Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 23, 2018

A look at quant performance in China

Investors' interest in China's capital markets has gained momentum following the launch of the Shanghai-Hong Kong stock-connect program in November 2014 and the Shenzhen-Hong Kong stock-connect program in December 2016. Improved accessibility to the markets has ultimately resulted in the inclusion of over 220 China A-shares in the MSCI Emerging Markets Index, in two phases beginning 31 May 2018. Given this additional conduit for foreign investors to participate directly in the A-shares market, we review the economic landscape of China and recent quantitative factor and model performance within the China A-shares universe of the Research Signals Global Factor Library.

- Despite an economic environment of mild growth deceleration and bear market pricing, especially in May and June, positive equity ETF flows support a positive investor outlook

- From a long-only perspective, factors which outperformed on average year-to-date include North America Sales Exposure along with gauges of low risk and medium-term price momentum

- Short-term price reversal and valuation measures were among the most successful thus far this year in identifying stocks to avoid, underweight or sell

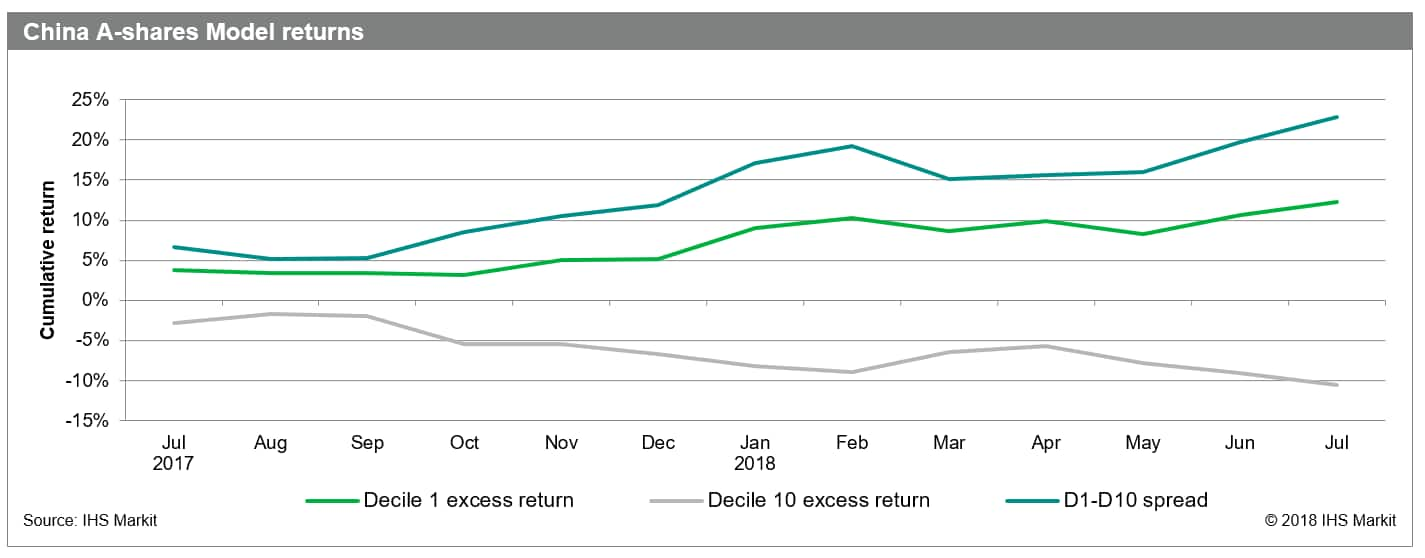

- Our China A-shares Model, a quantitative multi-factor model developed in 2016, has performed well in 2018, with the decile 1 (long) names outpacing the universe average by just over 1% monthly

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fA-look-at-quant-performance-in-china.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fA-look-at-quant-performance-in-china.html&text=A+look+at+quant+performance+in+China+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fA-look-at-quant-performance-in-china.html","enabled":true},{"name":"email","url":"?subject=A look at quant performance in China | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fA-look-at-quant-performance-in-china.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+look+at+quant+performance+in+China+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fA-look-at-quant-performance-in-china.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}