Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 26, 2015

Week Ahead Economic Overview

Worldwide manufacturing and service PMI releases, plus labour market updates in the eurozone and the US, are data highlights of the week. Interest rate decisions at the Bank of England and the European Central Bank are the policy highlights.

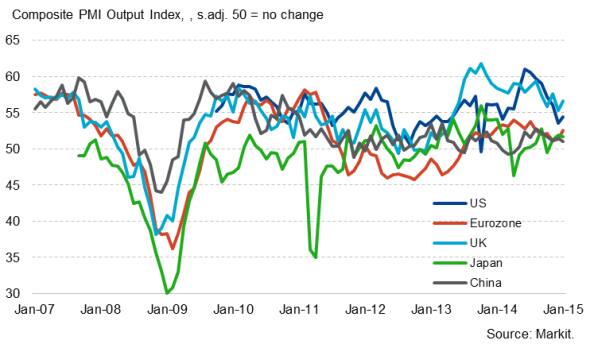

Composite PMI Output Index

Besides the ongoing debt crisis in Greece, one of the biggest uncertainties facing the eurozone in 2015 is the degree to which the introduction of quantitative easing (QE) will boost economic growth. Final PMI data will therefore give important insights into how the currency union's members are performing in February. Flash data for the eurozone signalled the strongest rate of economic growth for seven months, with employment rising at the fastest pace since 2011. Growth was largely dependent on the services economy, however, with manufacturing barely expanding.

Flash inflation numbers for February and unemployment numbers for January are released on Monday. It is likely that consumer prices continued to fall in February, having dropped 0.6% on a year ago in January, but that the jobless total may show modest signs of improving.

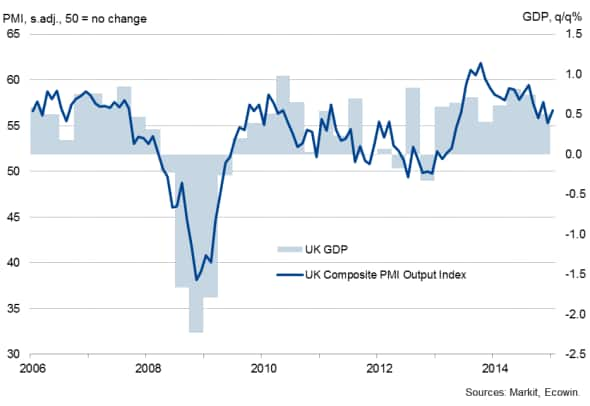

The Bank of England presented a surprisingly upbeat view of the UK economy's outlook at the publication of its latest quarterly Inflation Report, but managed to also raise concerns that it sees the possibility of having to cut interest rates in the event of a deflationary spiral setting in. Therefore, no change in interest rates is the most likely outcome of Thursday's meeting.

Prior to the MPC meeting, manufacturing, services and construction PMI survey results will give the first insights into how the UK economy is performing in the middle of the first quarter. In January, the 'all-sector' PMI showed that the economy picked up speed again, with the survey's Employment Index nearing a record high.

UK GDP and the PMI

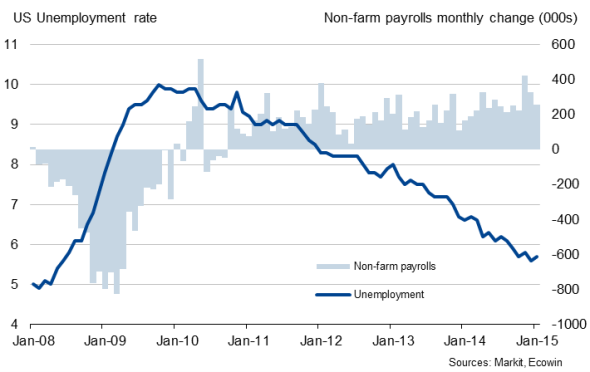

Friday sees labour market data released in the US. In January, non-farm payrolls rose by 257,000, while November and December data were revised up markedly. Further strong employment growth is likely in February, with the business surveys pointing to non-farm payroll growth in the region of 200,000.

The job market data will provide a major steer to US policymaking, with the FOMC remaining "patient" in timing the first increase in interest rates and watching the data flow carefully in the lead up to their next meeting on 17-18 March. It is widely expected that the Fed will start raising interest rates in the summer, especially after flash PMI data signalled an upsurge in service sector activity and ongoing robust manufacturing growth. If confirmed by the final data and sustained over the coming months, the first rate hike might take place in June.

US labour market

Final PMI data for China, including services, will provide data watchers with insights into economic growth trends in February. In 2014, GDP rose at the slowest rate for 24 years and January's survey data signalled a slowing in the rate of private sector output growth to the weakest in eight months.

Hopes that economic growth in Japan will revive this year were buoyed after flash PMI results signalled a sustained expansion of the manufacturing economy in January. Final business survey results for manufacturing and services will provide more detail.

Monday 2 March

Worldwide manufacturing PMI results are published by Markit.

In Australia, business inventory data are issued while India publishes an update on its trade balance.

Business confidence numbers are out in South Africa.

Retail sales figures are issued in Germany.

Flash inflation numbers and an update on unemployment are published for the eurozone.

In the UK, house price data are released by Nationwide, and the Bank of England issues consumer credit information.

Current account numbers are out in Canada while personal spending data are issued in the US.

Tuesday 3 March

The Reserve Bank of Australia announces its latest interest rate decision.

Markit releases a number of whole economy PMI results and the UK Construction PMI.

Current account and building permit data are out in Australia.

Producer price figures are updated in the euro area and in Canada, with the latter also seeing the release of fourth quarter GDP numbers.

Wednesday 4 March

Worldwide services PMI results are released by Markit.

Fourth quarter GDP numbers are updated in Australia.

In India, M3 money supply information are out.

Meanwhile, retail sales numbers are issued for the eurozone.

The Bank of Canada announces its latest interest rate decision.

Thursday 5 March

The Eurozone Retail PMI is published by Markit.

Retail sales numbers and trade balance data are meanwhile released in Australia.

Inflation figures are issued in Russia.

Unemployment numbers are updated in France and Greece.

The Bank of England and the European Central Bank announce their latest interest rate decisions.

Industrial orders figures are issued in Germany, while revised GDP numbers are out in Italy.

In the US, initial jobless claims and factory orders data are released.

Friday 6 March

The KPMG/REC UK & English Regions Report on Jobs is released.

Global sector PMI data are issued by Markit.

The latest AIG Construction Index is out in Australia.

In Japan, the Leading Economic Index is released.

Industrial output numbers are meanwhile published in Germany and Spain, while Italy sees the release of producer price figures.

Fourth quarter GDP data are updated in the eurozone.

In France, trade balance data are out.

Halifax house price numbers are issued in the UK.

Canada and the US see updates on labour market data and trade numbers.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}