Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 27, 2014

Economic uncertainty hits business investment in the UK

News of yet another robust expansion of the UK economy in the third quarter was marred by details in the report showing a drop in business investment, which in turn raises doubts about the sustainability of the upturn. Caution is required, as the investment data are volatile and subject to substantial revision. However, we find good reason to believe that investment spending has slowed amid heightened economic uncertainty.

PMI data confirm investment slowdown

Data from the Office for National Statistics showed gross domestic product grew 0.7% in the three months to September. However, business investment fell 0.7%, dropping for the first time in just over a year. The decline follows a 3.3% rise in the second quarter, leaving investment still up a solid 6.3% on a year ago, but this annual rate of growth has eased from 11.0% in the second quarter.

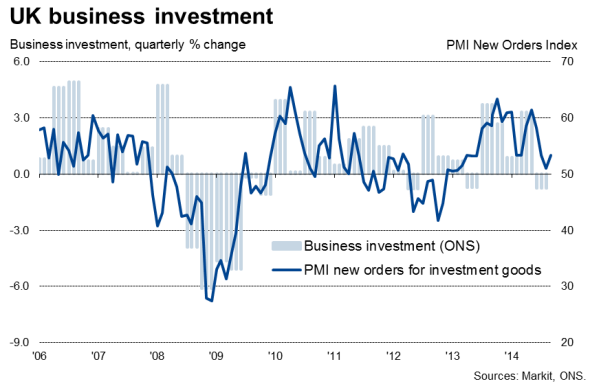

Given the volatility and revision-prone nature of the investment data, it's important to get a reality check on the numbers. In this respect, a useful series is the PMI survey's index of new orders placed at investment goods manufacturers. This series has provided an accurate advance guide to actual business investment in the UK (see chart). The PMI index rose sharply rose sharply to a near all-time high in June before falling sharply again during the third quarter. By September, the index had dipped to its lowest since February 2013, with only a modest pick-up evident in October. The three-month moving average has consequently sunk to a one-and-a-half year low.

Mapping the PMI investment goods new orders index against actual investment spending therefore confirms the slowing in business investment growth.

Financial conditions and business investment

Heightened economic uncertainty

It's easy to find reasons as to why investment growth may have weakened in recent months compared to the historically strong rate seen in the second quarter. PMI surveys have found that UK companies have grown increasingly worried about deteriorating economic conditions in the eurozone as well as geopolitical uncertainties linked to the crises in Ukraine and the Middle East. Closer to home the main concern is uncertainty arising from the General Election next year and how government policy may consequently change.

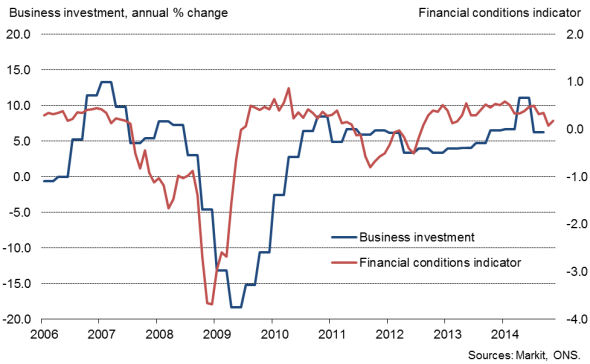

Tighter financial conditions

This environment of greater uncertainty has been accompanied by a slight tightening of financial conditions. A composite index derived from bond, equity, credit and currency market indicators points to financial conditions being the least favourable since mid-2012 in October, although the indicator has picked up slightly so far in November.

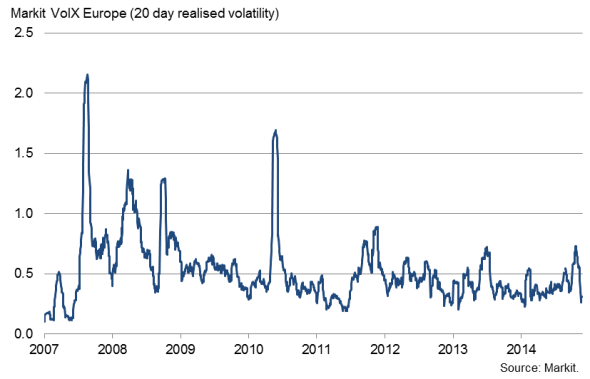

The recent appreciation of sterling has been a key factor causing a deterioration in UK financial conditions, while equity prices have also shown signs of peaking and credit market volatility - a key measure of market jitters and uncertainty - had risen sharply in September and October, according to Markit's VolX Europe Index, most likely reflecting concerns about ultra-loose policy starting to be withdrawn in the US and UK. Some calm has been restored to markets in recent sessions, which may translate into an environment more conducive to investment.

Credit market volatility

Darker outlook for investment

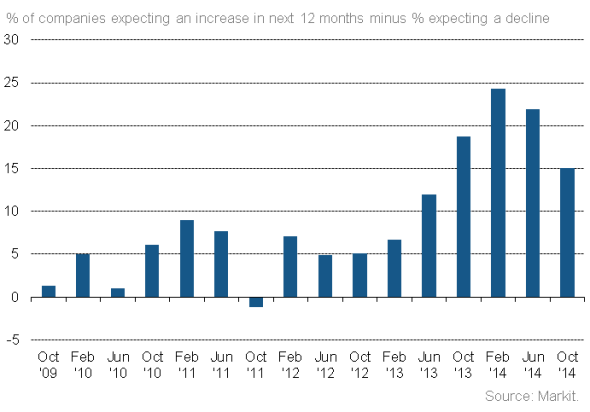

It's perhaps no surprise therefore that Markit's latest Business Outlook Survey showed that investment intentions among UK service sector providers and manufacturers consequently dropped in October to the lowest seen since June of last year.

On one hand, investment intentions in both sectors remain far higher than seen between late 2007 and early 2013, having merely eased from a post-crisis high earlier in the year (see chart).

However, companies are certainly entering 2015 in a less positive mood than was seen at the start of 2014, suggesting investment growth could disappoint in the coming year unless we see some improvement from the current phase of heightened economic uncertainty.

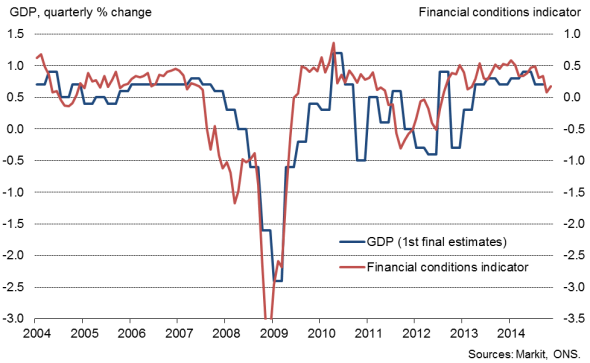

Financial conditions and economic growth

Markit UK Business Outlook Survey: capex

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Economics-Economic-uncertainty-hits-business-investment-in-the-UK.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Economics-Economic-uncertainty-hits-business-investment-in-the-UK.html&text=Economic+uncertainty+hits+business+investment+in+the+UK","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Economics-Economic-uncertainty-hits-business-investment-in-the-UK.html","enabled":true},{"name":"email","url":"?subject=Economic uncertainty hits business investment in the UK&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Economics-Economic-uncertainty-hits-business-investment-in-the-UK.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+uncertainty+hits+business+investment+in+the+UK http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Economics-Economic-uncertainty-hits-business-investment-in-the-UK.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}