Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 24, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

- Short sellers tighten grip on Carbo Ceramics as rig counts and fracking operations plummet

- End to the pilot strikes at Air France KLM and Norwegian Air Shuttle lifts stocks

- Shares in China's largest cement maker rally, sending short sellers packing

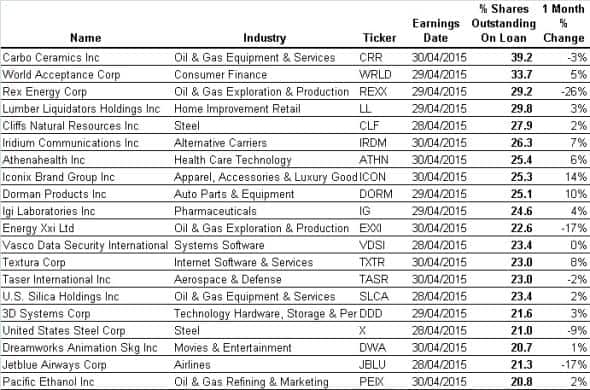

North America

With rig counts expected to bottom out in the US this summer and oil production becoming less profitable, Carbo Ceramics features yet again as the most shorted stock ahead of earnings. The company's share price has remained flat over the last three months while short sellers have continued to increase positions with shares outstanding on loan increasing from 35% to 39%.

The demand to borrow stock in Carbo Ceramics has risen significantly in the last three months, indicating increased conviction among short sellers that the company's share price may come under further pressure. The benchmark fee to borrow stock has increased fivefold year to date from below 5% to above 25%.

Carbo Ceramics announced on March 17th that it has cut its quarterly dividend by two thirds to $0.10 (record date May 1st 2015). The cut is accompanied by a reduction in workforce, an idling of production and mothballing of a plant forming as part of a cost-reduction and cash preservation initiative. Management cited "severe market deterioration" as motivating the recent moves.

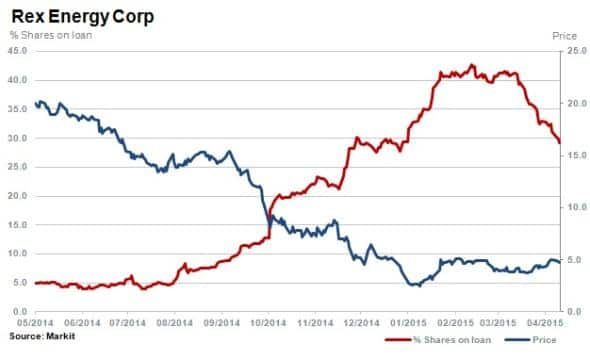

Rex Energy is a primary oil & gas explorer and producer in the Appalachian and Illinois regions and is currently the third most shorted in North America ahead of earnings. With 29% of shares outstanding now on loan, short sellers have covered in recent weeks as oil prices have recovered. The stock price has actually already recovered by 70% in the last three months but is still 76% down over the last 12 months.

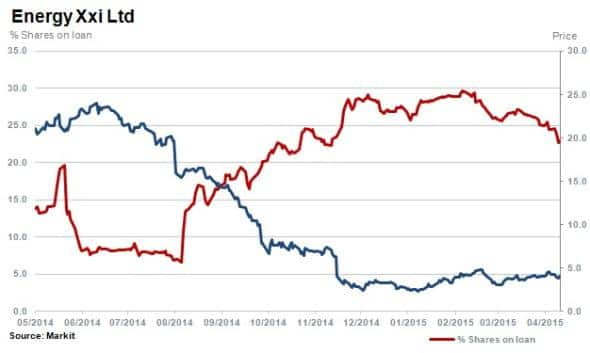

Another oil & gas name among the most shorted ahead of earnings is Energy XXI which currently has 23% of shares outstanding on loan. The company explores and produces oil in the Gulf of Mexico and recently cut their dividend by 90% in January.

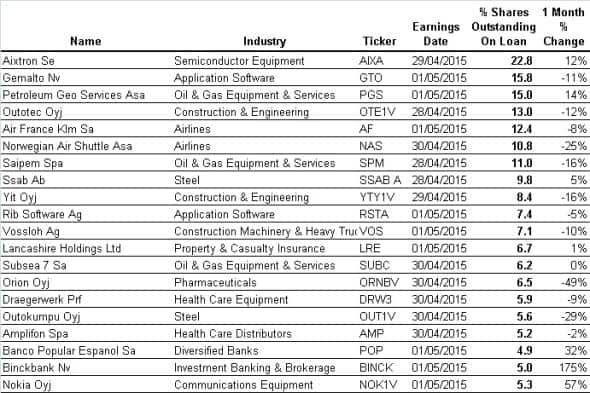

Western Europe

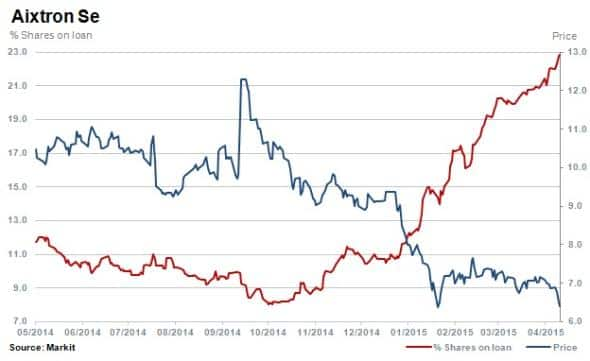

Perennial target of short sellers Aixtron retains the top spot of the most shorted in Europe ahead of earnings this week. The stock has seen a 40% rise in short interest over the last quarter, with shares outstanding on loan increasing to 23%.

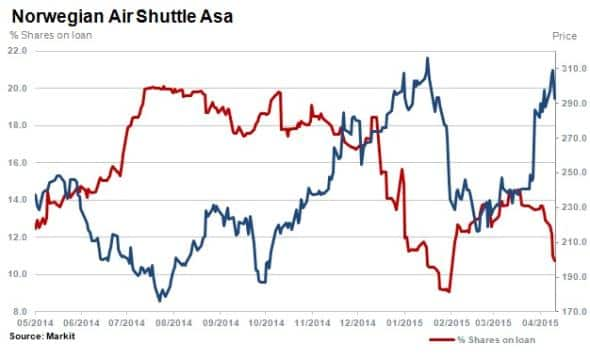

Two airlines featuring in the most shorted ahead of earnings this week are Air France Klm and low cost carrier Norwegian Air Shuttle.

With 12% and 11 % of shares outstanding on loan respectively, both airlines have recently recovered from union led pilot strikes with both companies' share prices recovering and short sellers closing some of their positions.

Asia Pacific

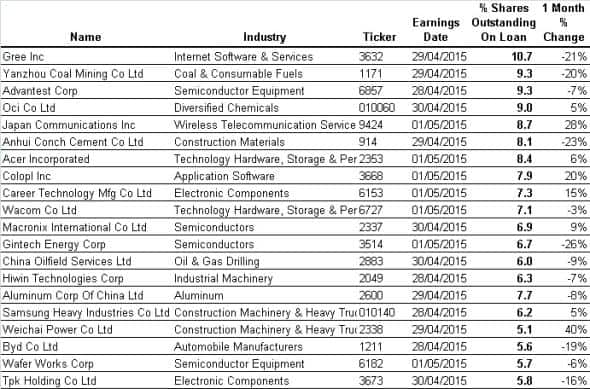

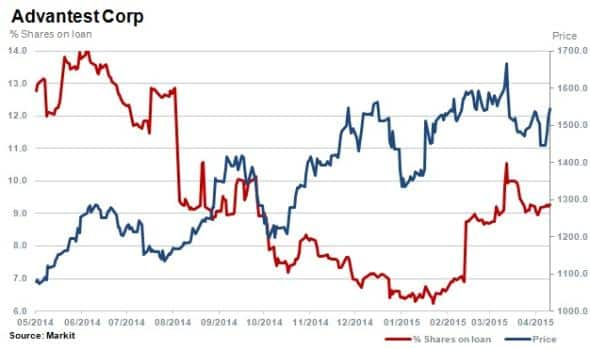

Advantest is the third most shorted stock ahead of earnings this week with in Apac with 9.3% of shares outstanding on loan. The provider of automated testing equipment into the semiconductor industry has seen resurgence in interest year to date, with shares outstanding on loan rising 30% to 9%.

Anhui Conch Cement recently sent short sellers covering significantly as the share price rallied some 30% since the beginning of February 2015. Shares out on loan have decreased by a half since then but more noticeably, shorts have receded 70% since reaching highs in 2014 of 27% of shares outstanding on loan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}