Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 30, 2014

Week Ahead Economic Overview

Worldwide manufacturing and services PMI releases plus an update on the US labour market are highlights of the week. Other standouts are industrial production numbers for Germany and the UK plus the latest Bank of England and European Central Bank policy decisions.

The Bank of England announces its latest monetary policy decision for the UK on Thursday. The UK economy expanded by 0.7% in the three months to September, but policymakers were expecting growth to have remained robust in the third quarter. The latest estimate of the health of the economy will do little to change the outlook for interest rates and no change is therefore expected at the Bank of England meeting.

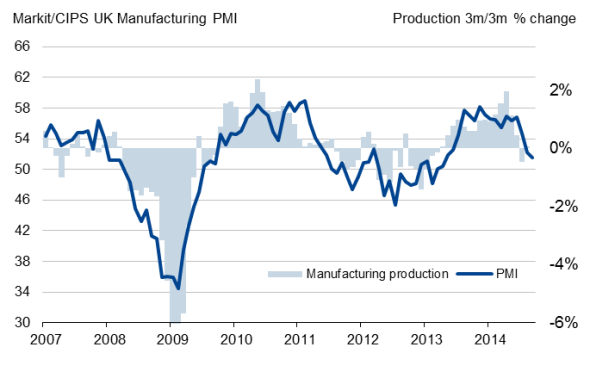

An update on how the UK economy is performing at the start of the fourth quarter is meanwhile given by construction, manufacturing and services PMI releases. September's survey data showed that the weighted average output index from the three Markit/CIPS PMI surveys, which acts as a reliable advance indicator of GDP, fell to a six-month low of 58.1. Updates from the ONS on UK industrial production and trade will add to the policy debate.

UK industrial production and the PMI

Sources: Markit, ONS via Ecowin.

Final PMI data for the euro area will give insights into the currency union's performance in October and include more national detail. 'Flash' data suggested that growth remained sluggish and while the survey signalled that the eurozone has so far avoided a slide back into recession this year, a renewed downturn cannot be ruled out.

No change is meanwhile expected at the ECB meeting, after the European Central Bank took further steps to bolster the faltering eurozone economic recovery and also announced the commencement of a programme to buy asset backed securities and covered bonds, which started in October at their last meeting.

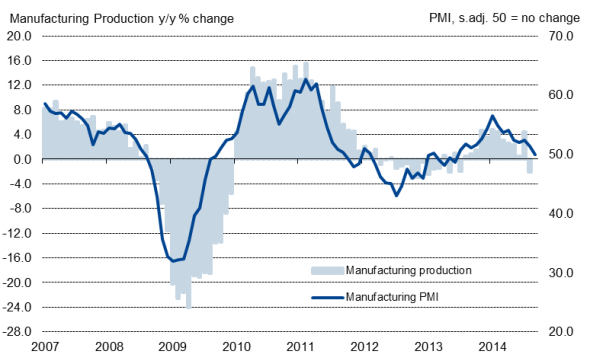

Other important releases in the eurozone include Industrial production data for Germany, which will give further clues as to how the region's largest economy performed in the third quarter. Last month, industrial production fell at the strongest rate since 2009, but a sharp rise in vehicle production in September and signals sent by the PMI suggest that industrial output rebounded in September.

German industrial production and the PMI

Sources: Markit, Statistisches Bundesamt via Ecowin.

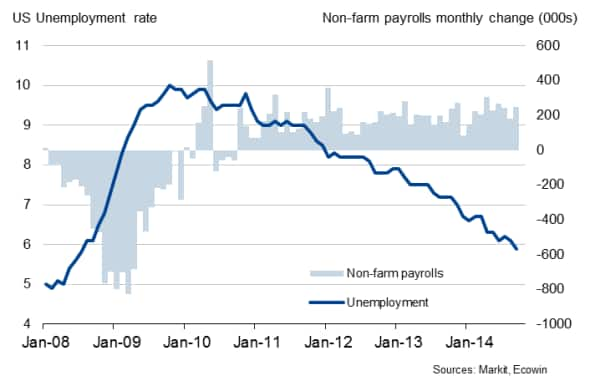

Early indications of how the US is performing in October are meanwhile provided by the final manufacturing and services PMI releases and the monthly employment report, which includes non-farm payroll numbers. In September, jobs growth rebounded and the jobless rate plunged to 5.9%, the lowest since 2008. 'Flash' PMI data meanwhile signalled an easing in the pace of economic growth, possibly down to 2.5% or less in the fourth quarter if the PMI falls further in coming months.

US labour market

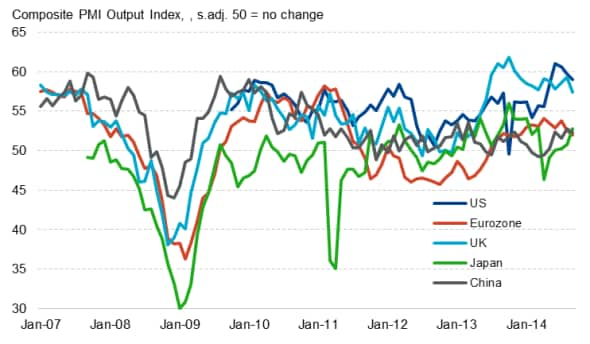

The release of PMI data for China will indicate whether growth continued to slow at the start of the fourth quarter. Any positive signals from the survey data would represent welcome news to the Chinese authorities, after 'flash' PMI data suggested that manufacturing growth slowed in October and official data signalled that economic growth slowed to the weakest since the start of 2009.

The PMI data for Japan will also be eagerly awaited by policymakers for signs that the economy is regaining momentum after GDP dropped 1.7% in the second quarter. October's 'flash' PMI signalled the largest monthly improvement in manufacturers' operating conditions since March.

Composite PMI Output Index

Sources: Markit, CIPS, HSBC, JMMA.

Monday 3 November

Manufacturing PMI" results are released worldwide by Markit.

Building permit numbers are meanwhile issued in Australia and the euro area.

In Brazil, trade balance data are out.

The US Census Bureau publishes an update on construction spending data.

Tuesday 4 October

Markit publish a number of PMI results including the Markit/CIPS UK Construction PMI" and the JMMA Japan Manufacturing PMI".

Trade data and retail sales numbers are published in Australia and the Reserve Bank of Australia announces its latest interest rate decision.

Producer price numbers are released by Eurostat for the currency union.

Brazil sees the release of industrial output figures.

Trade balance data are meanwhile issued in Canada.

The OECD publishes a statistics release on consumer prices.

In the US, trade data are published alongside factory orders numbers and economic optimism information.

Wednesday 5 November

Services PMI results are published worldwide by Markit.

The Office for National Statistics releases its latest economic review.

Iceland's Central Bank announces its latest interest rate decision.

Retail sales numbers are meanwhile issued for the eurozone.

Thursday 6 November

The Australian Bureau of Statistics published a labour market update.

The Bank of Japan issues minutes from its October meeting.

In South Africa, business confidence data are out.

The Eurozone Retail PMI and the HSBC Russia Services PMI are released by Markit.

Factory order numbers are meanwhile released in Germany.

In the UK, the Office for National Statistics releases updated industrial production numbers while the Bank of England announces its latest interest rate decision.

The latest ECB interest decision is also announced on Thursday.

Building permit numbers are out in Canada.

Labour costs numbers and initial jobless claims are issued in the US.

The OECD presents its preliminary economic outlook.

Friday 7 November

Markit releases sector PMI data, the HSBC Emerging Markets Index and UK & the English Regions Report on Jobs.

Trade data are released in the UK, France and Germany, with the latter also seeing industrial production numbers.

Industrial output figures are also out in Spain.

The US Department of Labour issues updates on non-farm payrolls, unemployment and earnings data.

Canada also sees an update on labour market data.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102014-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}