Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 02, 2023

2M breakup throws carriers’ operating playbook out the window

No one remotely familiar with container shipping, when they first saw the Jan. 25 announcement of the breakup of the 2M alliance, failed to recognize the thunderclap it represented for the industry and supply chains more broadly.

The immediate recognition of seismic significance echoed that of

the June 17, 2014 rejection by China of the proposed P3 alliance

among Maersk, Mediterranean Shipping Co., and CMA-CGM, a stunning

announcement at the time that confirmed China's global influence

and led directly to two of those carriers — Maersk and MSC

— joining up in the 2M for the past eight years.

This time, it wasn't just that the two largest carriers by deployed

capacity had decided to end their alliance in 2025 after 10 years,

a development many analysts greeted with minimal surprise given the

vastly different styles, cultures, and strategies of the two

entities.

Rather, in going their separate ways, it pulled back the curtain on

yet another industry era when concentration of market share among

the largest carriers had reached an inflection point, such that the

largest of them now have the ability to operate at scale outside of

a formal alliance. The potential impact on factors such as

long-term pricing can't be underestimated.

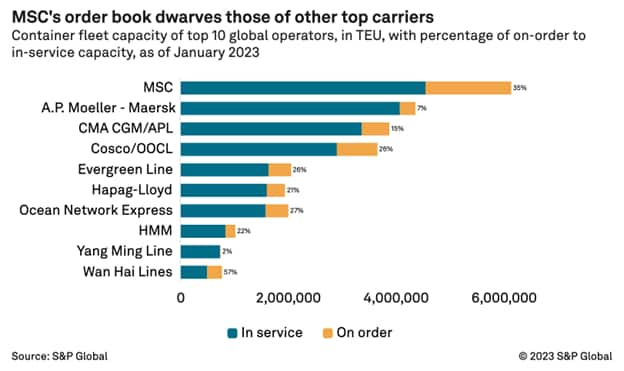

MSC did not say outright that it has no plans to re-join a formal

east-west alliance, only that its fleet provides it "with the scale

we need for the most comprehensive ocean and short-sea shipping

network in the market." Its fleet is already the world's largest

and will be further bolstered in the coming years after a spree of

new ordering and the largest secondhand tonnage acquisition spree

in shipping history, according to Alphaliner.

"Every move that the Swiss-Italian carrier made in the past two

years has apparently already been aligned with MSC's new

alliance-free strategy," Alphaliner said.

Maersk was clearer in disavowing alliances, with ocean product head

Johan Sigsgaard telling the Journal of Commerce, "we have come to

the conclusion that a more standalone Maersk network is a better

response to the coming years than it was in the past."

But irrespective of what actually happens in two years, the mere

possibility that Maersk or MSC could operate alone is a historic

change. Contrast this moment to an earlier era, when the industry

was far less consolidated and vessel-sharing agreements (VSAs) much

more limited in scope.

In that environment, carriers, unlike in the modern alliance era,

had little ability to blank sailings in the face of sagging demand,

as that could mean up to a two-week gap between sailings, which

even back then would have alienated customers. "Flexibility to

withdraw ships and services in response particularly to temporary

changes [in demand] is limited," then-APL CEO Flemming Jacobs said

in the first TPM opening keynote speech in 2001.

Alliances offer scale, agility

As VSAs and later full-fledged alliances evolved, the situation

changed: The scale and agility of the combined networks within the

2M, Ocean, and THE alliances evolved to the point where capacity

for the first time could be pulled on short notice without

catastrophic disruptions to service. That was nothing less than a

breakthrough for an industry that had suffered for decades with

inadequate returns on capital invested. Even in 2001, Jacobs made

reference to "the low return carriers receive for the capital

invested," a reality that persisted until the onset of

COVID-19.

Mass blanking of capacity was a turning point. It enabled the

industry to envision more stable and acceptable returns when prior

to that the only lever carriers had in their control to impact the

bottom line was cost reduction, often achieved through M&A

activity. Alliances allowed the carriers via their partners to

build extensive service networks, distribute and lower the costs of

deploying tonnage, increase utilization, and engage in capacity

management on a scale that had never been seen before. Maritime

analyst Linerlytica reported last week that services operated

within alliance arrangements enjoyed a 6 percent utilization

advantage over independent services.

The breakup of the 2M Alliance and the two largest carriers

potentially going it alone throws all of that into question.

It opens the door to a few possibilities. One is that the industry

— especially as it enters a potentially extended period of

overcapacity — reverts to a competitive scramble for market

share, driving down profits and forcing yet another round of

M&A, especially if regulators move against alliances. When MSC

has taken delivery of all the tonnage it has on order, it will be

30 to 35 percent larger than Maersk, capacity the company will

ensure does not go unutilized, according to several analysts. MSC

operating on its own "could lead to aggressive pricing," Jefferies

noted in a research note.

In that scenario, rate levels would return marginal profits to

ocean carriers while carriers would blank sailings when they are

forced to in order to stop bleeding cash.

"When there's over-capacity, freight rates will be roughly the cost

of providing the service. If the freight rates do not increase,

carriers will have to close down services and lay up vessels," said

Alan Murphy, CEO of Sea-Intelligence Maritime Analysis. That, in

turn, "should lead to freight rates increasing again."

Hardly a convincing recipe for an industry again in search of a

profitable formula.

Subscribe now or sign up for a

free trial to the Journal of

Commerce and gain access to breaking industry news, in-depth

analysis, and actionable data for container shipping and

international supply chain professionals.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f2m-breakup-throws-carriers-operating-playbook-out-the-window.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f2m-breakup-throws-carriers-operating-playbook-out-the-window.html&text=2M+breakup+throws+carriers%e2%80%99+operating+playbook+out+the+window+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f2m-breakup-throws-carriers-operating-playbook-out-the-window.html","enabled":true},{"name":"email","url":"?subject=2M breakup throws carriers’ operating playbook out the window | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f2m-breakup-throws-carriers-operating-playbook-out-the-window.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=2M+breakup+throws+carriers%e2%80%99+operating+playbook+out+the+window+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f2m-breakup-throws-carriers-operating-playbook-out-the-window.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}