Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 24, 2016

Most shorted ahead of earnings

A look at how short sellers are positioning themselves in companies announcing earnings in the coming week.

- Iridium is most shorted firm announcing earnings with 33% of shares on loan

- Fingerprint Cards Ab sees 59% jump in demand to borrow ahead of earnings

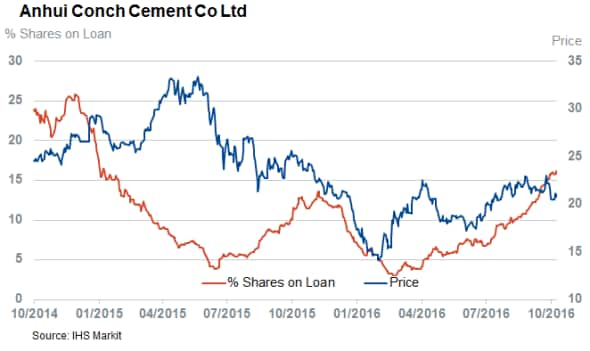

- Anhui Conch Cement short interest hits 18 month high

North America

The most shorted company reporting earnings this week is satellite telephone provider Iridium Communication which sees just under a third of its shares out on loan. Iridium has been a key focus of short sellers for some time but short interest has surged to new highs since launch partner Space X saw one of its rockets explode on the launch pad. This has caused some to ponder the impact of the latest setback on the firm's goals to introduce its second generation satellite constellation.

Metals and miners continue to feature high on short sellers' minds this earnings season as speciality metal firm Allegheny Technologies, steelmaker AK Steel and mineral producer Compass Minerals are all seeing more than 20% of shares out on loan. Short interest activity in the sector shows no signs of slowing down despite the fact that the recent stability in the commodities space has seen shares rebound across the board.

Casual dining chain Chipotle is another major short play heading into this week as short sellers have borrowed more than 20% of its shares prior to its Tuesday earnings announcement. Current Chipotle short interest is over ten times higher than on the eve of the company's recent food poisoning controversy which has taken 40% off its share price.

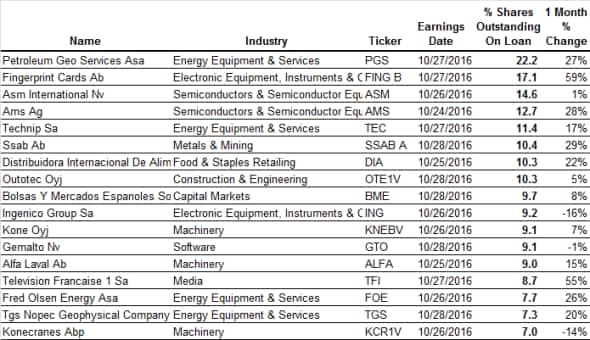

Europe

Offshore oil service providers are the main European focus for short sellers this week with geophysical firms Petroleum Geo Services and TGS Nopec both making the most shorted ahead of earnings screen as 22% and 8% of their shares are currently out on loan. This high conviction among short sellers looks to have been somewhat misled however as PGS's preliminary earnings sent its share price up by over a quarter. The bullish mood was reflected in PGS whose shares are now trading at new 52 weeks highs.

Drilling operator Fred Olsen Energy is another heavily shorted name announcing earnings this week with 7.7% of its shares out on loan, the highest in over 18 months.

The largest pre earnings jump in shorting activity is in Fingerprint Cards which has seen a 59% jump in demand to borrow its shares over the last month.

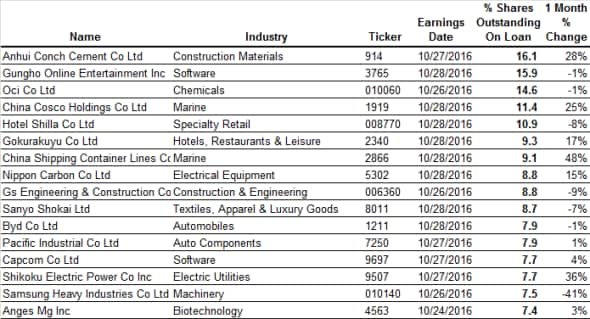

Asia

Hong Kong traded Ahnui Conch Cement, the largest mainland China cement producer, sees the largest demand to borrow out of any Asian company announcing earnings this week with 16.1% of its shares out on loan. The 28% jump in demand to borrow Anhui Conch shares takes its short interest to a new 18 month high for the firm.

Shipping firms continue to make popular short positions with China Costco and China Shipping Container Lines both seeing more than 9% of their shares out on loan.

Duty free operator Hotel Shilla, which as seen its shares struggle as South Korean regulators allowed more participants to enter the market for duty free shops, is another popular short with 11% of its shares out on loan. This loosening of regulation has seen margins shrink across the sector as operators battle for footfall.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}