Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2015

UK retail sales fall, but upward consumer spending trend helps deficit reduction

Retail sales fell in March, but it would be wrong to get too worried about one month's fall. The underlying trend in fact looks to have remained firm, and so far this year sales are showing reasonably strong growth. The UK is clearly seeing robust consumer-driven economic growth, and this has helped bring the deficit down below target. The danger is that the upturn looks unsustainable unless wage growth picks up soon.

Sales weaken at end of first quarter

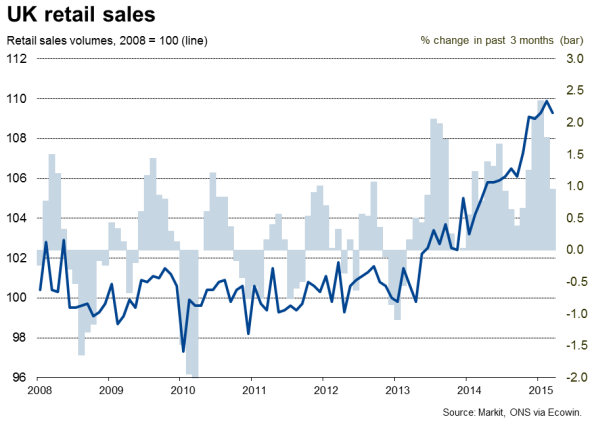

Retail sales fell 0.5% in March, according to the Office for National Statistics, dragged down by a steep 6.2% drop in fuel sales. Even excluding fuel, sales were up only a measly 0.2%.

However, the March weakness needs to be looked at in the context of strong data in prior months, and in part reflected payback after robust 0.6% sales growth in February. Over the first quarter as a whole, sales were up 0.9%. That's down from 2.2% in the final three months of last year but still a solid pace of expansion, which adds to evidence to suggest that the economy has continued to enjoy robust growth so far this year. The PMI surveys are pointing to the economy having expanded by 0.7% in the first quarter.

Cutting through the noisy monthly data, we are clearly seeing a sustained robust trend in retail sales, and rising consumer spending therefore looks to be still providing an important thrust to growth in the wider economy.

This spending upturn is in turn linked to the fact that we are currently seeing the strongest real-terms growth of regular employee earnings since January 2008. But it is important to recognise that this is largely a reflection of falling inflation rather than actual wage growth. With inflation set to start rising again later this year, we need to see pay growth picking up further to ensure the economic upturn maintains momentum.

Policy on hold amid uncertain pay outlook

At present, however, there is scant evidence that pay growth will pick up significantly. In fact, the recent drop in inflation to zero looks to be feeding through to weaker pay reviews. Not surprisingly, therefore, while lower inflation has boosted current household finances, people have become less optimistic about their future finances.

Yesterday's minutes from the Bank of England's Monetary Policy Committee meeting showed policymakers were unanimous in keeping interest rates at their record low. Although the arguments were "finely balanced" for two of the nine committee members, any hike in interest rates therefore still looks a long way off. However, the policy outlook remains largely dependent on what happens to wage growth, as this will not only have a major bearing on inflation but also the pace of economic growth.

Deficit reduction boost

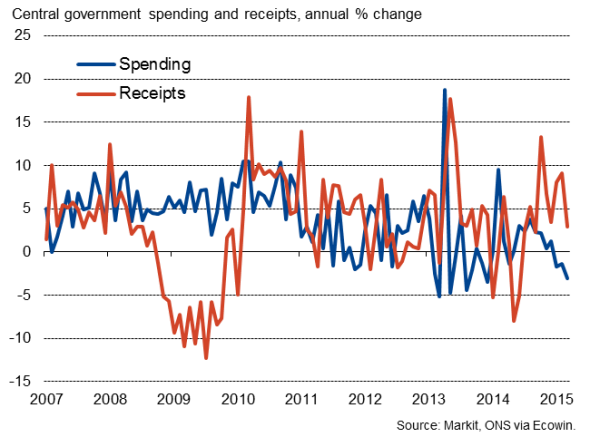

Separate data from the ONS also indicated that the sustained robust pace of economic growth was reflected in an improvement to the government finances. Public sector borrowing was 5.6% lower than a year ago in March after the bank bail-outs are excluded, resulting in the lowest monthly borrowing figure for that month since 2004. The deficit for the 2014-15 year came in at "87.3 billion against a projected "90.2 billion, providing some last-minute good news for the government heading into the general election.

Tax revenues are rising in year-on-year terms while government spending is falling.

However, with the deficit remaining some 4.8% of GDP, the improvement does little to alter the fact that the next government faces difficult decisions when it comes to deficit reduction.

Public sector finances

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-uk-retail-sales-fall-but-upward-consumer-spending-trend-helps-deficit-reduction.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-uk-retail-sales-fall-but-upward-consumer-spending-trend-helps-deficit-reduction.html&text=UK+retail+sales+fall%2c+but+upward+consumer+spending+trend+helps+deficit+reduction","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-uk-retail-sales-fall-but-upward-consumer-spending-trend-helps-deficit-reduction.html","enabled":true},{"name":"email","url":"?subject=UK retail sales fall, but upward consumer spending trend helps deficit reduction&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-uk-retail-sales-fall-but-upward-consumer-spending-trend-helps-deficit-reduction.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+retail+sales+fall%2c+but+upward+consumer+spending+trend+helps+deficit+reduction http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-uk-retail-sales-fall-but-upward-consumer-spending-trend-helps-deficit-reduction.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}