Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 28, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week.

- Activist short sellers in Ambarella profit as stock falls 25% in the last month

- China's Evergrande sees short sellers return as stock slumps 42% from 52 week high

- Markit Dividend Forecasting expects a 56% cut to China's Rexlot's interim dividend

North America

General merchandise retailer Big Lots is the most shorted company in North America ahead of earnings this week with 23.9% of shares outstanding on loan. Short sellers have increased positions fourfold over 12 months while the shares are trading 10% down.

Short sellers have returned to speciality discount retailer Five Below, which has seen short interest surge 25% in the last three months reaching 17.6%.

Returning for a second consecutive quarter, with its share price falling 10% is Canadian Western Bank with 21.4% of shares outstanding on loan. The bank's stock has fallen 37% in the last 12 months with short sellers increasing positions by 200%.

Over the last three months short interest has surged 155% to 18% of shares outstanding on loan in Navistar International. The stock has continued its slide over the last 12 months, falling by 55% in total. The truck maker has struggled to regain market share and grow revenues as continued losses hit the company despite the industry seeing orders for heavy-duty trucks at their highest levels in a decade.

A public target of activist short seller Citron Research, shares in Ambarella have fallen by 25% in the last month. Prior to the fall, shares had risen 145% year to date.

Europe

Most shorted ahead of earnings in Europe is cancer care firm Elekta, a perennial favourite among short sellers in recent years. The stock has fallen by 36% in the last half year with short sellers covering positions by 17%. 19.5% of shares outstanding are currently on loan.

Second most shorted is Trevi Group with 10.2% of shares outstanding on loan. The global civil and engineering firm is heavily exposed to energy intensive infrastructure projects. The stock is down 70% over the last 12 months.

German and Austrian focused residential property developer and manager Buwog is the third most shorted in Europe with 5.5% of shares outstanding on loan. The stock has attracted 50% more interest from short sellers in the last year while the share price has increased by 24%.

Apac

Most short sold in Apac ahead of earnings is Yanzhou Coal mining with 12% of shares outstanding on loan. Short sellers have flocked to the stock in the last three months as energy and commodities slump and Chinese markets collapsed. Shares outstanding on loan have increased by a third in the last three months while the stock has fallen by 45%.

Since appearing in the most shorted ahead of earnings in March 2015, shares in the second largest property developer in China, Evergrande Real Estate, have increased by 25%. This increase masks the interim volatility seen in general over recent months in the region. The stock is actually off highs reached in early May 2015 by 42%.

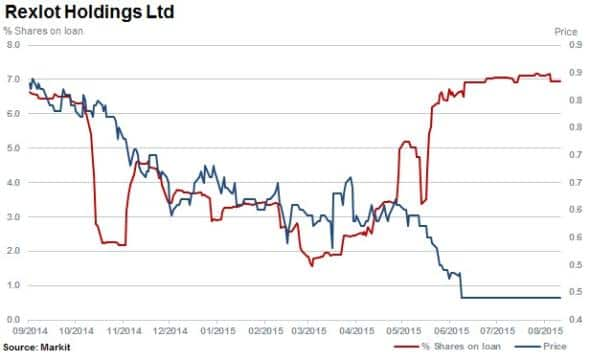

Interim dividend cut expected at Rexlot

Markit Dividend Forecastingis forecasting a chunky 56% cut to the interim dividend from Rexlot with operating conditions for its lottery business in China expected to remain challenging. The company's turnover has dipped 22% for the year.

The company's stock has been suspended since June after a report highlighted accounting irregularities at the firm. Short sellers have maintained their positions with 6.9% of shares currently outstanding on loan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}