Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 27, 2014

Oil slump sees investors spurn producers

The oil price tumble in the last few weeks has seen investors turn away from high cost oil producers and the firms which service high cost exploration.

- Unconventional energy companies have seen short interest surge by 10% in the last three months, as ETF investors spurn these comparatively high cost producers

- Services firms also see heavy shorting activity along with offshore operators and geological service firms leading the way

- Fracking service firms have been at the centre of recent market volatility

Falling oil prices have caused ripples among industry players over the last few weeks. The commodity's 26% price fall since the end of June has seen previously profitable extraction methods fail to turn a profit for oil exploration firms.

This development has seen investors add to their short positions in primary and secondary companies exposed to fracking and other high cost energy sources, as the viability of their business models come under pressure, according to WSJ, with oil dipping below $80 a barrel (bbl).

Unconventional firms targeted

Perhaps no one industry subsector has felt the recent price tumble more than those that rely on relatively expensive unconventional producers which extract oil and natural gas from shale and oil sands sources. These firms flourished during the three years when oil traded north of $100bbl, but we have seen them lag behind the rest of the market as investors take fright of their high marginal cost.

A case in point in this scenario is the Market Vectors Global Unconventional Oil & Gas ETF, whose constituents derive at least half their revenues from unconventional oil and gas sources. Oil's recent tumble has seen the ETF lose a fifth of its value; 5% more than the Energy Select Sector SPDR ETF which tracks the wider energy producing sector. Investors were reluctant to pull funds from the ETF, but the recent rout in oil price has seen 10% of the fund's investors head to the door.

The constituents of the Unconventional ETF have also seen their shares come under renewed pressure from short sellers in the last three months. The average demand to borrow shares of its 66 constituents is up by over 9% in the last three months and now sits at 4.7% of shares outstanding. This appears to have been a shrewd move, as only two of the ETFs constituents have seen their prices appreciate in the last three months.

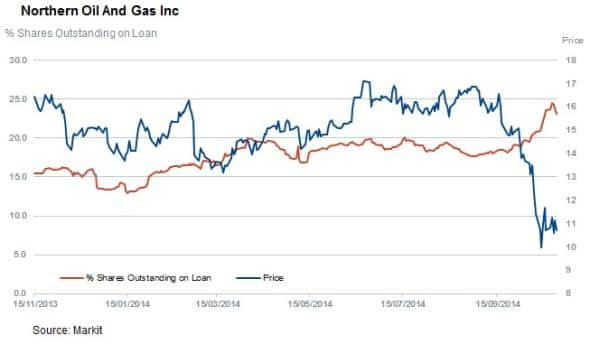

Leading the shorting activity these constituents is Northern Oil and Gas, which operates in the Bakken formation, and has seen short interest jump up to 23% in recent months as its shares hit three year lows.

The only other company to see more than 20% of shares out on loan among the unconventional ETF's constituent is Ultra Petroleum which extracts unconventional tight gas in the Marcellus and Green river area. Ultra's short interest has jumped by more than the ETF average in the last three months.

Service firms feel the heat

Companies which provide services to the industry have also come under pressure in recent weeks as the slump in prices looks set to trim investment in the industry. This has seen large withdrawals out of the Market Vectors Oil Services ETF, which saw its biggest yearly outflow last week when investors withdrew $209m of the funds' $1.4bn AUM. The largest shorts in the industry are those related to future production as concerns mount that supply will outpace demand for another year, something which will no doubt crimp investment in extra capacity.

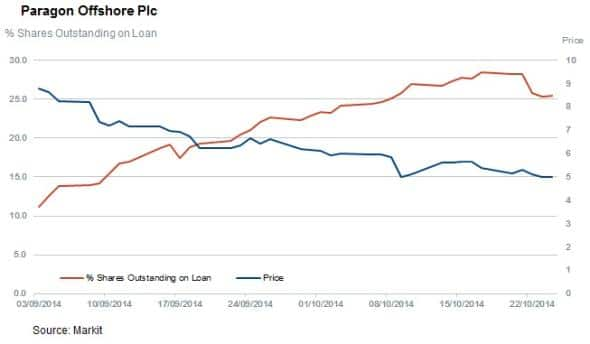

The most shorted oil service company globally is US firm Paragon Offshore. The company is a global provider of offshore drilling rigs. The firm's primary business is contracting out rigs, equipment and personnel to conduct oil and gas operations for customers around the world. The company has 25% of shares out on loan and the share price is down 74% year to date. While the firm has yet to release its third quarter earnings, its peers which have already done so have already indicated that the market for oil rig leasing was weakening in the last few months, something which looks set to continue into the New Year.

Another industry sector that has suffered is geoscience firms which provide underground survey to oil prospectors. A possible reduction in their order books has seen shorts target these firms across the board, with Norwegian firm TGS Nopec seeing the most bearish sentiment with 23% of shares out on loan.

Peers CGG and Petroleum Geo Services Asa also see bearish sentiment with 10% and 17% of shares out on loan respectively

Fracking targeted

In the fracking space, Carbo Ceramics provides synthetic proppants (small sand-like particles) to the fracking industry, and has seen the proportion of its shares out on loan increase from 10% at the beginning of the year to highs of 22% last month.

Carbo's share price has come down 54% year to date as fracking companies continue to come under revenue pressure and look to cheaper substitutes, which in Carbo's case are natural sand products.

Ceramic proppants have been found to dramatically increase the longevity of fracking, but investors have preferred lower cost natural sand for smaller wells. This initially benefited competing companies such as U.S. Silica Holdings who produce sand-based products. However oil's rout in the last month has also hurt lower cost competitors as US Silica's share have fallen by over 40% in the last few weeks.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102014-equities-oil-slump-sees-investors-spurn-producers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102014-equities-oil-slump-sees-investors-spurn-producers.html&text=Oil+slump+sees+investors+spurn+producers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102014-equities-oil-slump-sees-investors-spurn-producers.html","enabled":true},{"name":"email","url":"?subject=Oil slump sees investors spurn producers&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102014-equities-oil-slump-sees-investors-spurn-producers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+slump+sees+investors+spurn+producers http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102014-equities-oil-slump-sees-investors-spurn-producers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}