Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2016

Week Ahead Economic Overview

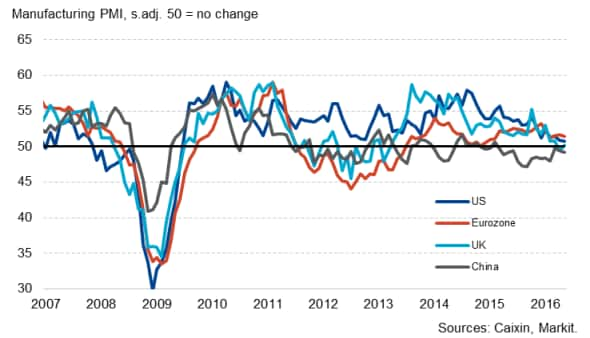

Worldwide manufacturing PMI results will provide analysts with important information on industry trends at the end of the second quarter, while first quarter GDP results are updated in the UK and the US. Moreover, inflation and unemployment numbers are out in the eurozone, while Japan sees the release of industrial production and retail sales figures.

Manufacturing PMI

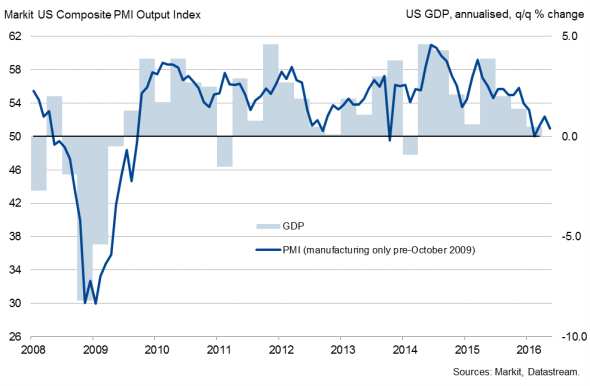

After the FOMC kept interest rates on hold following their June meeting, US policymakers will be carefully viewing the data flow in coming weeks and months for signs that the US economy is ready for a further rate rise. Separate manufacturing PMI results are released by Markit and ISM and will provide important information on the US goods-producing sector. Markit also releases a flash estimate for the US service sector at the start of the week. Moreover, analysts will be interested to see how consumer confidence is developing after the Conference Board's index fell to a six-month low in May. All data releases are likely to add to the policy debate at the Fed.

The US Bureau of Economic Analysis also updates first quarter GDP numbers. The advance estimate of a 0.5% rise has already been revised up slightly to 0.8%.

US GDP and the PMI

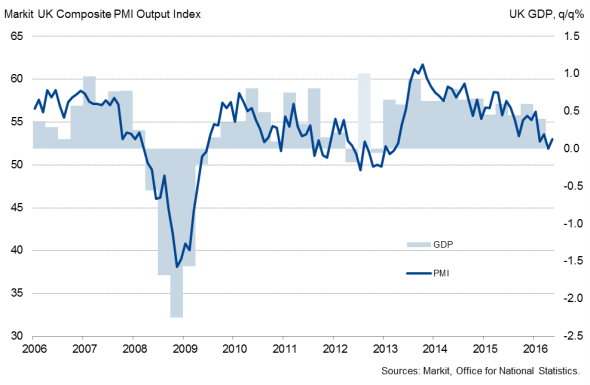

In the week following the EU referendum, manufacturing PMI data will be viewed for any Brexit-related impact on the UK manufacturing sector in June. Survey data available for the second quarter so far point to only marginal GDP growth, a slowdown which was in part linked to growing uncertainty regarding the UK's possible exit from the European Union.

The Office for National Statistics meanwhile updates first quarter UK GDP results. Latest GDP data showed the economy growing just 0.4% in the opening three months of 2016, down from 0.6% during the closing quarter of last year and dragged down by disappointing business investment, construction, manufacturing and export trends.

UK GDP and the PMI

More information on the health of the eurozone economy will be provided by Eurostat, the European Commission and Markit during the week. Flash PMI data for June pointed to the region's economy remaining on a steady, although disappointingly lacklustre growth path, with GDP likely to have slowed from the solid 0.6% expansion seen in the opening quarter. Final PMI results are released on Friday and will include more national detail. Meanwhile, the European Commission updates its business climate data. In May, the index reached a four-month high, thereby pointing to improved economic conditions in the region.

Consumer prices declined in the euro area over the past two months, and policy makers need to see a pick-up after the ECB raised its 2016 inflation forecast from 0.1% to 0.2% earlier this month. The inflation projection for 2017 currently stands at 1.3%.

New labour market data will be released by Eurostat on Friday and will be eyed for signs that the better than expected start to the year will have helped bring unemployment down, having remained stuck at 10.2% In April.

There will also be a big focus on PMI releases in Asia. The business surveys highlighted a continuation of the manufacturing downturn across the continent in May, with the region - especially China - acting as a drag on global economic growth. Flash PMI data already suggested that that the Japanese manufacturing economy remained mired in a renewed downturn in June, with the survey also flashing warning signs about potentially persistent weak growth moving into the second half of the year. There are some other notable releases in Asia, including industrial production and retail sales numbers in Japan.

Monday 27 June

In New Zealand and the US, trade balance numbers are published, with the latter also seeing the release of Markit's flash Services PMI results.

M3 money supply data are issued in the eurozone.

Destatis releases latest retail sales figures in Germany.

Consumer confidence numbers are meanwhile out in Brazil.

Flash services PMI results are published in the US.

Tuesday 28 June

Consumer confidence figures are out in France and Italy, while retail sales numbers are published in Spain.

Brazil sees the release of producer price figures.

In the US, final first quarter GDP and consumer confidence data are issued alongside the latest S&P/Case-Shiller Home Price Index.

Wednesday 29 June

Japan sees the release of retail sales figures.

The European Commission updates consumer confidence and business climate numbers for the eurozone.

Preliminary inflation data for June are out in Germany and Spain.

The Bank Austria Manufacturing PMI is published.

In the UK, mortgage approvals and consumer credit numbers are released.

Unemployment and budget data are updated in Brazil.

Personal income and mortgage application figures are meanwhile out in the US.

Thursday 30 June

Japan sees the release of industrial production, housing starts and construction orders numbers.

M3 money supply and producer price information are issued in South Africa.

Eurostat publishes consumer price figures for the currency union.

Unemployment data are updated in Germany.

In Spain, current account numbers are issued, while Greece sees the release of producer price and retail sales data.

Final first quarter GDP figures are meanwhile out in the UK.

Monthly GDP numbers are released in Canada alongside producer price data.

Initial jobless claims figures are issued in the US.

Friday 1 July

Manufacturing PMI results are published worldwide.

In Japan, household spending, consumer price, consumer confidence and unemployment data are issued.

Eurostat publishes jobless numbers for the currency bloc.

Brazil sees the release of industrial production and trade balance figures.

Construction spending numbers are out in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}