Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 24, 2016

Market recovery asserted by falling distressed bond numbers

The US high yield bond market has seen the number of distressed bonds continue to fall over the past month.

- Ratio of distressed bonds in the Markit iBoxx $ Liquid High Yield Index stands at 12%

- 17% of the Basic Materials sector is in distressed territory, down from 61% in February

- In European HY the distressed ratio had increased to 8% from 7% last month

Continued positive sentiment in the US HY bond market has meant the number of bonds trading at ''distressed'' levels (1000bps over US treasuries) fell to 12% from 14% last month.

Ratio continues decent

Stronger commodity prices and calmer markets have meant perceived credit risk in the US HY bond market has continued to fall. The current spread for the Markit iBoxx $ Liquid High Yield Index is 557bps, down from 581bps last month and over 2% tighter than the year to date high seen in February. Distress level ratios have fallen in tandem, a metric which can serve as leading indicator for potential defaults.

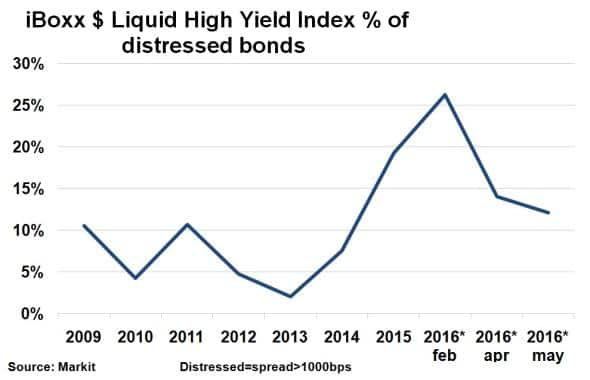

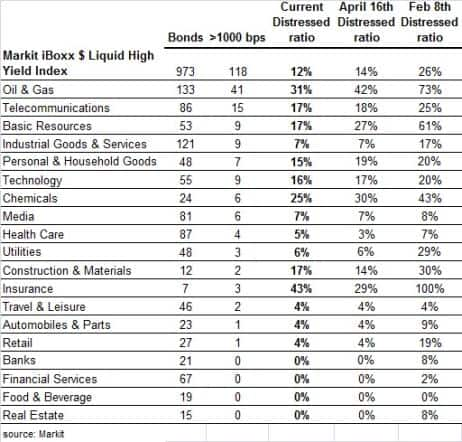

During the heightened period of volatility earlier this year, 26% of the constituents in the Markit iBoxx $ Liquid High Yield Index were valued distressed levels - the highest ratio since post financial crisis. Calmer markets, however, brought investors back to risky assets, and the number of distressed bonds regressed. 118 bonds out of the 973 constituent Markit iBoxx $ Liquid High Yield Index currently trades at a distressed level, or 12%, down from 14% in last month, as the recovery in risk assets continues. Current levels are lower than those seen in 2015 (19%), but still much higher than levels seen between 2009 and 2014.

Sector breakdown

Among distressed individual names, the main protagonists remain those in the Oil & Gas and Basic Materials sectors. However, both areas have seen vast improvement. 31% of the bonds in the Oil & Gas sector are currently valued in distressed territory, down from 73% in February. The Basic Materials sector has also enjoyed a significant recovery, buoyed by stronger commodity prices. 61% of Basic Material bonds were valued as being in distressed territory in February whereas now the figure stands at just 17%.

A majority of sectors saw continued improvement in distressed levels from February's highs.

Utilities saw its distressed ratio fall to 6% from 29% in February, as investors returned to the defensive sector. Despite the recent troubles in the retail sector, only one bond is distressed, Laureate Education Inc.'s 10% coupon bond maturing in 2019.

European HY

Given its smaller size, minimal exposure to the commodity prices and accommodative QE environment, the European HY market remained relatively isolated regarding the number of distressed bonds.

34 bonds in the 449, or 8%, of the iBoxx EUR Liquid High Yield Index, currently trades at distressed levels, up from 30, or 7% last month. ArcelorMittal and Kerling PLC are just two of the high profile names on the list.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052016-credit-market-recovery-asserted-by-falling-distressed-bond-numbers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052016-credit-market-recovery-asserted-by-falling-distressed-bond-numbers.html&text=Market+recovery+asserted+by+falling+distressed+bond+numbers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052016-credit-market-recovery-asserted-by-falling-distressed-bond-numbers.html","enabled":true},{"name":"email","url":"?subject=Market recovery asserted by falling distressed bond numbers&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052016-credit-market-recovery-asserted-by-falling-distressed-bond-numbers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Market+recovery+asserted+by+falling+distressed+bond+numbers http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052016-credit-market-recovery-asserted-by-falling-distressed-bond-numbers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}