Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 26, 2015

Week Ahead Economic Overview

As tensions mount between Athens and Brussels, the Greek debt crisis will play a major role in determining market trends next week. However, all-important non-farm payroll numbers from the US and worldwide manufacturing PMI releases are also likely to influence market direction.

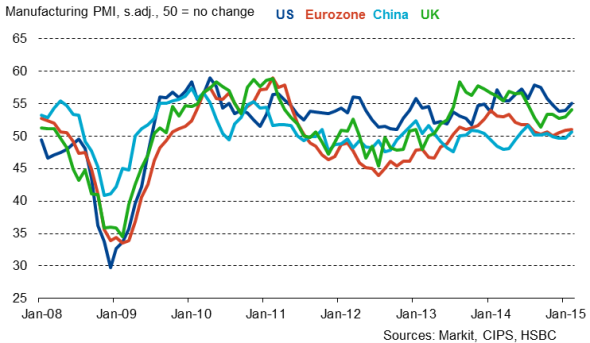

Manufacturing PMI

Friday sees labour market data released in the US. In February, non-farm payrolls rose by a consensus-beating 295,000, with the unemployment rate falling to 5.5%. The business survey data indicate that the updated release is likely to show further strong employment growth, which will add to the chance of the Fed hiking rates in either June or, more likely, September.

The FOMC dropped the word "patient" from its policy statement at its March meeting, leaving the door open to hike rates any time from June onwards, but noted that it wanted to see further improvements in the labour market before tightening policy. A key missing ingredient in particular has been the lack of wage growth, which remains stuck at around 2%. Any upturn in wage growth will fuel expectations of an early rate rise. The release of factory order numbers will provide policymakers with additional information about the health of the US goods-producing sector.

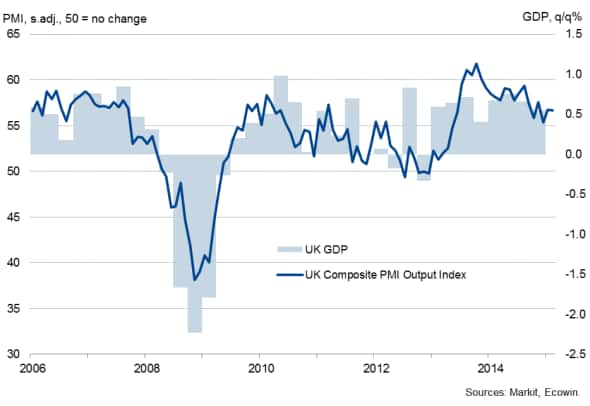

In the UK, the final estimate of fourth quarter GDP numbers is released on Tuesday. Current estimates suggest that the economy expanded by 0.5% in the final three months of last year, but data for 2015 so far are suggesting that growth is likely to have picked up again. February's 'all-sector' PMI pointed to a stronger expansion in the first quarter, with growth set to accelerate from the slowdown seen late last year and the current drop in inflation is a boon to the economy, providing households with greater spending power at a time when pay growth remains frustratingly weak.

UK GDP and the PMI

Manufacturing and construction PMI releases will meanwhile provide first insights into how the UK economy is performing at the end of the first quarter. Manufacturing data will be eyed for signs that the sector is picking up after a disappointing start to the year. Weak official construction data from the ONS have meanwhile contrasted with Markit/CIPS PMI survey data in recent months, which have signalled an ongoing impressive recovery of the sector.

The release of manufacturing PMI data for the eurozone will include more national detail, after a flash estimate showed the sector expanding at the strongest rate for ten months. Data for Italy, Spain and Greece will be especially closely watched.

Unemployment and inflation data will meanwhile be updated by Eurostat. The unemployment rate in the euro area fell to 11.2% in January and is likely to edge lower, after flash PMI data suggested that employment growth accelerated to the strongest since 2007 in March. Inflation numbers are also updated in the currency union. February data showed consumer prices falling 0.3% on a year ago, with only three member states seeing rising prices (Austria, Italy and Malta).

Final PMI data for China, including services, will provide data-watchers with insights into economic growth trends in March. In 2014, GDP rose at the slowest rate for 24 years and flash manufacturing PMI data signalled a renewed downturn in March. The recent weak economic data flow from China lead many to believe that GDP growth will have slowed further from the 7.3% seen in the final quarter of last year, jeopardising the government's 2015 growth target of "around 7%".

Hopes that economic growth in Japan will revive this year were dampened by March's flash PMI results, as a near-stagnation of manufacturing activity suggested that the country's disappointing recovery is once again losing momentum. Final PMI data (including services) and official industrial production data will therefore be eyed for any positive signs that economic growth can be sustained in the first quarter.

Monday 30 March

The Bank Austria Manufacturing PMI is released.

Industrial output numbers are issued in Japan.

Flash inflation figures are released in Spain and Germany, with the latter also seeing the publication of retail sales data.

Business and consumer sentiment numbers are issued by the European Commission.

In Greece, producer price figures are out.

The Bank of England publishes mortgage approval data.

South Africa sees the release of M3 money supply information.

Personal income data and pending home sales numbers are issued in the US.

Tuesday 31 March

In Australia, new home sales data are published, while Japan sees the release of housing starts numbers.

Meanwhile, infrastructure output figures are issued in India.

The UK sees the final estimate of fourth quarter GDP numbers.

Unemployment and inflation data are meanwhile published for the euro area.

Meanwhile, France sees the release of consumer spending data, while retail sales numbers are out in Greece.

In Spain, current account data and retail sales figures are published.

Trade balance information are issued in South Africa, while budget balance information are released in Brazil.

The US sees the publication of consumer confidence numbers and Case/Shiller home price information.

In Canada, monthly GDP data are issued.

Wednesday 1 April

Manufacturing PMI results are released worldwide by Markit.

In Australia, building permit numbers are issued.

M3 money supply data are out in India.

Meanwhile, the Bank of Japan releases its Tankan Index results.

In Brazil, industrial output figures and trade balance data are updated.

The US sees the release of ADP employment data and construction spending numbers.

Thursday 2 April

Markit releases a number of PMI survey results, including the Markit/CIPS UK Construction PMI.

Trade balance data are meanwhile published in Australia and Canada.

In the US, trade data, factory orders figures and initial jobless claims numbers are updated.

Friday 3 April

Services PMI results are released in Japan, China and Russia.

Halifax house price figures are out in the UK.

The US sees the publication of non-farm payrolls and unemployment data.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}