Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 25, 2015

Week Ahead Economic Overview

The release of manufacturing and service PMI results will provide insights into global economic trends in June. A labour market update (including non-farm payrolls) is one of the highlights in the US and the eurozone sees updates on unemployment and inflation. The Office for National Statistics meanwhile releases final first quarter GDP numbers in the UK.

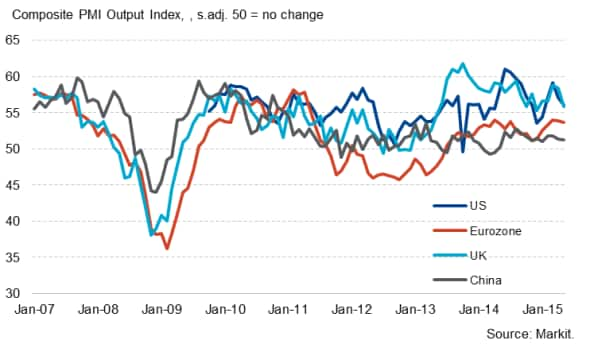

Composite PMI Output Index

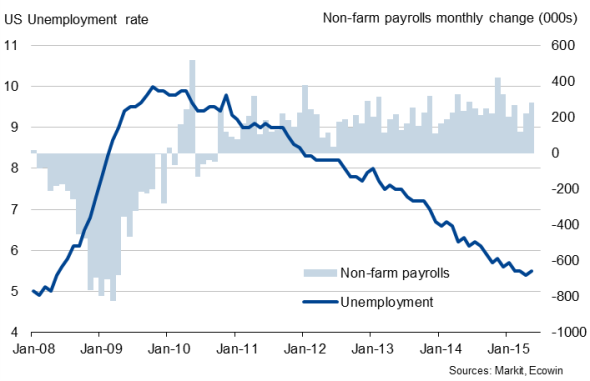

US policy makers are awaiting the latest labour market update, after non-farm payrolls increased by 280,000 in May against expectations of a 225,000 rise. That was the largest rise so far this year. While May's jobs report raises the likelihood of the Fed taking the first step towards normalising policy and hiking rates in September, the FOMC will be watching the data keenly in coming months to seek reassurance that the economy is not losing too much momentum.

Flash PMI data signal a 220k rise in non-farm payrolls in June, but also showed that the economy expanded at the slowest pace since January, with companies often blaming the strong dollar for the slowdown. While the survey data point to the economy growing by approximately 3% (annualised) in the second quarter, there has clearly been a loss of momentum in recent months. If confirmed by the final data, this could put question marks over a potential September rate hike.

US labour market

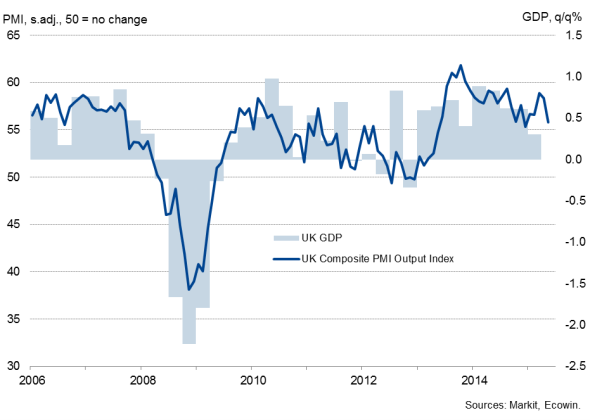

In the UK, the Office for National Statistics releases its third and final estimate of first quarter GDP numbers. The current estimate suggests the economy grew a mere 0.3% in the opening three months of the year. However, with construction data revised up heavily, it now looks as if the UK economy expanded by 0.4%. Business survey data had pointed to an even stronger start to the year than the official data.

UK GDP and the PMI

Recent upbeat PMI data have raised hopes that the pace of expansion in the UK is likely to have picked up again in the second quarter, led by strong service sector growth. But there is a lingering weakness evident in some sectors, notably manufacturing. Business survey data for the construction, manufacturing and service sectors for June will therefore provide data watchers with important information of the health of the UK economy at the end of the second quarter.

Besides the Greek debt crisis, policy makers in the eurozone are awaiting inflation and unemployment numbers as well as final PMI data for the region.

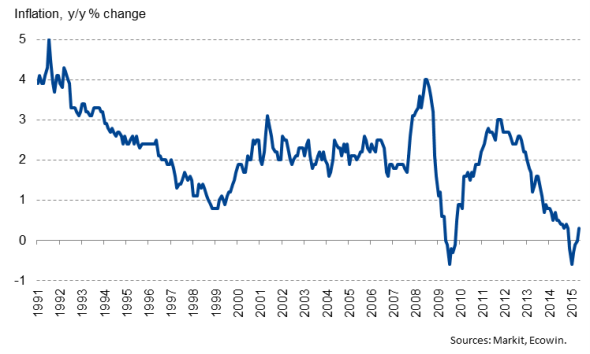

Consumer prices rose at an annual rate of 0.3% in May, the largest increase since last November and suggesting that the region's dip into deflation was only brief. Unemployment meanwhile fell to 11.1% during April. While jobless rates remained historically low in Austria and Germany, Greece and Spain still struggle with high rates of unemployment (despite having fallen in recent months). Final PMI results will be eyed for confirmation of the positive Flash data, which signalled that economic growth accelerated to a four-year high, suggesting that the region's economy expanded by roughly 0.4% in the second quarter, and a continuation of strong jobs growth.

Eurozone consumer prices

Flash PMI data for China's manufacturing sector suggested that the economy continued to struggle at the end of the second quarter. The survey signalled a fourth successive monthly deterioration in manufacturers' operating conditions. A fuller picture of the economy in the second quarter will only become available with the publication of final manufacturing data on July 1st and services PMI results on July 3rd. If the data flow continues to disappoint, more stimulus measures look likely to be unveiled by the central bank in coming months.

Monday 29 June

In Japan, retail sales and industrial output numbers are published.

Germany and Spain see the release of inflation and retail sales data.

The European Commission issues economic sentiment information for the currency bloc.

The Bank Austria Manufacturing PMI for June is published.

The Bank of England issues mortgage approval data.

Producer price figures are out in Canada, while the US sees the release of pending home sales numbers.

Tuesday 30 June

In Australia, new home sales information are released.

Housing starts numbers are issued in Japan, while India sees the publication of fiscal deficit data.

M3 money supply information and trade balance figures are out in South Africa.

The eurozone sees the release of unemployment and inflation data.

Current account numbers are issued in Spain, while consumer spending figures are out in France.

In Greece, producer price and retail sales data are updated.

Final third quarter GDP numbers and GfK consumer confidence figures are meanwhile published in the UK.

Monthly GDP data are out in Canada.

Consumer confidence data are issued in the US alongside the latest Shiller Home Price Index.

Wednesday 1 July

Worldwide manufacturing PMI data are released by Markit.

In Australia, building permit numbers are issued.

The Bank of Japan publishes latest Tankan business sentiment survey results.

ISTAT releases data on Italy's public deficit.

Meanwhile, trade balance data are out in Brazil.

In the US, ADP employment numbers are published.

Thursday 2 July

The UK Construction PMI and Canada Manufacturing PMI are released.

In Australia, trade balance data are issued.

Eurostat issues producer price numbers for the eurozone

In Brazil, industrial output figures are out.

Non-farm payroll numbers and initial jobless claims figures are released in the US.

Friday 3 July

Worldwide service PMI results are published by Markit.

In Australia and the eurozone, retail sales figures are issued.

Meanwhile, Halifax house price data are out in the UK.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}