Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 27, 2017

Nordic securities lending feels Fingerprint slump

Shares in most lucrative European special of 2016, Fingerprint Cards, have cratered since the start of the year which has drastically impacted revenues derived from lending out Nordic equities

- Fingerprint Cards revenues down by over $115m ytd as share price plummet

- Finnish, Norwegian and Swedish securities lending revenue down by 38% yoy

- Fingerprint Cards windfall helped gloss over a disappointing 2016 for Nordic securities lending

The increasing reliance on specials has ensured that securities lending revenues are ever more volatile due to the nature of the shares which see the most demand from short sellers. These bearish investors have correctly called some of the largest share price implosions of recent times, but these successful high conviction short campaigns, which make up a large part of the current crop of specials, are often followed by a drying up of the revenues derived from facilitating these trades. Even if short sellers remain willing to pay a premium to keep their positions open, the dwindling market value of their most successful short targets ensures that lenders on the other side of the trade have a much smaller asset base from which to derive revenues. The irony shouldn't be lost to the securities lending industry as these fluctuations can be large enough to materially impact the revenue dynamics of entire countries or regions.

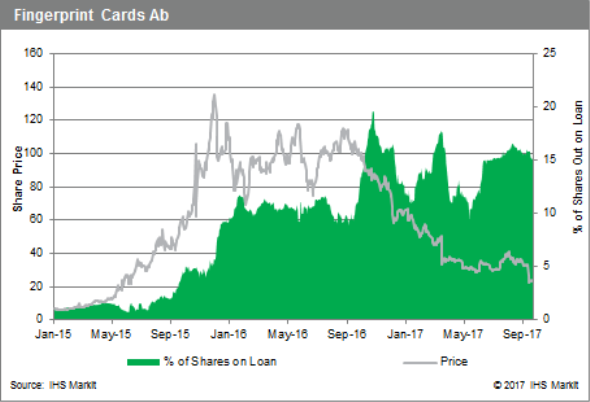

Perhaps the most flagrant example of this phenomenon is Swedish biometric technology developer Fingerprint Cards. The increasing adoption of fingerprint sensing by phone manufacturers made Fingerprint shares the darling of the market over 2015 as they rose by over 1,500%. This love affair wasn't to last however and short sellers started smelling blood in the opening months of last year. Shorts were extremely confident in their Fingerprint trade as they were willing to pay 40% for much of last year. This commitment was ultimately vindicated as a slew of earnings setbacks have since knocked over 80% from the value of Fingerprint shares from their recent highs.

Although demand to borrow shares in Fingerprint Cards, and the associated fee, is as high as at any time over the last 18 months, their falling value means that the current notional now out on loan only represents $160m, roughly a quarter of the $570m high reached late last year. Fees generated by this practice have fallen by a similar measure as lenders have only managed to earn roughly $28m out of this stock since the start of the year, a fifth of the tally generated by the same practice at the same point last year.

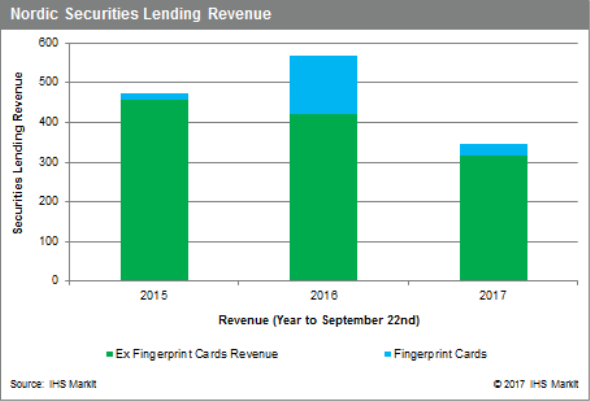

These revenues are being felt across the region as the aggregate Nordic securities lending revenues, those derived from lending Danish, Finnish, Norwegian and Swedish equities, are down by a massive 38% YTD from where they stood at the end of last September. Furthermore, there appears to be little hope of the industry being able to claw back any of this lost ground in the coming three months as the fourth quarter of last year was the most lucrative month for Fingerprint Card lenders.

The revenue boon delivered by Fingerprint also allowed the industry to gloss over a pretty disappointing year for the region as the revenue derived from the remaining Nordic equities, which makes up over 99% of the region's inventory, fell by 8% over 2016. Revenues from non-Fingerprint Cards loans have continued to slide in 2017 and the revenue tally from these loans is 25% behind last year's total due to both shrinking fees and falling balances.

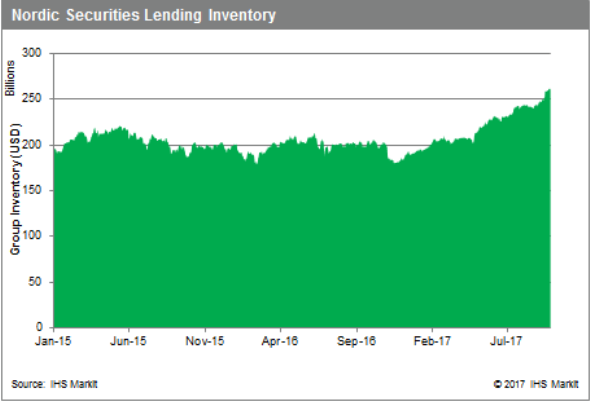

Beneficial owners looking to grab a share of this dwindling revenue pie will have to contend with many more lenders as the average value of all Nordic equities in lending programs has climbed by a third since the start of the year to $260bn. These surging inventory levels will ensure that return to lendable across the region will likely be around quarter lower than healthy 23bps delivered over 2016.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27092017-Equities-Nordic-securities-lending-feels-Fingerprint-slump.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27092017-Equities-Nordic-securities-lending-feels-Fingerprint-slump.html&text=Nordic+securities+lending+feels+Fingerprint+slump","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27092017-Equities-Nordic-securities-lending-feels-Fingerprint-slump.html","enabled":true},{"name":"email","url":"?subject=Nordic securities lending feels Fingerprint slump&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27092017-Equities-Nordic-securities-lending-feels-Fingerprint-slump.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nordic+securities+lending+feels+Fingerprint+slump http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27092017-Equities-Nordic-securities-lending-feels-Fingerprint-slump.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}