Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 24, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the third week of the third quarter results season.

- Software firms see significant demand to borrow in the run up to earnings

- Nokian Tyres, which is heavily exposed to Russia, has 16% short interest

- Tech firms dominate the sectors seeing high short interest ahead of earnings

North America

The third quarter earnings season continues in earnest next week and there are 20 firms with more than 20% of shares out on loan prior to announcing earnings next week.

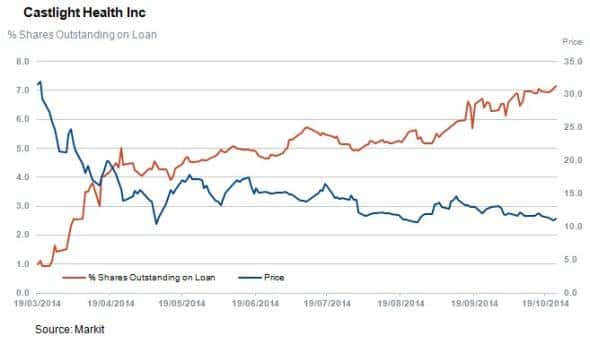

Software as a Service (SaaS) companies dominate the firms seeing the highest short interest in the US ahead of reporting earnings. Castlight Health Inc, which serves the enterprise healthcare software market via the cloud to employers, is the most shorted company in the US. The company is trading 72% lower from its IPO in March of this year, which peaked at $40.00. Currently trading at $11.20, 49% of its shares are out on loan. Analysts continue to question the company's ability to convert reported backlog orders and to aggressively grow revenue figures.

NeuStar's share price is down 47% over the last 12 months and currently has 30% of its shares out on loan. The ex-Lockheed Martin subsidiary was originally in the business of providing telephone number portability in the late '90s, and now provides IT, security and marketing services. Other SaaS stocks with a high short interest include recently listed Rubicon Technologies, which is down 54% trading at $4.49 with 26% of shares out on loan, and Fleetmatics Group, which has previously been questioned by Prescience Point Research Group on inflating profitability and has been publicly shorted by the firm in the past. Fleetmatics currently has 23% of shares out on loan despite the fact that the stock is down just 6% over the past 12 months.

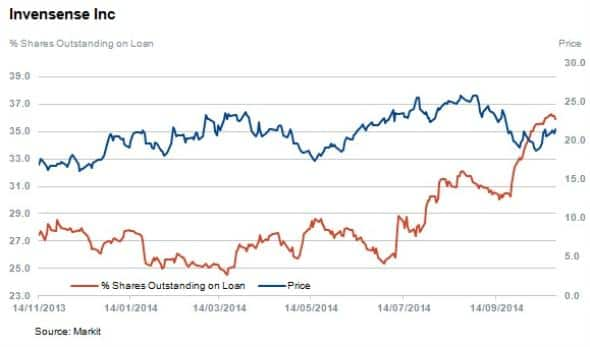

InvenSense Inc, the Intelligent Sensor Solutions company, which provides micro-electromechanical gyroscopes for consumer devices such as smart phones, remotes and even screwdrivers, has 36% of its shares currently out on loan. One of the most heavily shorted non-SaaS stocks this week , the shares are up 11% over the last 12 months. The company is currently dealing with a legal dispute with Swiss company STMicro over alleged sensor patent infringement.

Other highly shorted stocks in the US this week include Iron ore producer Cliffs Natural Resources which is trading 63% down over the past year and currently has 34% of its shares out on loan. Iron ore prices continue to face pressure from subdued demand expectations coming out of China and increased supply due to come on line during the course of the year.

Rayonier Advanced Materials has 29% of its shares out on loan. The company recently announced a fourth quarter cash dividend and is the "leading supplier of higher purity, cellulose specialities natural polymers for the chemical industry".

Other highly shorted companies include Ultra Petroleum and Arch Coal with 22% and 20% of shares out on loan respectively.

Europe

Weak European growth has been a theme in recent weeks and the current batch of heavily shorted shares ahead of imminent earning plays on this theme, with several capital goods firms featuring prominently among the 18 firms seeing over than 4% of shares out on loan ahead of earnings.

Among the capital goods firms seeing the most shorted include Yit in Finland with 13.9% of shares out on loan, Outotec with 9.4% and Vossloh with 6.3%. These firms have all seen their shares fall since the start of the year, as the growth situation in Europe continues to deteriorate.

The title of the most shorted company announcing earnings this week goes to Finnish tyre manufacturer Nokian Tyres which has just under 16% of its shares out on loan. The company has a heavy exposure to the Russian market and the devaluating rouble, combined with the threat of recession in its biggest market, has seen shorts double their positions in the firm from the start of the year.

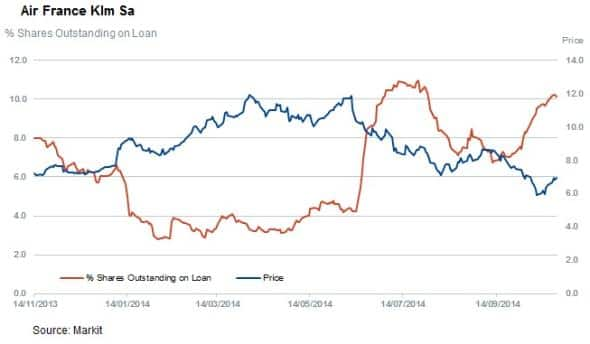

Airlines also feature prominently among the shares seeing heavy short interest prior to earnings, as increasing competition across long distance routes looks set to trim profits for legacy carriers. These airlines have also been constrained in their efforts to trim costs due to a series of recent labour actions. As a result, both Air France and Deutsche Lufthansa have seen their share prices tumble and shorts circle in recent weeks, despite the recent fall in oil prices.

While airline shorts have not reacted much to the recent moves in oil prices, the same can't be said for oil rig leasing firms, two of which have seen heavy short interest ahead of earnings announcements next week. Both Fred Olsen and Saipem have seen shorts increase by more than 10% in the last months as falling oil prices make oil exploration less attractive.

Asia

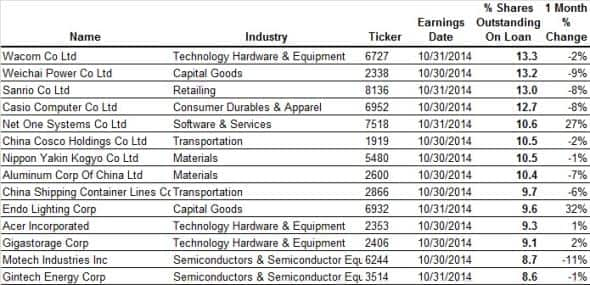

In Asia, tech firms dominate the most shorted sector, with software, component and hardware firms all featuring within the 14 firms with a high 8% or more of their shares out on loan ahead of earnings.

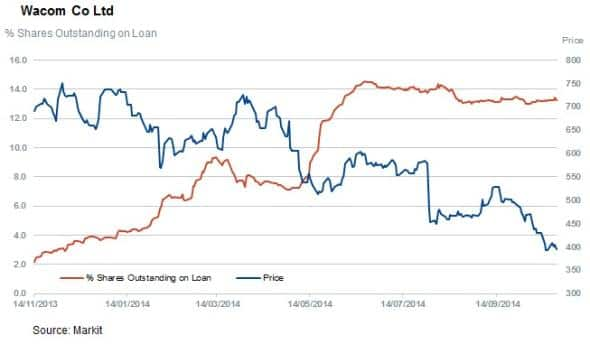

his weeks' list of heavily shorted Asian firms is led by tablet manufacturer Wacom which has 13.2% of share out on loan. Wacom has seen its share price fall by 46% since the start of the year as weak demand for tablets impacts both its branded equipment and component businesses. The company missed earnings expectations last time around and shorts don't look to have much high hopes for its coming results; a sentiment that has been mirrored across the sector.

Also joining Wacom among heavily shorted firms are computer manufacturers Casio and Acer, with 13 and 9.3% of shares out on loan respectively.

Software firm Net One System and semiconductor companies Motech and Gintech all see a high proportion of their shares out on loan ahead of earnings.

The weak demand for Asian goods hasseen shorts continue to add to their positions in the shipping sector, with China Costco and China Shipping Container both making the heavily shorted list.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102014-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102014-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}