Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 30, 2015

Cocoa futures contracts launch despite price fall

Two new euro denominated cocoa futures contracts have launched, competing for trading volumes. But uncertainty remains as cocoa prices and global demand for chocolate weakens.

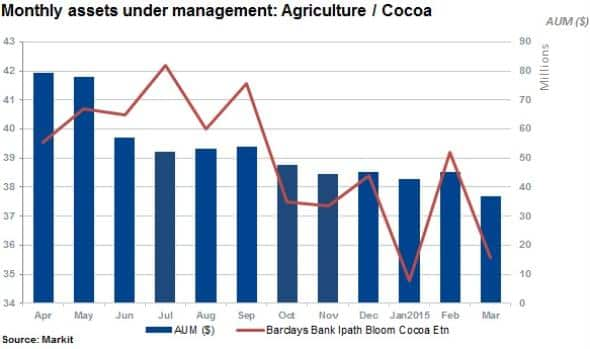

- Cocoa ETFs have continued to see outflows in recent months halving AUM

- Nestle expected to pay the largest dividend in Europe by 2016

- Hershey's is the most short sold chocolate maker ahead of Easter

Exchange rivals launch new euro cocoa futures

Exchange operator CME has launched a new euro denominated physical cocoa contract in conjunction with a US dollar cocoa futures contract. ICE, the incumbent cocoa provider which oversees the two existing US dollar and sterling denominated cocoa contracts, has followed suit with its own euro denominated contract. These developments ought to please the large European chocolate makers, which represent approximately 60% of global chocolate manufacturing and stand to benefit from a reduced foreign currency exposure to the dollar.

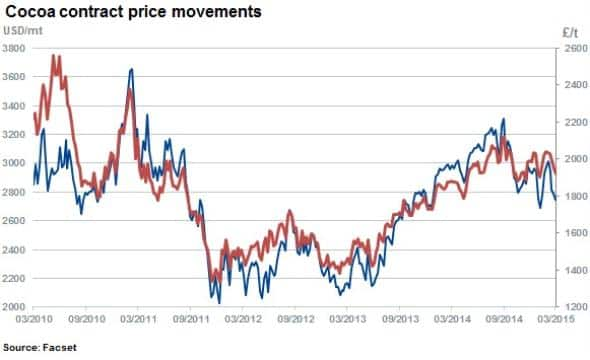

This potential uptick in new trading comes despite a recent slump in the price of cocoa which now trades 17% below (in USD/metric tonnes) highs reached last September. Most of the recent price fall looks to have been driven by a reduction in demand from the European and US markets. Despite the recent falling demand, the price of cocoa actually registered a new high last year amid fears of a possible shortage.

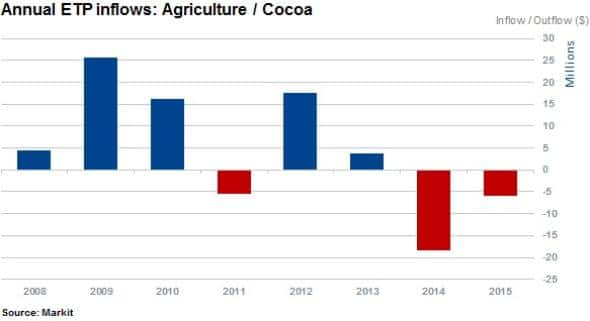

The recent cocoa price decline saw ETP investors last year withdraw $18m from cocoa tracking funds and a further $5.8m this year to date. Although the niche ETP category is relatively small, the outflows represent a significant portion of total AUM which has almost halved from $79m to $37m in the last 12 months.

Both of the largest cocoa ETPs track dollar denominated contracts, meaning that the advent of euro denominated futures could open the door for broader uptake among European investors.

Swiss Easter dividends

The recent slump in cocoa could be a boon for income investors as Markit Dividend Forecasting expects Nestle, the third largest Cocoa consumer, to become the biggest dividend payer in Europe in 2016 (in euro terms). The recent Swiss franc surge has been a key driver as the firm is committed to increasing the dividend level in Swiss francs, and a fall in input cost will only help the firm. Nestle has managed to raise its dividend between 2.3% and 5% for the past four years. Markit Dividend Forecasting is currently expecting a 2.3% dividend increase next year.

Fellow chocolatier Lindt has reported even higher dividend growth, and the company's payout ratio has risen to 50% over the past three years. 2014 saw the dividend increase by 11.5% and Markit's forecast for fiscal 2015 is for repeated double digit growth, with the payment up 10.3% in line with consensus earnings expectations.

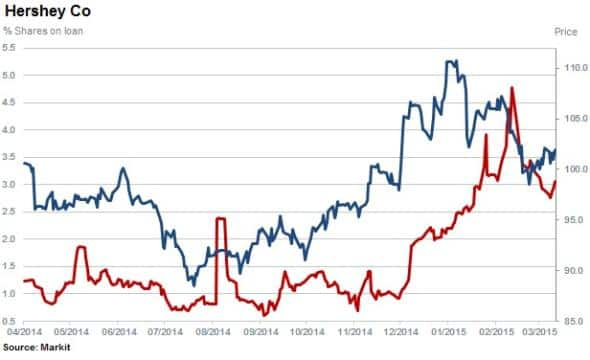

These European successes contrast with the US chocolate market where Hershey Co has seen its short interest surge in recent weeks despite the slump in cocoa price. There are now over 3% of Hershey's shares out on loan - making the company the most short sold chocolate maker globally.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032015-Equities-Cocoa-futures-contracts-launch-despite-price-fall.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032015-Equities-Cocoa-futures-contracts-launch-despite-price-fall.html&text=Cocoa+futures+contracts+launch+despite+price+fall","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032015-Equities-Cocoa-futures-contracts-launch-despite-price-fall.html","enabled":true},{"name":"email","url":"?subject=Cocoa futures contracts launch despite price fall&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032015-Equities-Cocoa-futures-contracts-launch-despite-price-fall.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Cocoa+futures+contracts+launch+despite+price+fall http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032015-Equities-Cocoa-futures-contracts-launch-despite-price-fall.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}