Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 01, 2018

Europe leads global manufacturing upturn, but also sees highest price pressures

- Global PMI dips for second month but holds close to seven-year highs

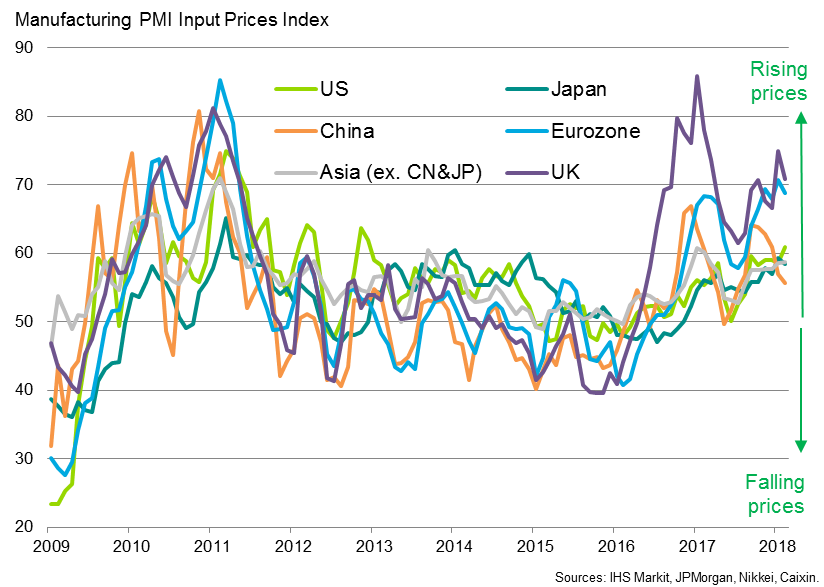

- Upturn accompanied by rising prices as demand exceeds supply

- Eurozone leads the global upturn, but also sees steepest price rises

Global manufacturing lost a little momentum for a second successive month in February, according to the latest PMI™ surveys, though growth remained among the strongest seen over the past seven years. At least some of the slowdown in production growth could be linked to firms hitting capacity constraints, notably in supply chains, which suggests that inflationary pressures are also intensifying. Such problems are especially evident in Europe.

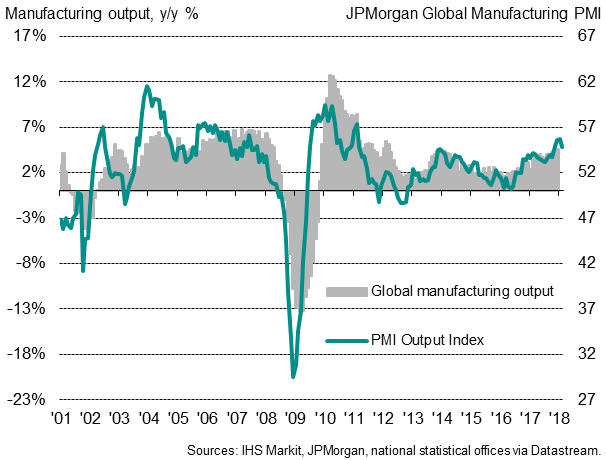

The headline JPMorgan Manufacturing PMI, compiled by IHS Markit, registered 54.2 in February, down to a three-month low from 54.4 in January but nevertheless still attaining one of the highest levels since early-2011.

Output grew at the slowest rate for four months, accompanied by a similar waning in growth of new orders, but both measures remained elevated by standards seen over the past seven years.

During the past two decades, the PMI shows an 86% correlation with the official manufacturing output data, with the PMI acting with a four-month lead. Historical comparisons indicate that the latest surveys are running at a pace broadly consistent with global factory production rising at an annual rate of 5%.

Capacity constraints

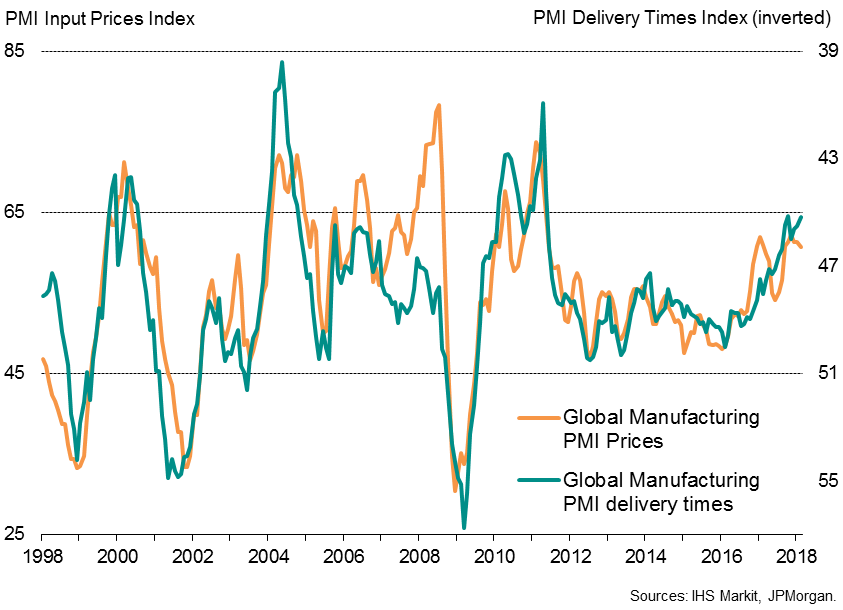

The surveys also indicated that capacity continued to be stretched. A further rise in unfilled orders continued the longest spell of backlog accumulation in the survey’s history. Supplier delivery delays, which tend to develop when demand exceeds supply, were meanwhile the second-most widespread for nearly seven years. Supply delays were also linked to higher prices, as difficulties in purchasing inputs meant pricing power increasingly shifted to the seller/supplier.

Although global factory input costs and selling price inflation rates cooled slightly in February, they remained among the highest seen over the past seven years.

Europe leads despite seeing growth cool

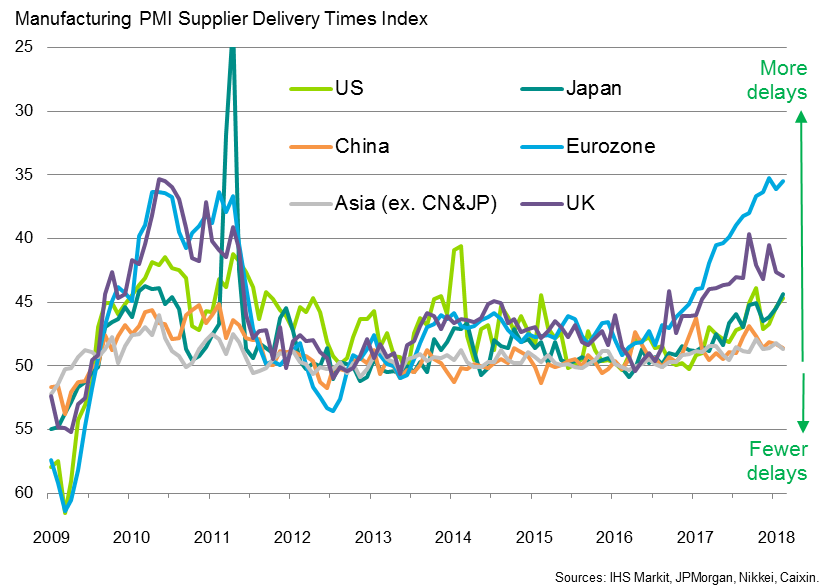

Manufacturing growth was fastest in Europe, though the continent also saw the most severe lengthening of suppliers’ delivery times and accompanying price pressures.

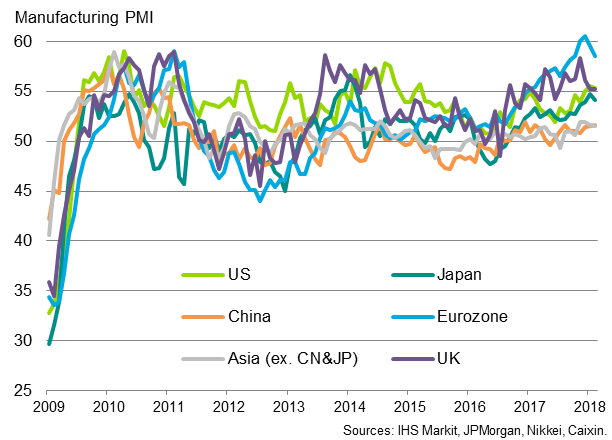

While the Eurozone Manufacturing PMI fell for a second successive month in February, it continued to run well above all other major economies and suggests the region is enjoying its best growth spell for two decades.

The UK, which had seen manufacturing growth run only moderately below that of the eurozone in the early half of last year, has slipped behind in recent months, losing further momentum in February.

Growth also edged very slightly lower in the US, though the IHS Markit PMI remained among the highest readings seen over the past three years. Similarly in Japan, a slight drop in the Nikkei PMI failed to materially change the picture of a manufacturing economy enjoying its best growth spell since 2014.It was a different story in the rest of Asia, however, with the Caixin PMI for China running at one of the highest levels seen over the past seven years but remaining very subdued by historical standards. Likewise, the average PMI for Asia excluding Japan and China continued to indicate only modest growth.

Supply delays and prices

Supply chain trends have also varied markedly around the world. Delays in the supply of inputs have, in recent months, been far more extensively reported in the eurozone than in the US, Asia and, to a lesser extent, the UK. The eurozone and the UK have seen a commensurately steeper jump in input costs as a result of the ability of suppliers to hike prices as demand outstrips supply.

However, improved pricing power has also led to increased supplier prices in both the US and Japan, pushing rates of input cost inflation up to multi-year highs in recent months.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEurope-leads-global-manufacturing-upturn-but-also-sees-highest-price-pressures.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEurope-leads-global-manufacturing-upturn-but-also-sees-highest-price-pressures.html&text=Europe+leads+global+manufacturing+upturn%2c+but+also+sees+highest+price+pressures","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEurope-leads-global-manufacturing-upturn-but-also-sees-highest-price-pressures.html","enabled":true},{"name":"email","url":"?subject=Europe leads global manufacturing upturn, but also sees highest price pressures&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEurope-leads-global-manufacturing-upturn-but-also-sees-highest-price-pressures.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Europe+leads+global+manufacturing+upturn%2c+but+also+sees+highest+price+pressures http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEurope-leads-global-manufacturing-upturn-but-also-sees-highest-price-pressures.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}