Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 27, 2015

US flash PMI data signal weakest rise in new orders since recession

Weaker than expected economic data out of the US are calling into question the economy's resilience in the face of weak global growth and send a dovish signal to FOMC policymakers.

PMI surveys show order growth waning

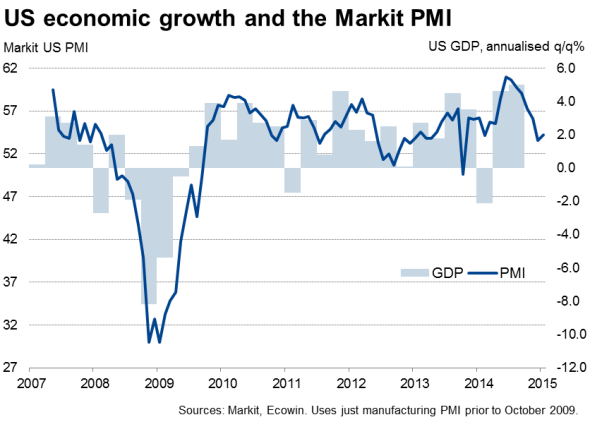

At 54.2 in January, up from 53.5 in December, the Markit Flash US Composite PMI Output Index signalled a further expansion of private sector business activity, but the latest reading was the second-weakest for 11 months.

The January manufacturing and services surveys also collectively recorded the weakest monthly increase in new orders since the recession, sending a major warning that growth of demand has continued to slow at the start of the year.

The 5.0% annualised rate of GDP expansion in the third quarter certainly looks like a peak in the pace of expansion, with the surveys pointing to 2.5% annualised growth at the start of the year.

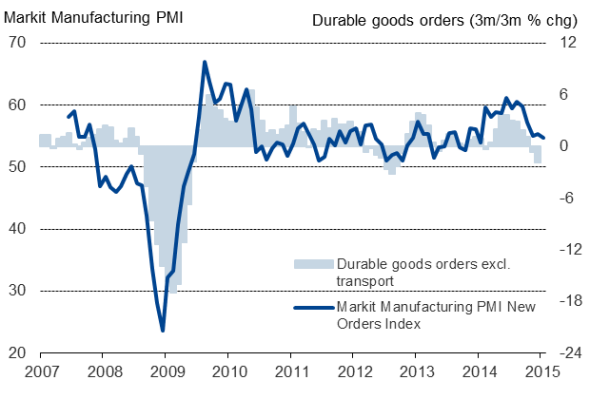

Durable goods orders slump

The flash PMI was published on the same day that official data showed a further fall in durable goods orders in December. Orders slumped 3.4%, leading to a 9.5% decline over the fourth quarter as a whole. Excluding volatile transportation goods, orders were down a more modest 1.8% in the fourth quarter, but that was still the steepest fall since the third quarter of 2012 and represents a marked contrast to the strong rises seen in the second and third quarters.

Durable goods orders and Markit PMI

Sources: Markit, Ecowin.

The data therefore send a dovish signal for interest rates, and if official data such as Friday's GDP report show similar signs of the economy cooling, expectations of the first rate hikes are likely to get pushed back into late-2015 and even, as we have seen in the UK recently, early-2016.

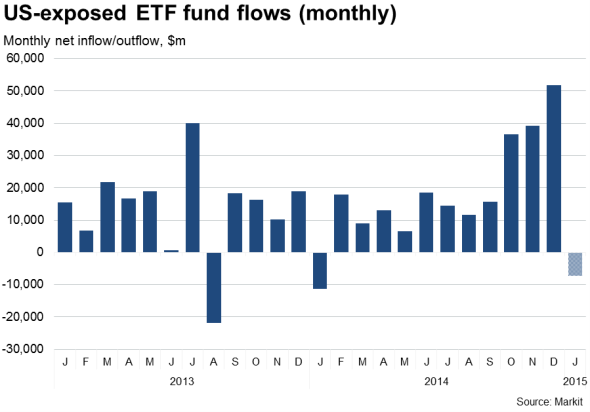

Investor sentiment sours

The weaker economic data correspond with signs of a souring of investor sentiment towards the US. January has so far seen net outflows from US-exposed ETFs. This would be the first month since January of last year that net outflows have been recorded. A $6billlion inflow into fixed-income ETFs has so far been countered in January by a $13bn outpouring from equity funds.

The outflows from US-exposed ETFs follow record inflows into equity and fixed-income funds in 2014 as investors sought increased exposure to the US economic upturn and the rising dollar.

However, with the dollar hitting an 11-year high on a trade-weighted basis, the Greenback's strength looks to be increasingly taking its toll of companies' earnings. Companies as diverse as Caterpillar, Pfizer and P&G have all cited the rising dollar as a headwind to their 2015 earnings guidance. Such warnings will no doubt serve as a further deterrent to FOMC rate hikes.

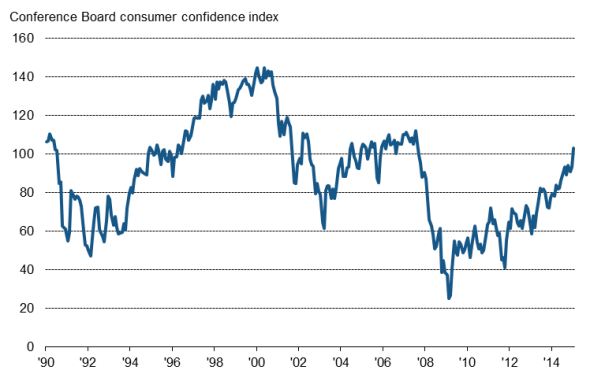

Low inflation boosts consumer confidence

There are signs, however, that lower oil costs and the recent slide in inflation (down to 0.8% in December) may provide a welcome boost to the economy in 2015.

According to the flash PMI surveys, companies' input costs showed no increase for the first time since 2009, highlighting how lower oil prices are feeding through to the economy and should drive inflation down further in coming months.

Consumer confidence meanwhile rose to its highest since August 2007 in January, according to the Conference Board.

US consumer confidence

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-economics-us-flash-pmi-data-signal-weakest-rise-in-new-orders-since-recession.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-economics-us-flash-pmi-data-signal-weakest-rise-in-new-orders-since-recession.html&text=US+flash+PMI+data+signal+weakest+rise+in+new+orders+since+recession","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-economics-us-flash-pmi-data-signal-weakest-rise-in-new-orders-since-recession.html","enabled":true},{"name":"email","url":"?subject=US flash PMI data signal weakest rise in new orders since recession&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-economics-us-flash-pmi-data-signal-weakest-rise-in-new-orders-since-recession.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+data+signal+weakest+rise+in+new+orders+since+recession http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-economics-us-flash-pmi-data-signal-weakest-rise-in-new-orders-since-recession.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}