Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2015

China flash PMI signals renewed decline as job losses hit six-year record

China’s hopes for the economy to grow by around 7% for 2015 suffered a setback as the flash manufacturing PMI fell to its lowest level for nearly a year in March, signalling a renewed downturn in business conditions. The survey also revealed a further marked fall in output prices in the goods-producing sector, highlighting the current weakness demand.

Jobs were cut at the fastest rate for over six years as companies scaled back capacity in line with the tougher trading climate. The increasing impact of the slowdown in the labour market is a key factor likely to push the Chinese authorities into further efforts to stimulate demand.

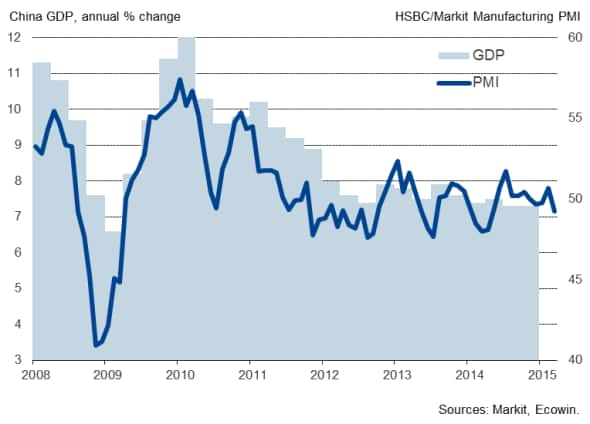

PMI and GDP compared

PMI at 11-month low

At 49.2, the HSBC Manufacturing PMI fell to an 11-month low in March, according to the flash reading (which is based on an estimated 85% of usual monthly replies). Down from 50.7 in February, the index also returned below the 50.0 ‘no-change’ mark to signal a renewed deterioration of business conditions in the manufacturing sector.

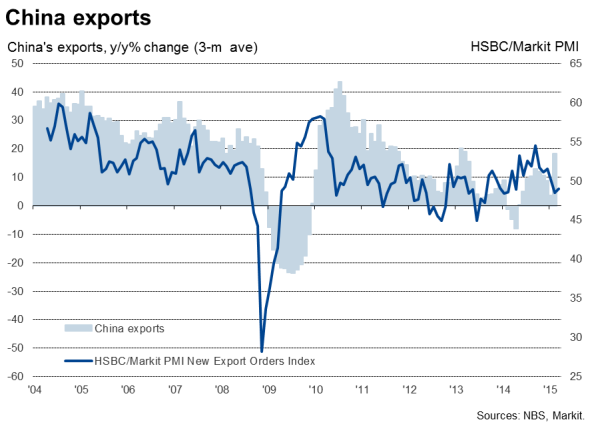

The worsening picture reflected the first fall in new orders for three months, the rate of decline of which was the fastest since April last year. The order book downturn reflected a drop in new export orders for a second month running, albeit falling to a slightly lesser extent than in February, which had seen the steepest monthly fall since early 2014.

Factory output rose for a third consecutive month, but only modestly and at a slower rate than in February, and the forward-looking orders-to-inventory ratio hit an 11-month low to suggest that the production trend will continue to deteriorate in April.

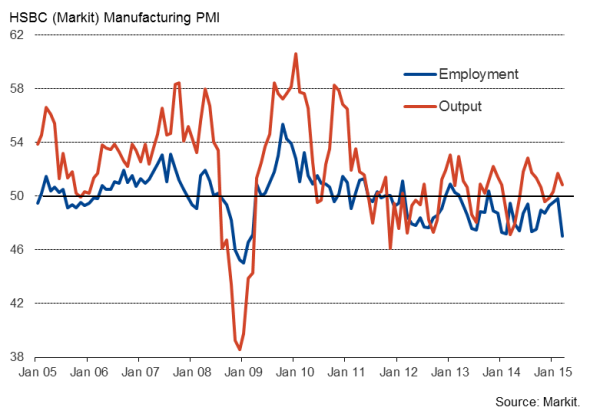

Output and employment

Companies certainly appear to be preparing for further weak demand in coming months, cutting headcounts to the greatest extent seen since the height of the global financial crisis in February 2009.

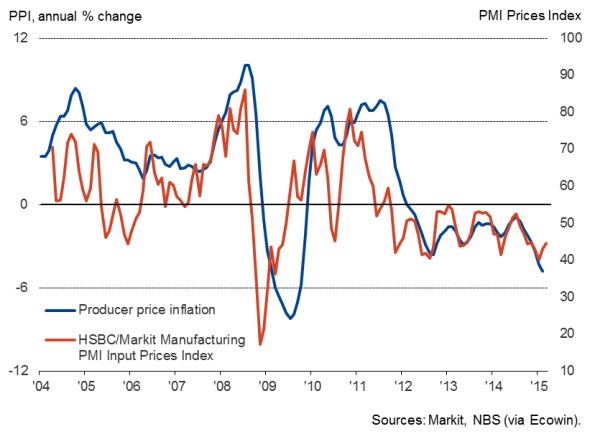

Prices continue to decline

Factory input costs and selling prices both fell markedly again in March, although in both cases the rate of decline eased for a second successive month. The strong deflationary forces facing Chinese goods producers was nevertheless also highlighted by the latest Global Outlook Survey, which showed companies expecting output prices to fall over the coming year for the first time since data were first collected in 2009.

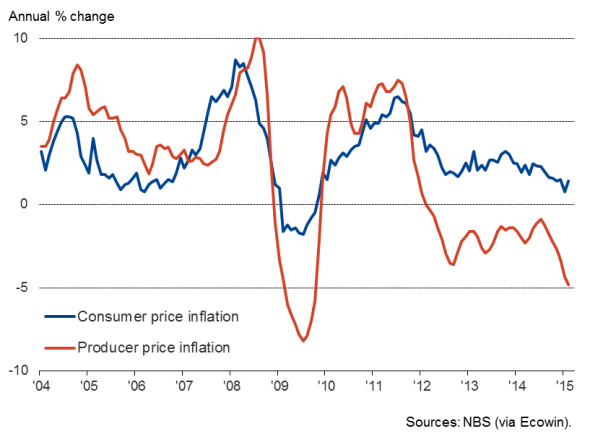

Although consumer price inflation picked up from 0.8% to 1.4% in February, producer prices fell at an annual rate of 4.8%, the steepest decline since late-2009. The weakness of the producer price and PMI numbers therefore suggest consumer price inflation could ease again in coming months.

PMI and producer prices

Producer and consumer prices

PMI adds to scope for more stimulus

The weakness of the survey data overall, and the downbeat assessment of the economic situation indicated by the steepness of the decline in employment in particular, suggests that the authorities will seek to address the slowdown.

China’s Premier Li Keqiang has noted that they are keen to step up their efforts to boost the economy if the slowdown shows signs of hitting the labour market in particular, which is precisely what the PMI is indicating.

The authorities have set a lower growth target of “around 7%” for 2015 compared to 7.5% in 2014, which would be the lowest expansion for quarter of a century, as the economy transitions away from a boom in fixed-asset investments.

However, in the absence of renewed stimulus efforts, even this reduced target may not be achieved given the weakness of the recent economic data flow, with corporate performance suffering markedly alongside the slowdown. Markit’s dividend forecasting team already sees the dividend outlook to have deteriorated in 2015. The aggregate dividend of FTSE China A50 companies is expected to grow by just 3.1% in 2015 compared to the 14.5% growth seen in 2014.[1]

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

[1] Similar to previous years, approximately 60% of the contribution is estimated from Chinese banks (the financial services sector is expected to realise the largest dividend growth of 80% in 2015) , benefitting from the recent positive sentiment on the mainland capital market.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-economics-china-flash-pmi-signals-renewed-decline-as-job-losses-hit-six-year-record.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-economics-china-flash-pmi-signals-renewed-decline-as-job-losses-hit-six-year-record.html&text=China+flash+PMI+signals+renewed+decline+as+job+losses+hit+six-year+record","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-economics-china-flash-pmi-signals-renewed-decline-as-job-losses-hit-six-year-record.html","enabled":true},{"name":"email","url":"?subject=China flash PMI signals renewed decline as job losses hit six-year record&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-economics-china-flash-pmi-signals-renewed-decline-as-job-losses-hit-six-year-record.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+flash+PMI+signals+renewed+decline+as+job+losses+hit+six-year+record http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-economics-china-flash-pmi-signals-renewed-decline-as-job-losses-hit-six-year-record.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}