Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2015

Near-four year high eurozone flash PMI smashes consensus as recovery gains momentum

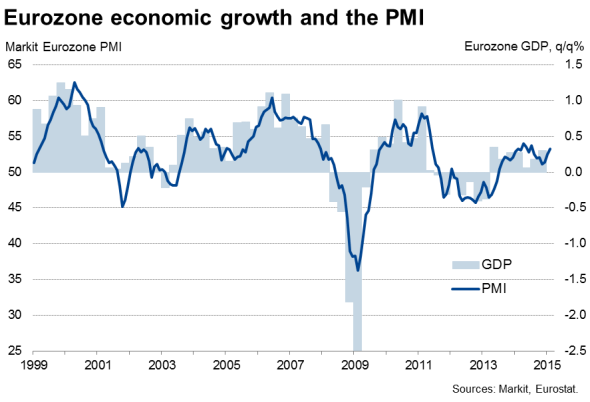

Key eurozone equity benchmarks and the single currency are higher after signs that the region’s economic recovery gained further momentum in March. The Markit PMI™ hit its highest level for almost four years, rising from 53.3 in February to 54.1, according to the flash reading[1]. The March reading was higher than all economists polled by Reuters had been expecting, with a consensus prediction of just 53.6.

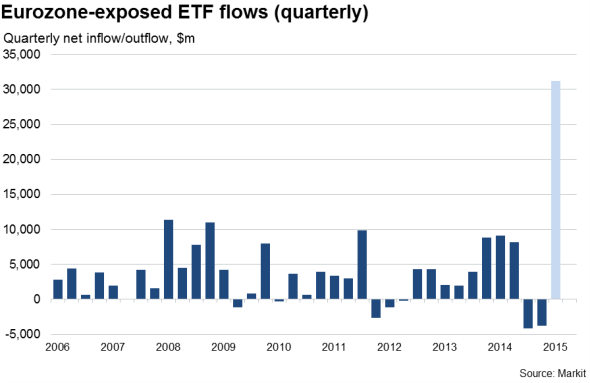

The improvement in the PMI provides welcome news to a region awaiting signs that the ECB’s quantitative easing is stimulating the real economy. Investors have flocked to gain exposure to eurozone assets since the central bank announced its stimulus plans.

The data suggest that eurozone GDP looks to have expanded by 0.3% in the first quarter, buoyed by a 0.4% expansion in Germany and signs of a long-awaited recovery in France.

Although the surveys are signalling a mere 0.2% expansion of the French economy in the first quarter, the euro area’s second-largest economy is seeing its best performance since 2011.

Business conditions are also picking up in the rest of the region, where the surveys showed growth of new orders and employment both hit the highest since 2007.

Service sector growth again outpaced that seen in manufacturing across the region as a whole, but both sectors saw improved rates of expansion. While service providers and manufacturers have been helped by consumers enjoying low prices, manufacturing has also been boosted by exporters benefitting from the weaker euro.

Deflationary pressures also eased during the month, linked to higher wages and rising import costs resulting from the euro’s depreciation.

Nascent recovery gets QE boost

The survey data therefore indicate that the ECB’s quantitative easing has been started at a time when the eurozone’s economic upturn is already starting to gain traction. This augurs well for the region to enjoy further improvements in business conditions as the year proceeds, helping drive greater business investment and hiring, thereby helping ensure the recovery becomes sustainable.

The consensus-beating PMI reading therefore adds to the likelihood of eurozone growth forecasts being revised higher. The ECB has already revised up its forecast for the economy to expand by 1.5% in 2015. The IMF pencilled-in 1.2% growth in its World Economic Outlook back in January. Such forecasts may prove overly pessimistic if the PMI continues to gain ground in coming months.

Investors flock to gain eurozone exposure

The consensus-beating PMI data drove equity markets higher, with the euro also receiving a boost relative to the US dollar. Key equity benchmarks had recently dropped from seven-year highs but regained ground after the PMI releases. The euro pushed back above $1.10.

Investor sentiment towards the region has shown no signs of abating in March, according to Markit’s exchange traded fund data. ETFs exposed to the eurozone enjoyed record inflows so far in the first quarter. A net $31bn extra invested so far this year, including an $11bn net inflow in March, has outstripped the prior quarterly record almost three-fold. Investors have ploughed money into both equity and fixed income ETFs to extents not previously recorded, though the former has vastly outstripped the latter. So far this year, equity funds exposed to the euro area have seen some $24bn net inflows while fixed income fund inflows have reached almost $7bn.

However, if the economic data continue to surprise on the upside it is perhaps only a matter of time before there’s a market pull-back, not least because investors will start to perceive an end to the ECB’s ‘open-ended’ QE programme.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

[1] The flash PMI is a preliminary reading of the final survey results, based on approximately 85% of the full number of responses expected from each country each month. The remaining 15% of replies subsequently received in the final week of the month explain the difference between the flash and the final results.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-economics-near-four-year-high-eurozone-flash-pmi-smashes-consensus-as-recovery-gains-momentum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-economics-near-four-year-high-eurozone-flash-pmi-smashes-consensus-as-recovery-gains-momentum.html&text=Near-four+year+high+eurozone+flash+PMI+smashes+consensus+as+recovery+gains+momentum","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-economics-near-four-year-high-eurozone-flash-pmi-smashes-consensus-as-recovery-gains-momentum.html","enabled":true},{"name":"email","url":"?subject=Near-four year high eurozone flash PMI smashes consensus as recovery gains momentum&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-economics-near-four-year-high-eurozone-flash-pmi-smashes-consensus-as-recovery-gains-momentum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Near-four+year+high+eurozone+flash+PMI+smashes+consensus+as+recovery+gains+momentum http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-economics-near-four-year-high-eurozone-flash-pmi-smashes-consensus-as-recovery-gains-momentum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}