Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 28, 2015

Gold: a flash in the pan?

Gold has broken through the $1300 mark for the first time in over four months, once again garnering the attention of investors as other precious metals seemingly fall out of favour.

- Gold ETFs attract $2bn worth of net inflows in January, the highest level since 2012

- Investors pull funds from other precious metal ETFs amounting to $1.3bn

- But gold's volatility levels indicate investors still question safe haven status

Golden opportunity

The gold price is still down over 30% from all-time highs reached in 2011, but as the metal rose this week above $1300 for the first time in four months investors are questioning if these are the first glimpses of a potential gold rally.

The factors are stacking for a bullish gold scenario as increased global debt levels have continued to flow through financial systems and now will be bolstered by Europe's new QE program, which should increase market liquidity further while also adding to volatility levels. Speculative long positions in the metal have increased and gold prices have actually exhibited a stable price level in the last 12 months, trading in a $100 range in a year that was anything but stable for other commodities and major currencies.

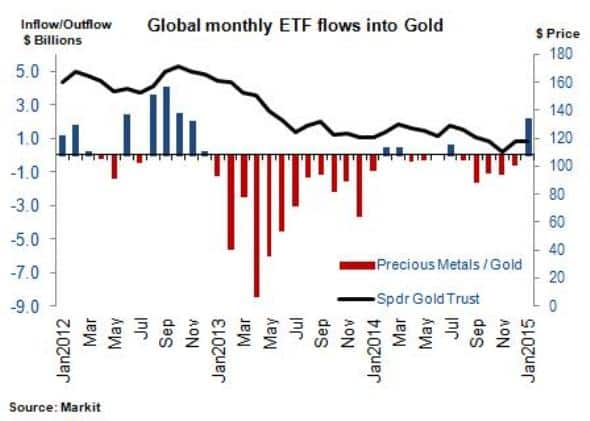

Inflows into gold ETFs ticked up dramatically in January 2015 to $2.2bn and are set to be the highest since November 2012. This new trend comes after 21 months out of the past 25 seeing investors pull money out of ETFs exposed to gold. During this period a total of $44bn worth of funds exited gold ETFs.

Others not so precious

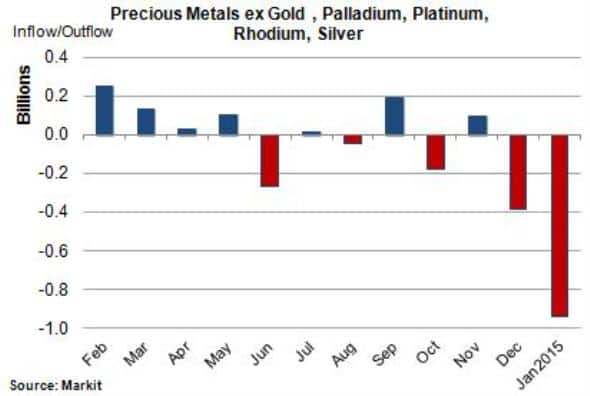

While gold's future prospects have attracted renewed interest and net inflows into ETFs, other precious metals have witnessed the opposite, particularly over the past two months.

ETF investors have withdrawn $1.3bn from non-gold precious metals ETFs in the last two months, perhaps indicating that uncertainties surrounding the global economy are driving renewed interest in the yellow metal's historic function of a safe haven for capital.

Mining new gold

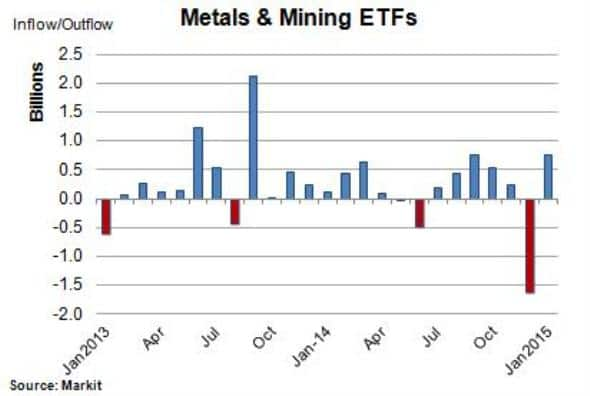

Metals and Mining ETFs are made up predominantly by gold miners, which represent 80% of the categories AUM. While gold has come back into favour and other precious metals are seemingly falling out, materials and metal mining ETFs have not witnessed significant prolonged outflows. In fact, despite seeing a large outflow occuring in December 2014, investors have consistenly invested in mining and metal ETFs since 2006, with net annual inflows every year.

Gold miners will benefit from increases in the gold price and have also recently benefited from oil prices halving in less than a year; driving operating costs lower. Lower oil prices and an increasing gold price overall can only be positive for gold minering firms.

This haven's more volatile

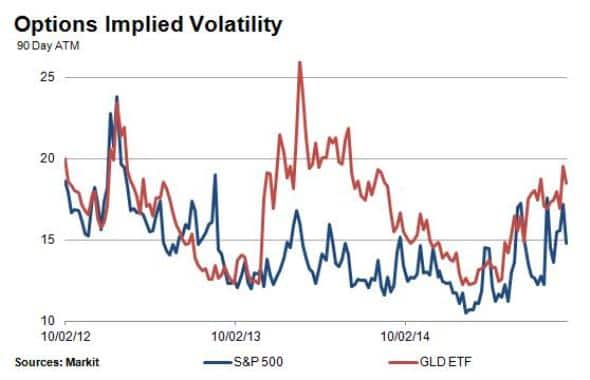

Despite the recent bullish sentiment towards the commodity in recent weeks, the last couple of years of volatility appear to have taken some of the shine off gold's safe haven status, if the options market is assessed. 90 day at the money options for contracts written against the SPDR Gold Trust are now trading with a greater implied volatility than those written against the S&P 500 according to Markit Daily Volatility.

GLD options used to trade with roughly the same implied volatility as the S&P 500 options prior to gold's recent price dip and at one point in 2013 traded 10% higher than equities.

While this volatility trend has tapered off somewhat in recent months as calm returned to the price of gold, the fact that options market makers price gold options as more volatile than large cap equities ones does punch a big hole in gold's safe haven status.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28012015-Equities-Gold-a-flash-in-the-pan.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28012015-Equities-Gold-a-flash-in-the-pan.html&text=Gold%3a+a+flash+in+the+pan%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28012015-Equities-Gold-a-flash-in-the-pan.html","enabled":true},{"name":"email","url":"?subject=Gold: a flash in the pan?&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28012015-Equities-Gold-a-flash-in-the-pan.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Gold%3a+a+flash+in+the+pan%3f http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28012015-Equities-Gold-a-flash-in-the-pan.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}