Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 31, 2016

Most shorted ahead of earnings

A look at how short sellers are positioning themselves in companies announcing earnings in the coming week

- Fitbit and GoPro on list of heavily shorted stocks ahead of earnings

- Short sellers rush to cover airline shorts after better than expected preliminary earnings

- Neo Solar sees large jump in short interest after challenging sales numbers

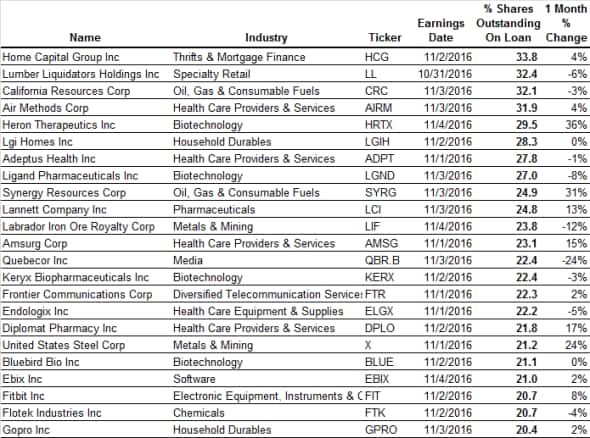

North America

Canadian mortgage lender Home Capital Group is the most shorted company announcing earnings this week with 33.8% of the company's shares out on loan. Home Capital and its Canadian mortgage peers have been popular short plays in recent months as investors look to express a view on the Canadian housing market. Home Capital's short interest has also been stoked following revelations that some of its third party brokers falsified borrower income in origination documents.

The second most shorted company announcing earnings in North America this week, Lumber Liquidator, is also no stranger to scandal as it faced charges of excessive formaldehyde in some of its laminate flooring. Lumber Liquidator's shares have been in short seller's crosshairs ever since as the fallout from the scandal hit footfall in its stores.

Wearables are another key focus for short sellers this week with both GoPro and Fitbit making the most shorted ahead of earnings list with 20% of each firm's shares now out on loan. Current shorting activity in both stocks stands at an all-time high after a string of disappointing earnings and product releases took the shine off these once high flying shares.

One firm seeing a large increase in short interest in the run-up to earnings is United States Steel whose demand to borrow has increased by a quarter in the last four weeks. The large tariffs imposed on imported Chinese steel had sent US Steel shares up sharply from the lows set in February which in turn saw short sellers cover nearly two thirds of their position. Spot steel prices have started to fall from their post tariff highs and short sellers have returned to both US Steel and its steel producing peers.

This increased bearish sentiment towards steel firms has yet to be rewarded however as AK Steel short sellers were caught out last week when the company announced some better than expected earnings which sent its shares up sharply.

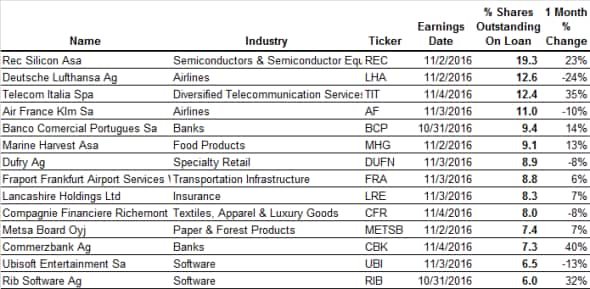

Europe

Norwegian silicon manufacturer Sec Silicon is the most shorted European stock announcing results this week as 19.3% of its shares are now out on loan. Rec downplayed expectations for the coming quarter last month when it announced that its third quarter polysilicon sales will not meet guidance due to ongoing issues in the photovoltaic market. This announcement saw short sellers pounce on the firm as demand to borrow its shares has surged by 23% in the last four weeks to the highest level in over three years.

Another firms seeing short interest hover at multi year highs is luxury conglomerate Richemont which has 8% of its shares shorted following a sustained downturn in the demand for luxury watches. The current demand to borrow Richemont shares is four times the level seen at the same time last year.

Short sentiment in European legacy airlines has gone the other way in the last four weeks with short sellers rushing to cover positions in Lufthansa over the last four weeks as the firm posted better than expected preliminary results which sent its shares up sharply. Fellow legacy carrier Air France has also seen a wave of short covering with demand to borrow its shares falling by a tenth in the last month.

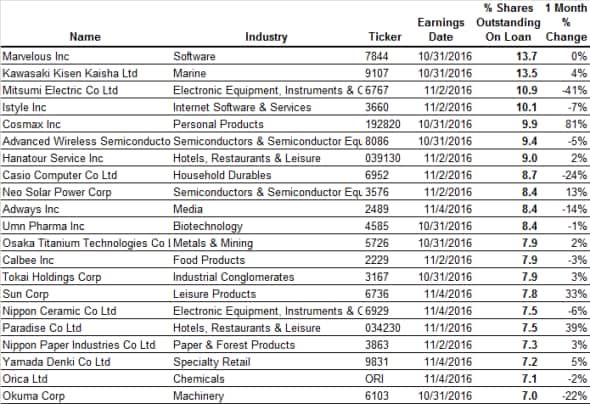

Asia

Japanese video game developer Marvelous leads the heavily shorted Asian stocks announcing earnings this week with 13.7% of shares out on loan. Marvelous shares have more than halved in the last 18 months as the firm posted declining revenue figures. Short sellers aren't showing any signs of backing down as over 80% of the Marvelous shares that currently sit in lending programs have already been spoken for.

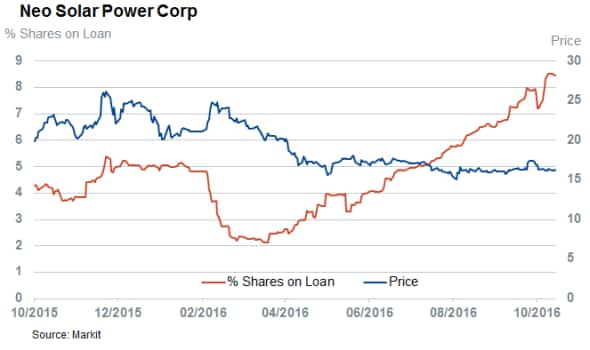

The tough market for photovoltaic, which energised European short sellers, is also driving bearish sentiment in Asia solar panel manufacturer Neo Solar also make the list of heavily shorted stocks ahead of earnings with 8.4% of the firm's shares now out on loan. Neo reported a larger than expected loss in its last set of earnings and analysts aren't forecasting the firm to return to profitability anytime soon as the firm's sales more than halved in August.

The sole Australian firm making this week's most shored ahead of earnings list is Orica which has 7% of its shares out on loan to short sellers. Demand to borrow Orica shares is down significantly over the last few months as the stabilisation in commodities prices has lifted its shares from the previous multi year lows.

Simon Colvin, Research Analyst at IHS Markit

Posted 31 October 2016

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}