Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 28, 2015

Week Ahead Economic Overview

First insights into global economic growth trends will be provided by worldwide PMI results. A fleet of data are meanwhile published in the US and will be closely watched by policy makers for gauges as to when to start raising interest rates. Moreover, the European Central Bank announces its latest interest rate decision.

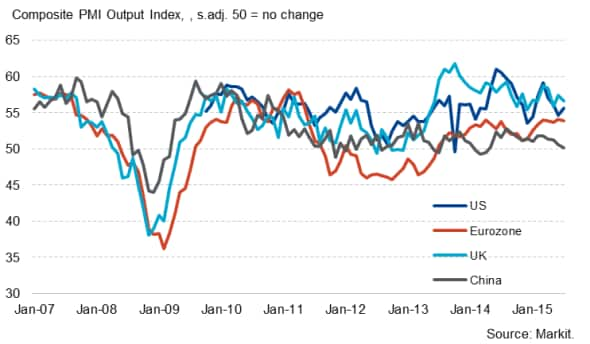

Composite Output Index

With market turmoil caused by fears that the Chinese economy is in the midst of a slowdown, many investors seem to have decided that a September rate rise in the US is off the table. Moreover, Fed president William Dudley said that a rate rise in September now "seems less compelling" than a few weeks ago. However, he also stressed that things "could become more compelling by the time of the meeting as we get additional information on how the US economy is performing".

Therefore, economic data released throughout the week will give important steers to monetary policy. Factory orders data are released on Wednesday and are likely to show a marginal increase. In June, orders rose 1.8% and economists polled by Thompson Reuters expect a marginal 0.1% rise for July.

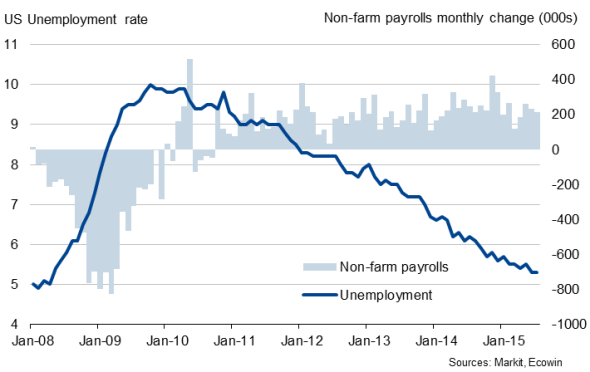

Non-farm payrolls for August are out on Friday. July's data highlighted how the labour market continued to tighten alongside a steady improvement in the economy and a further positive labour market report will certainly add to arguments for a September rate hike. Flash PMI data for August signalled that job creation continued at a solid pace, and markets expect non-farm payrolls to rise by 214k.

US labour market

Final PMI results will give more insights into the performance of the world's largest economy in August. While flash data highlighted that the service sector continued to expand at a solid pace, manufacturers signalled the slowest improvement in business conditions for nearly two years, largely a result of the strong dollar and heightened global economic uncertainty.

If the data released throughout the week surprise on the upside, a September rate rise remains very likely. However, disappointing data could postpone the first hike, possibly even into next year.

Over in Europe, the European Central Bank announces its latest monetary policy decision on Wednesday. While no change is expected, the ECB stated that "there should be no ambiguity on the willingness and ability of the Governing Council to act if needed."

Final PMI results for August are also published and will include more national detail. Flash results signalled that growth of eurozone economic output held broadly steady at a solid pace. GDP is currently tracking close to 0.4% so far in the third quarter, slightly above the 0.3% seen in Q2.

Business survey results for the construction, manufacturing and service sectors are meanwhile released in the UK. The pace of UK economic growth slowed at the start of the third quarter, according to PMI survey data. Although still robust, the expansion of activity was the second-weakest seen so far this year after the General Election-related slowdown in May. Despite falling, the PMI remains at a level which has encouraged the Bank of England to tighten policy in the past, which will add to the hawkish mood among a divided Monetary Policy Committee. However, there are plenty of excuses to hold off from hiking interest rates any time soon, including zero inflation, a waning rate of job creation, a strong pound hurting exports and the growth slowdown in China.

UK PMI

Source: Markit

After China's stock market endured its largest one-day fall since 2007 on what has been called "Black Monday", policy makers will be closely watching the data flow in Asia's largest economy. The Caixin Flash China General Manufacturing PMI dropped to a 77-month low in August, adding to fears that growth in the Chinese economy is slowing. Final manufacturing and services results - released simultaneously for the first time - will provide data watchers with more detailed information on the health of the Chinese economy in August.

Monday 31 August

In Australia, new home sales and business inventories data are released.

Housing starts and preliminary industrial output numbers for July are published in Japan.

Second quarter GDP data are meanwhile issued in India.

M3 money supply information and trade balance data are out in South Africa.

Inflation numbers are issued by Eurostat for the currency union.

Germany, Greece and Italy meanwhile see the release of retail sales figures.

Current account data are published in Canada and Spain.

Tuesday 1 September

Worldwide manufacturing PMI results are released.

Current account data and building permit numbers are released in Australia. Moreover, the Reserve Bank of Australia announces its latest interest rate decision.

Unemployment data are published for the eurozone.

In Canada and Italy, revised second quarter GDP figures are issued.

In the UK, Halifax house prices and Bank of England mortgage data are released.

Trade balance data are out in Brazil.

Construction spending numbers are published in the US.

Wednesday 2 September

Second quarter GDP numbers are out in Australia.

In India, M3 money supply information are issued.

The eurozone sees the release of producer price data. Moreover, the European Central Bank announces its latest monetary policy decision.

The UK Construction PMI is published.

Industrial output numbers are meanwhile published in Brazil.

In the US, ADP national employment data and factory orders figures are issued.

Thursday 3 September

Worldwide service sector PMI results are released.

Retail sales and trade balance data are issued in Australia.

The South African Chamber of Commerce & Industry releases business confidence numbers.

Eurostat publishes retail sales figures for the currency bloc.

Meanwhile, unemployment data are out in France.

Trade balance information numbers are released in Canada.

International trade data and initial jobless claims numbers are published in the US.

Friday 4 September

Inflation numbers are released in Russia.

Revised second quarter GDP data are issued for the eurozone. Moreover, Markit publishes the latest Eurozone Retail PMI.

In Germany, factory orders figures and construction PMI results are published, while France sees the publication of consumer confidence data.

Labour market data are meanwhile released in Canada.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}