Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 24, 2014

Subdued Japan PMI provides food for thought for policymakers

Japan's economy looks set to rebound from the contraction seen in the second quarter, but the recovery looks far from convincing, which will worry policymakers wrangling over whether the country can withstand a further sales tax rise.

At 51.7, the flash Markit/JMMA Japan Manufacturing PMI remained above the 50 'no-change' level in September, signalling a fourth successive monthly improvement in business conditions. But, in falling from 52.2, the PMI also signalled an easing in the rate of expansion from the already-modest pace seen in August.

While the PMI has risen compared to the second quarter - when the economy shrank due to an increase in the country's sales tax - the third quarter average is indicative of only modest expansion, pointing to GDP growth in the region of just 0.3%.

A slowing in the rate of increase of new orders suggests growth of production may weaken again in October. Poor domestic demand was widely to blame for the subdued order book growth, although export orders also grew at a slower rate than August.

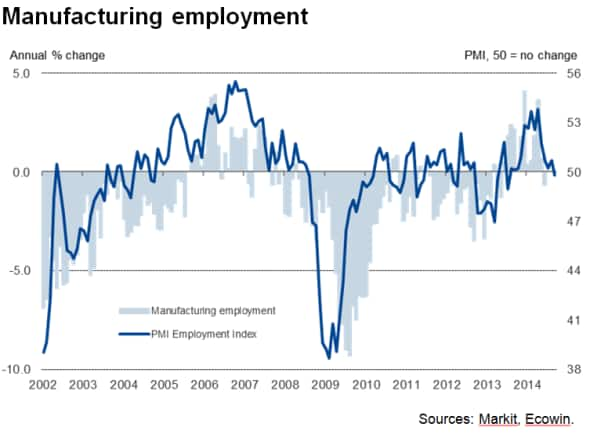

Perhaps one of the most worrying signals about the health of the Japanese manufacturing economy came from the survey's Employment Index, which signalled a renewed downturn in factory payroll numbers. Although only marginal, the drop in employment was significant in being the first recorded by the survey since July of last year. Employment fell in response to the disappointing order book situation: backlogs of unfulfilled orders fell at the fastest rate since May.

It now appears that sales were pulled forward earlier in the year, prior to the tax hike, causing GDP to rise 1.5% in the first quarter before falling back 1.7% in the second quarter, leaving an economy that can manage to sustain only meagre growth.

Prices barely rise

The September survey also found little evidence of inflationary pressures. Although costs rose, partly because a weakened yen pushed up the costs of imported raw materials and fuel, producers' selling prices barely rose, suggesting firms were forced to soak up the increased costs via squeezed margins.

Short-term policy gain

The survey provides some interesting clues for policymakers who are grappling with whether to go ahead with another hike of the sales tax. The April hike from 5% to 8% was always intended to be followed by another hike to 10% in October 2015. Prime Minister Abe has said he will review the appropriateness of next the hike once the picture of the health of the economy in the third quarter becomes more apparent. That's taken to mean when third quarter GDP data become available later in the year, and most likely when the 'final' data are published in December.

The tax hike is important, as more revenues are needed to meet rising social security costs and show investors that Japan means business in reducing its government debt.

The message from the PMI survey data is that the sales tax rise has had an initial policy gain, in that it brought forward consumption expenditure. The tax hike has also not induced another recession, as had been feared, following the experience of the previous tax rise in the late-1990s. However, the tax increase certainly appears to have hit the goods-producing sector by cooling domestic demand, suggesting that other policy measures may be required to boost consumption and provide a short-term offset to the impact of higher taxes if a further rise in the sales tax goes ahead next year.

Download the full PDF via link below for more charts

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092014-Economics-Subdued-Japan-PMI-provides-food-for-thought-for-policymakers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092014-Economics-Subdued-Japan-PMI-provides-food-for-thought-for-policymakers.html&text=Subdued+Japan+PMI+provides+food+for+thought+for+policymakers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092014-Economics-Subdued-Japan-PMI-provides-food-for-thought-for-policymakers.html","enabled":true},{"name":"email","url":"?subject=Subdued Japan PMI provides food for thought for policymakers&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092014-Economics-Subdued-Japan-PMI-provides-food-for-thought-for-policymakers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Subdued+Japan+PMI+provides+food+for+thought+for+policymakers http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092014-Economics-Subdued-Japan-PMI-provides-food-for-thought-for-policymakers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}