Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 24, 2015

Week Ahead Economic Overview

Preliminary estimates of first quarter gross domestic product in the US and UK set the scene for a number of manufacturing PMI surveys later in the week, the latter providing the first indication of the health of the global economy at the start of the second quarter. The week also sees the last FOMC meeting until June.

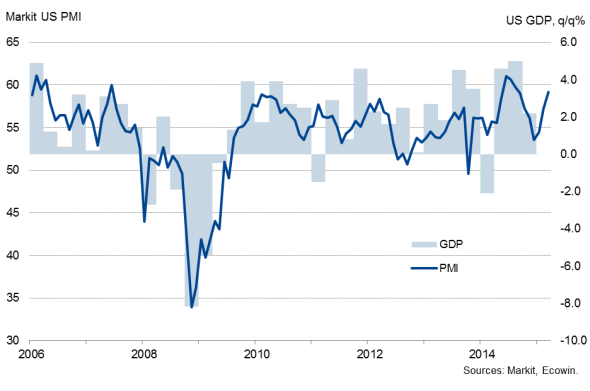

Economic growth in the US is widely expected to have slowed sharply in the first quarter, with annualised GDP growth sliding from 2.2% at the end of last year to around 1.0%. The data will be scrutinised for signs that the slowdown is only temporary, with the economy widely thought to have been disrupted by port closures and extreme weather, in which case the data will be discounted by policymakers.

US GDP and the PMI

The GDP data will be mulled over by the FOMC in their last meeting until June. Policymakers were split at their last meeting on when to hike interest rates, with some recommending a tightening of policy as early as June but others worrying that any premature hike in interest rates will push inflation further away from the Fed's 2% target.

Since the last FOMC meeting, the news have been mixed. The labour market showed a surprise weakening, supporting the doves, but on the other hand core inflation rose more than expected.

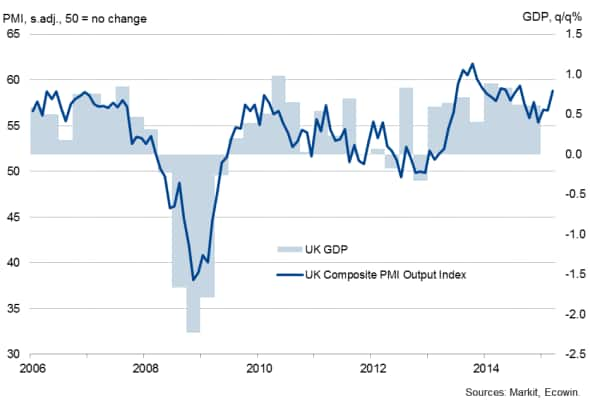

The release of first quarter GDP data will also important for policymakers in the UK. Although the Bank of England's Monetary Policy Committee was unanimous in voting for interest rates to remain on hold at their last meeting, two of the nine members saw the decision as to whether to hike rates as 'finely balanced'. Opinion could therefore be easily swayed in either direction by the GDP numbers. We expect the economy to have grown by a robust 0.7%, bolstering the case for higher interest rates.

UK GDP and the PMI

Friday's manufacturing PMI data will also add insight into UK and global economic trends, and therefore also guide policy prescriptions. Preliminary 'flash' PMI data brought disappointment across the board, showing a broad-based slowdown encompassing the US, China, Japan and the eurozone. Signs of renewed weakness will raise the prospect of further policy loosening in Japan and China, while also reducing the likelihood of policy being tightened this year in the US and UK.

In the eurozone, the weak PMI data confounded expectations that recent ECB stimulus would have helped further kindle the region's fledgling recovery. Inflation data for April will therefore be eagerly awaited to gauge the extent to which deflationary forces remain a concern.

However, the main concern in Europe remains Greece. With IMF payments looming in May and a distinct lack of progress in debt negotiations, the markets will inevitably be dominated by worries about the rising possibility of Greek default.

Monday 27 April

The Confederation of British Industry publishes latest data from their Industrial Trends Survey.

In Germany, import price numbers are issued.

Consumer confidence figures are meanwhile released in Brazil.

Flash US Services PMI data for April are published by Markit.

Tuesday 28 April

Retail sales numbers are issued in Japan.

The first estimate of first quarter GDP is released by the Office for National Statistics in the UK.

In France, INSEE releases consumer confidence data.

Unemployment numbers are out in Brazil.

Case-Shiller home price information and consumer confidence data are meanwhile released in the US.

Wednesday 29 April

In India, M3 money supply information are published.

The Bank Austria Manufacturing PMI for April is released.

Retail sales numbers are issued in Spain and Germany, with the latter also seeing the release of inflation figures.

Economic sentiment data and M3 money supply information are published for the eurozone, while business confidence numbers are out in Italy.

The Swedish Central Bank announces its latest interest rate decision.

In the UK, house price data are issued by Nationwide.

The US sees the release of first quarter GDP numbers and pending home sales data. Moreover, the Federal Reserve's Federal Open Market Committee announces its latest interest rate decision.

Meanwhile, producer price figures are out in Canada.

Thursday 30 April

The Reserve Bank of New Zealand announces its official cash rate.

In Japan, industrial output numbers and housing starts data are released, while the Bank of Japan announces its latest monetary policy decision.

Australia sees the publication of trade price numbers.

Eurostat issues unemployment and inflation numbers for the currency union.

Producer price figures are out in Italy, France and Greece, with the latter also seeing the release of retail sales numbers. Moreover, consumer spending data are released in France.

In Spain, first quarter GDP data, flash inflation numbers and current account figures are issued.

Meanwhile, GfK consumer confidence numbers are released in the UK.

South Africa sees the publication of M3 money supply data alongside producer price and trade balance numbers.

Monthly GDP figures are issued in Canada.

Brazil's Central Bank announces its latest interest rate decision.

In the US, initial jobless claims numbers, personal spending data and the latest Employment Cost Index are issued.

Friday 1 May

In Japan, unemployment numbers and inflation data are issued, while producer price figures are out in Australia.

Markit publishes a number of survey results, including the UK and US Manufacturing PMIs.

The Bank of England releases information on mortgage approvals, consumer credit and M4 money supply.

The Reuters/Michigan Consumer Sentiment Index is issued in the US.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}