Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 26, 2014

US solar stocks lose their shine

Falling energy prices and the new republican leadership have halted the momentum of solar shares over the last few months, with short interest shooting up and solar ETFs experiencing heavy redemptions.

- Solar ETFs have seen outflows as sector's momentum waned

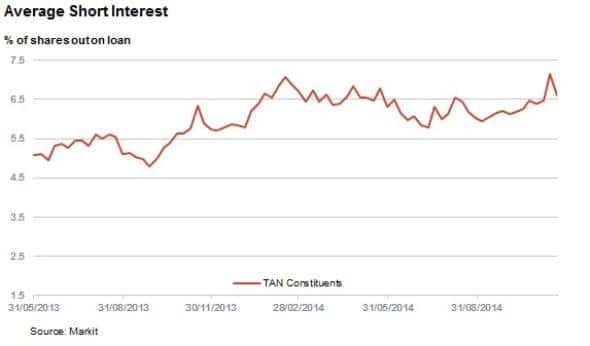

- Short interest has surged and recently hit a new annual high of 7.1% of shares outstanding

- But analysts have yet to significantly lower their forecast for the sector

Solar shares were one of the success stories of last years' stock market rally as evident by the 124% gain seen in the Guggenheim solar ETF, TAN. This was helped by standout performances from several constituents, most notably Canadian Solar which gained more than 700%.

This strong momentum has not carried through in 2014 with the TAN now trading relatively flat for the year after two third of its constituents posted declines. This has seen some investors head for the exit, with both the TAN, and the Market Vectors Solar ETF which has similar exposure, have seen outflows for the year.

Prime suspect for the recent decline has been the falling costs of hydrocarbons, whose continuing abundance and relative cheapness threaten to put a damper on solar appetite in the coming years. With oil prices down by a quarter in the last six months and with little sign of any impending rebound, commitments to solar projects will no doubt be tested even in the wake of the recent falling costs experienced by the industry.

US political developments have also looked to have swayed investors, with the recently elected republican congress generally seen as pro energy, as evident by incoming senate leader Mitch McConnell's stated intention to end the "war on coal". The new congress' intentions on alternative energy could prove pivotal when the current regime of solar tax credits, which has helped push solar installations to new records, expires in 2016.

Short interest rises

Both these factors have seen short sellers return to the solar sector in earnest in the last few months. The average short interest in the constituents of the TAN ETF has surged in the last few months and now stands at 6.6%. Levels have increased significantly since September and recently hit a fresh annual high on November 18th when average short interest hit 7.2% of shares outstanding which is very high when compared to the average of just 2.2% for the average company in the S&P 500.

Note that most of the recent surge in short interest occurred in the wake of the November 4th election. It is possible that investors expect a republican congress and potential republican president to be less supportive of the renewable energy industry that the previous democratic majority.

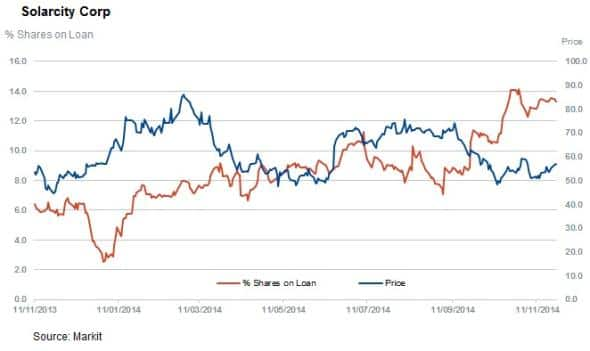

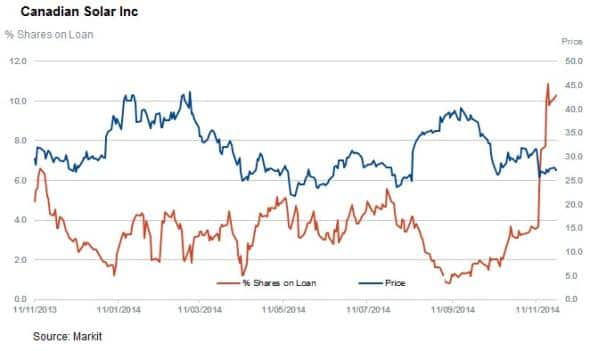

The two firms most targeted by short sellers in recent weeks have been SolarCity and Canadian solar which have both seen short sellers borrow over 5% of their shares in the last three months.

SolarCity, the company conceived by the legendary Elon Musk and run by his cousin, has seen the largest increase in short interest of all US solar companies as analysts pick apart the potential risks of its business model. As the stock price bounced between $86 and $50, short interest has risen from 6% of shares outstanding at the beginning of the year to over 13%.

The other firm to see a significant jump in shorting activity in the last three months is Canadian Solar which has seen its short interest jump to more than 10% of shares outstanding over the same period. Interestingly, Canadian Solar's recent earnings were better than expected and the company stated that its project pipeline looked strong in for the coming year. The recent selloff in the company's shares, and subsequent jump in short interest look to have been triggered by competitor Sunpower's recent lowering of its guidance for 2015 which sent the sector down sharply.

Analyst expectations still buoyant

Interestingly, while solar shares worldwide look to be taking a hit, analysts have yet to significantly lower their expectations for the coming year as measured by the fact that the sector as a whole has an above average decile rank in Markit's Research Signal Earnings Revision Model. This model, which gauges analyst sentiment across shares, scores global solar firms among the 40th percentile on average which indicates better than average analyst sentiment.

The one standout exception in the rank is SunEdison which has seen analysts increase their forecasted loss for the company in the coming year after a disappointing third quarter result. This has seen the firm rank among the worst 10% of shares in the Earnings Revision Model.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112014-Equities-US-solar-stocks-lose-their-shine.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112014-Equities-US-solar-stocks-lose-their-shine.html&text=US+solar+stocks+lose+their+shine","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112014-Equities-US-solar-stocks-lose-their-shine.html","enabled":true},{"name":"email","url":"?subject=US solar stocks lose their shine&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112014-Equities-US-solar-stocks-lose-their-shine.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+solar+stocks+lose+their+shine http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112014-Equities-US-solar-stocks-lose-their-shine.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}