Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 28, 2014

Muni bonds lose out in Fed reshuffle

The Federal Reserve's recent ambiguity regarding whether municipal bonds constitute high-quality liquid assets has seen the paper fall out of favour in the tri-party funding.

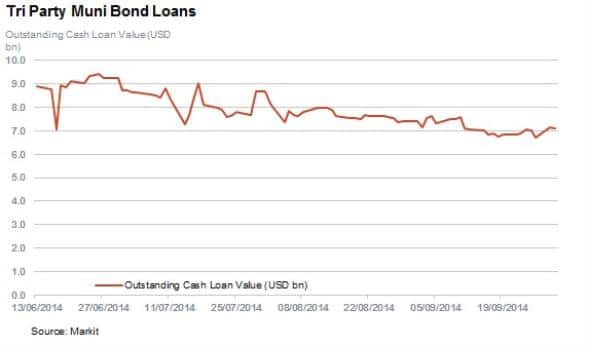

- The amount of loans collateralized by municipal bonds in the Markit US Dollar tri-party repo dataset* has fallen by 20% since the start of the year

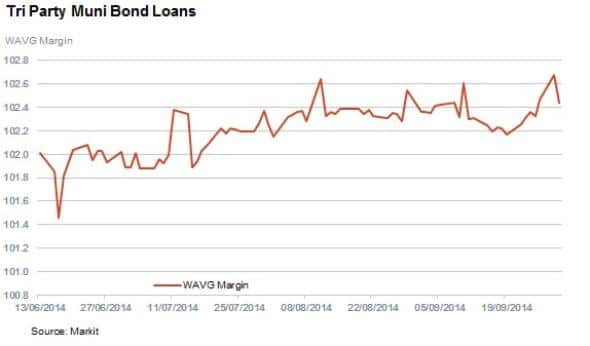

- The margin needed to fund municipal bonds has jumped by two thirds since January

- The balance of tri-party loans has proved buoyant in the last nine months, jumping by 7.6%

Finance companies are retooling their balance sheets to adhere to new capital adequacy rules which favour liquid transparent assets. As a result, any asset which doesn't garner the high quality liquid asset (HQLA) stamp issued by market regulators stands to lose favour against those which do. This could in turn potentially raise the cost of capital of companies which rely on these less liquid types of assets to raise capital.

While the excess returns required by investors to hold a certain asset is relatively straightforward to measure, another cost incurred by holders of assets which fail to meet the HQLA criteria occurs when holders try to raise cash by repoing these assets in wholesale funding markets. Owners of Non HQLA compliant assets, could be faced with having to raise cash against these assets in the wholesale funding markets in order to meet capital requirement ratios and be faced with having to post extra collateral by counterparties which would be less willing to hold non-HQLA compliant assets.

One asset class which is currently set to stand on the wrong side of the HQLA divide is municipal bonds, which stand to be labelled non-HQLA when the new Federal Reserve (Fed) liquidity coverage ratio rule takes effect at the start of next year. Although Fed Board member, Daniel Tarullo, said in a recent speech that the Fed was looking into steps to make some municipal and state bond issuances HQLA compliant, no details have been released yet.

The financial stress of state municipalities such as for Puerto Rico and Detroit also added to concerns over Muni bond safety. These recent developments have resulted in municipal bonds falling out of favour in the tri-party repo market as well as a surge in the level of overcollateralization required by lenders.

Muni bonds

The uncertainty around municipal bonds over the last few months has seen the aggregate value of tri-party loans collateralized by these assets fall significantly over the last nine months. Municipal tri-party bonds in the Markit USD tri-party repo dataset have fallen from $9bn at the start of the year to settle at a new recent low of $6.7bn in the closing days of September.

The falling popularity of municipal bonds in wholesale funding markets is demonstrated by the fact that the proportion of loans against municipal bond collateral in the Markit tri-party repo dataset has fallen from 1.1% at the start of the year to 0.8% currently.

The daily amount of transactions has also fallen significantly over the last nine months, falling from $4bn to just over $3bn at the start of September.

Haircuts getting longer

In line with their declining popularity in wholesale funding markets, municipal bonds have also seen the amount of over-collateralization required in order to raise cash jump steadily over the last few months. At the start of the year, the weighted average "haircut" for Muni bond collateral, the amount of extra collateral required to be posted against a loan, was 1.5%. That number has since climbed to 2.5% as of latest count.

This requirement from cash lenders to hold extra collateral highlights the increased weakness of the asset class among participants of the wholesale funding market.

Tri-party healthy

The rest of the tri-party funding universe has proven more buoyant in recent months, with the aggregate value of loans in the Markit USD tri-party repo dataset climbing by 7.6% since the start of the year to $907.4bn in the last nine months.

This large increase was mostly driven by US treasuries (excluding strips) whose aggregate balance has jumped to $520bn, 17% more than at the start of January.

Although the amount of overall Muni bonds funded by through tr-party repo is low both in absolute and relative terms, the decreased appetite for municipal loans in the tri-party repo world and the increased risk perception in the wake of their exclusion form the HQLA list suggests that holders of these assets would face a tougher time financing these assets in the repo market.

* Markit's securities finance service includes anonymised aggregate tri-party US Dollar repo data and position updates from BNY Mellon.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102014-equities-muni-bonds-lose-out-in-fed-reshuffle.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102014-equities-muni-bonds-lose-out-in-fed-reshuffle.html&text=Muni+bonds+lose+out+in+Fed+reshuffle","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102014-equities-muni-bonds-lose-out-in-fed-reshuffle.html","enabled":true},{"name":"email","url":"?subject=Muni bonds lose out in Fed reshuffle&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102014-equities-muni-bonds-lose-out-in-fed-reshuffle.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Muni+bonds+lose+out+in+Fed+reshuffle http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102014-equities-muni-bonds-lose-out-in-fed-reshuffle.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}