Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 23, 2015

Floaters fall out of favour with investors

Although investors have been increasingly piling into short term debt, appetite for Floating Rate Notes has shrunk since the beginning of the year.

- ETFs with a short term maturity investment approach have seen consistent inflows

- iShares Floating Rate Bond ETF has seen $633m of outflows this year

- Dollar denominated FRNs offer 1.07% extra yield over Euro FRNs

With central banks across the developed world still engaged in a zero interest rate policy (ZIRP), FRNs have enjoyed increasing popularity over the last several years.

FRNs are a type of bond issued by both corporations and governments. These instruments typically have a short term maturity and pay a regular stream of coupons based on an underlying funding rate, such as Euriobor. Payments adjust periodically to reflect changes in this funding rate and therefore FRNs are typically seen as a natural hedge for changes in interest rates. From an investor point of view, FRNs offer diversification and lower transaction costs as their returns largely match short term T-bills without the need to be rolled over every three months.

The US Treasury issued FRNs to investors for the first time in January of last year; joining governments such as Japan and Italy which have been issuing this type of security for years. The notes were issued to minimise the treasury's short term cash needs and reduce rollover risk of T-bills by lengthening the treasury's maturity profile.

ZIRP

The expectations of potential interest rate normalisation in the US has seen investors pile into at the short end of the curve as ETFs with a short term maturity investment approach have seen inflows for the last eleven consecutive quarters.

ETF investors have increased their exposure in FRNs over the past three years. The iShares Floating Rate Bond ETF, which tracks investment of an index composed of US dollar denominated investment grade FRNs, has seen its AUM grow from $20m in 2011 to $3.1bn today. In 2013 alone, the fund's AUM increased sevenfold as the 'Taper Tantrum' gripped US markets, with increased levels of market volatility stemming from the US Fed's unexpected rhetoric around interest rate normalisation.

Interestingly, this year has seen a reversal in the trend as the iShares Floating Rate Bond ETF has seen outflows of $633m. This contrasts with short term ETFs which have continued to see inflows.

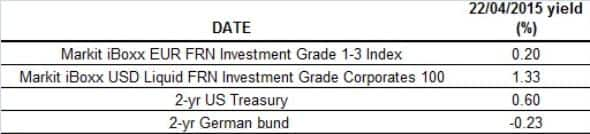

The flight out of FRNs, despite their built in interest rate hedge, could be due to investors simply reallocating capital to higher yield asset classes. The Markit iBoxx USD Liquid FRN Investment Grade Corporates 100 index currently provides an annual yield of 1.33%, 73bps over equivalent treasuries. But USD FRNs still provide much better yield than Euro FRNs, as represented by the Markit iBoxx EUR FRN Investment Grade 1-3 Index.

Another explanation of why investors are moving out of FRNs could be the changing expectations to interest rates rises. Outflows started to begin in August last year as deflationary pressures developed and macroeconomic data in the US weakened. Further dovish tones from the Fed have already pushed back a rise out until the second half of 2015 and expectations are that normalisation will be steady and gradual. The need to hedge against sudden interest rate moves looks to have subsided and investors are now searching for yield in riskier assets.

While issuance in both euros and US dollars remains strong, if interest rate normalisation in the US brings about the same sort of volatility seen during the 'Taper Tantrum' FRNs may fall back into favour.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-credit-floaters-fall-out-of-favour-with-investors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-credit-floaters-fall-out-of-favour-with-investors.html&text=Floaters+fall+out+of+favour+with+investors","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-credit-floaters-fall-out-of-favour-with-investors.html","enabled":true},{"name":"email","url":"?subject=Floaters fall out of favour with investors&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-credit-floaters-fall-out-of-favour-with-investors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Floaters+fall+out+of+favour+with+investors http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-credit-floaters-fall-out-of-favour-with-investors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}