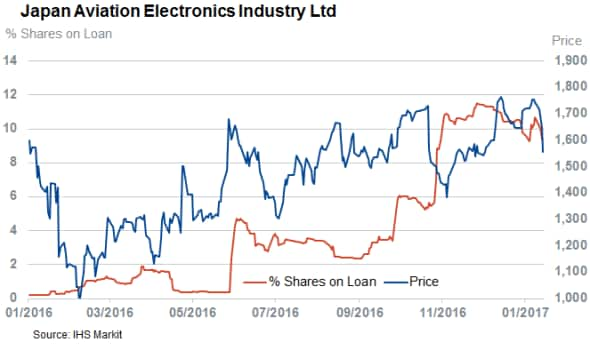

- Japan Aviation Electronics Industry is most shorted Asian firm announcing earnings

North America

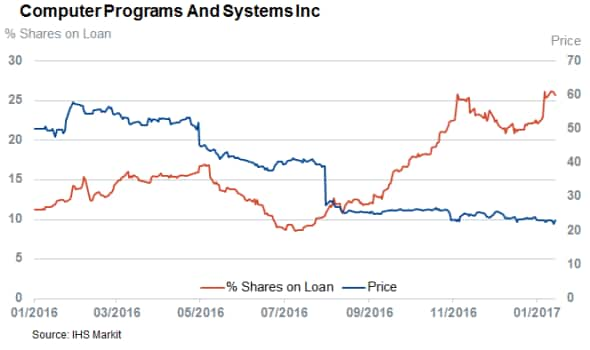

Computer Programs and Systems (CPSI), which offers IT solutions to rural hospitals and healthcare providers, is the most shorted company announcing earnings this week. Short sellers have a good track record in CPSI as over 15% of its shares were out on loan in March of last year, just before the company announced disappointing earnings which started a sustained price decline. While short sellers did close out their positions before CPSI's disastrous Q2 earnings which set off a 30% slide in its shares price, they are as committed to profit from any disappointment at present.

The current 25.5% of CPSI shares outstanding on loan which have been borrowed by short sellers represents an all-time high for the firm.

Energy continues to play a key role in many short portfolios despite the recent stability in energy prices and this week sees five energy firms feature among the 20 most shorted firms announcing earnings this week.

The five are led by contract driller Helmerich and Payne (HP) which has over 15% of its shares out on loan to short sellers. HP shares have more than doubled from the lows set in the opening weeks of last year, but the firm is still set to post losses for each of this year's four quarters. Short sellers were initially willing to ride HP's rebound however the post-Trump rally, which has accelerated this rebound, has prompted some large scale covering as the current portion of HP shares out on loan has fallen by over a third from the recent highs last October.

Energy short sellers are also still active in the sector's service providers as Core Laboratories and Carbo Ceramics both make the list of heavily shorted companies ahead of earnings.

Another name popping up among the heavily shorted stocks is Banc of California. The firm was the target of an activist short report in October of last year which alleged the firm had ties to a convicted fraudster. The bank's shares have recovered most of the ground lost in the wake of this announcement but short sellers are showing no sign of easing as demand to borrow its shares has more than doubled since the allegations first came to light.

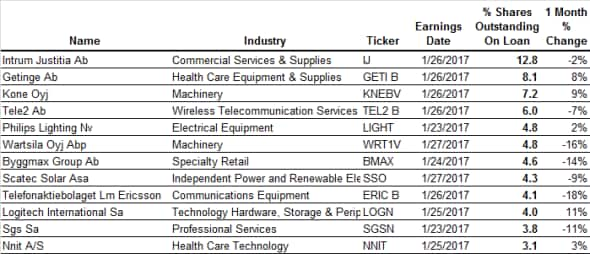

Europe

Elevator firm Kone, the largest short target announcing earnings this week, has 7.2% of its shares on loan to short sellers. The firm found itself a short target last year from investors looking to play a slowing Asia where Kone generated over 40% of its revenue. Recent rebounding growth has taken the urge to short Kone right down as demand to borrow its shares has fallen by 40% in from the highs in February last year.

Recent IPO Philips Lighting also makes the list of heavily shorted stocks as it has under 5% of its shares on loan. Short sellers largely steered clear of the firm in months immediately following its spinoff from Philips last year, but its disappointing Q3 earnings, which saw the firm miss its revenue target by 4%, has spurred on sceptics as bearish positions in the lighting firm have nearly doubled in the subsequent three months.

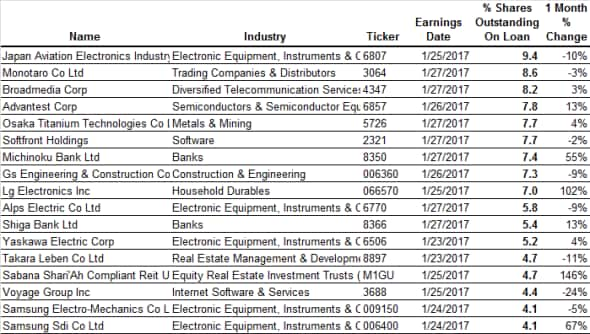

Asia

Japanese electronics manufacturer Japan Aviation Electronics Industry is the top short target in Asia as it has just under 10% of its shares outstanding on loan. Short sellers have nearly doubled their borrow in the firm's shares since it last posted results in November.

The largest non-Japanese short target is Gs Engineering which has 7.3% of its shares out on loan although this borrow is not likely to be driven by negative sentiment in the firm's share price as GS Engineering has a large convertible bond outstanding.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012017-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}