Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 12, 2022

Global Trade Outlook 2022. High global trade volume growth in 2021 and significant moderation in 2022. Supply chains disruption is likely to continue in the first half of 2022

This analytics article utilizes trade data published by IHS Markit Global Trade Atlas (GTA) delivered via the new integrated trade data tool Global Trade Analytics Suite (GTAS)

Key findings

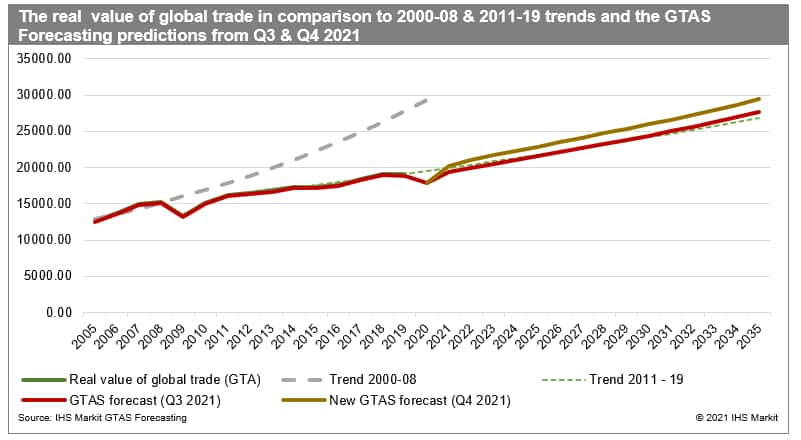

- The model predicts the real value of global trade to go up to USD 20,175 billion in 2021 and USD 21,038 billion in 2022

- Therefore, IHS Markit anticipates a year-on-year increase in the real value of global trade by 12.6% in 2021 (prior, it was +8.5%) and by 4.3% in 2022

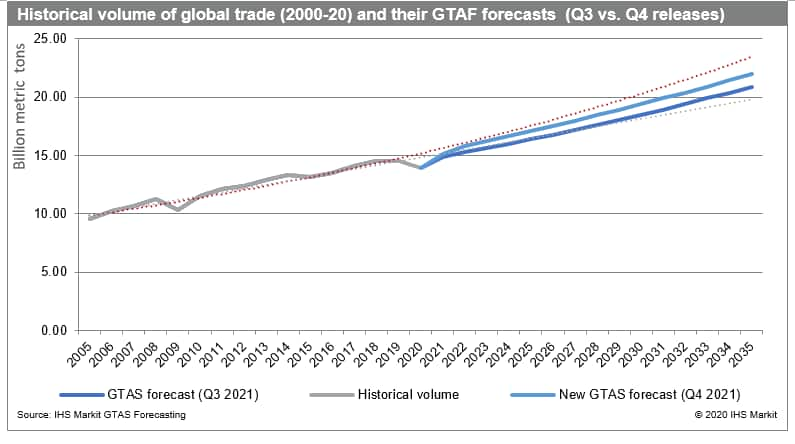

- The global merchandise trade volume forecast will grow to 15.2 billion metric tons in 2021 and 15.8 billion metric tons in 2022 (significantly higher than our prior forecasts for 2022)

- It points to a recovery in the forthcoming years with year-on-year growth rates of 8.7% in 2021 and 4.4% in 2022 (an adjustment by + 2.1% and 2.0%, respectively)

- The Omicron variant can adversely affect economic activity in Q1 2022

- Supply chain disruptions are unlikely to subside in H1 2022

Introduction

2021 was the second year of the ongoing COVID-19 pandemic, marked by rapid recovery from the dramatic 2020 resulting from the initial outbreak in Q1 2020. Q2 of 2020 proved to be the worst quarter for global trade on record, but the situation started to improve relatively fast.

Global trade is already at levels seen before the pandemic, but the growth rates peaked in Q2 2021 and then moderated. The recovery brought nonetheless several problems which proved to be persistent and will still affect global economic activity, at least in H1 2022. The present article will investigate these in detail.

Global trade in 2020

IHS Markit GTAS Forecasting team now estimates the contraction of global merchandise trade in 2020 to USD 17,921 billion or -5.5% year-on-year. In terms of volumes, GTAS Forecasting estimates a contraction of global trade in 2020 to 13.94 billion metric tons or by -4.2% year-on-year.

In comparison, the WTO estimated the fall in volume to be -5.3%, IMF estimated it to be -8.3% (for the volume of trade in goods and services), and WTO (June 2021 Outlook) at -8.3% for the volume of trade in goods and nonfactor services.

The ongoing COVID-19 pandemics

COVID-19 pandemic is the most prominent driver of the current global economic situation. As a pandemic cannot be fully predicted, it leads to significant uncertainty.

The reaction in trade in 2020 was to a large extent consistent with the escalating global COVID-19 pandemic and steps taken by individual countries/territories in controlling or mitigating it. The overall impact of COVID-19 on worldwide trade and the global economy will depend on the duration, severity, and spatial distribution of the pandemic and directly linked to the severity of containment efforts taken by individual states. The reaction of states is mainly related to the capacity of their health systems to cope with the numbers of incoming patients (hospitalizations) and the corresponding number of reported deaths showing to some extent the incapacity of health systems to manage.

It seems that with the duration of the pandemic, governments and international organizations learned to react to it and mitigate it in a more balanced and less harmful way.

The health crises, such as COVID-19, create problems both on the supply side (e.g., due to lockdowns, forced production stoppages, disrupted global value chains) and demand-side (e.g., lower consumer confidence, delayed consumption, lower incomes). The impact of COVID-19 on the worldwide economy outweighed the prior outbreaks of SARS or MERS. It resembled more the effect of the infamous Spanish Flu of 1918-20. In terms of the duration of the pandemic, we can expect it to endure up to 3 years. It could transform in 2022 from pandemic to endemic.

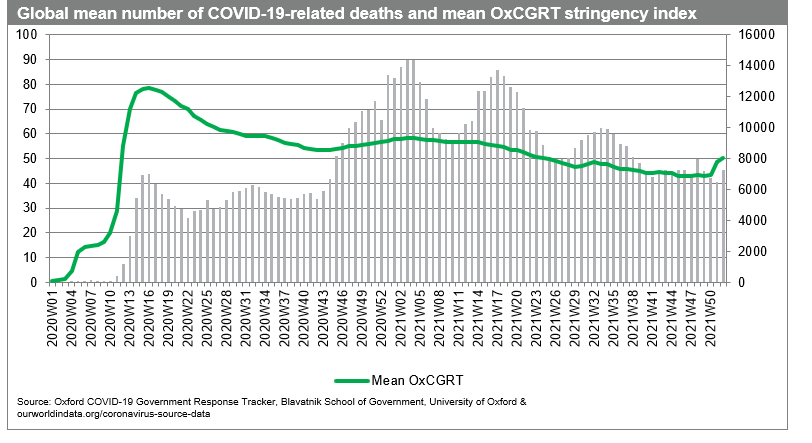

Recent econometric analysis on monthly processed bilateral trade flows by the GTAS Forecasting team has shown that COVID-19 still exerts an adverse impact on international trade flows; however, the effect is slowly diminishing in magnitude (it is observed both for new cases, new deaths, as well as COVID-19 monthly average of daily Oxford's Government Response Tracker on the stringency of response to the pandemic by individual states). The global economy is not reacting as such to the pandemic itself but mainly due to the severity of reaction by individual states and changes in it and due to the shifts in behavior of economic agents.

The overall impact of COVID-19 on global trade and the global economy depends on the duration, severity, and uneven spatial and temporal distribution of the pandemic (changing with the subsequent waves of the pandemic) and the associated severity containment efforts taken by individual states. The health crises create problems both on the supply side (e.g., due to lockdowns, forced production stoppages, disrupted global value chains) and demand-side (e.g., lower consumer confidence, delayed consumption, lower incomes)

On 26 November 2021, WHO designated a new SARS-Cov-2 variant B.1.1.529 as a variant of concern, named Omicron, on the advice of WHO's Technical Advisory Group on Virus Evolution. This decision was based on the evidence that Omicron has several mutations that may impact the speed of spread, higher transmitability, or the severity of illness it causes; the markets reacted strongly to the new adverse information with an increasing number of states reintroducing stricter contingency measures.

The full impact of Omicron will be known only within several weeks when we will understand the severity of the mutation. Nonetheless, it is likely to impact global economic activity in Q1 2022; the variant potentially could become an adverse game-changer.

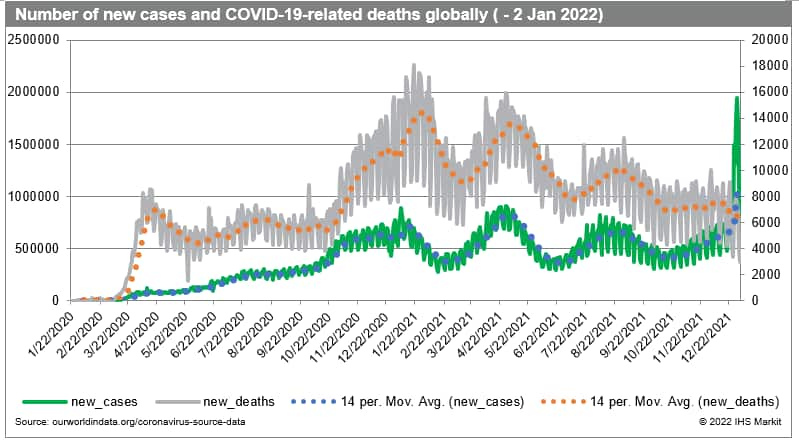

The cumulative number of confirmed cases of COVID-19 globally by 1 January 2022 reached 289.3 million and 5.45 million deaths.

The 2-week moving averages of new cases globally started to rise again by the end of October 2021, with global average death rates following with no apparent delay. Omicron led to the highest number of new cases reported since the pandemic outbreak in the last week of 2021, with no immediate impact, yet, on the number of COVID-19 related deaths. To illustrate the problem, in the U.S. the number of cases jumped to 500k daily in the last week of 2021 and then to 1 million confirmed cases daily in the first days of 2022. Thus, the shift from pandemic to endemic is becoming an actual reality.

There are two areas of concern now: the change in the number of hospitalizations (capacity of the health system to cope with the Omicron wave) and the level of vaccinations in the population.

According to some researchers, vector vaccines such as Russian Sputnik or Chinese Sinopharm and Sinovac's CoronaVac provide limited protection against Omicron, even with a booster dose, compared to mRNA vaccines such as Pfizer or Moderna. Thus, it could bring the countries that based their reaction to COVID-19 on vector vaccines under more significant pressures (particularly China (mainland) and Russia) in particular in Q1 2022.

The reported number of vaccinations globally reached 8.81 billion with 3.77 billion people fully vaccinated (with two doses or equivalent one dose), which is equal to 48.3% of the global population; to boost immunity to the new variant, an increasing number of countries, primarily advanced, started to distribute the third booster dose. At the same time, Israel began to distribute the fourth dose.

The disparities in vaccination levels and rates observed are of significant concern as a pandemic is global and needs to be resolved globally. The Omicron variant emerged in Botswana and then spread into South Africa, two countries, with low vaccination rates, before spreading globally. We can thus state that the size of the non-vaccinated population increases the chances of the emergence of new potentially more hostile variants of the virus.

The full impact of this new variant will be known only within several weeks when we understand the mutation's severity and the total size of the currently escalating wave. Nonetheless, it is likely to impact global economic activity in Q1 2022; the variant potentially could become a game-changer.

To provide more insight, we analyzed the average weekly global value of the stringency index by Oxford COVID-19 Government Response Tracker (Blavatnik School of Government, University of Oxford) & analyzed its correlation with COVID-19 related data on a number of deaths and cases. We took both contemporaneous and lagged dependencies into account. Overall, the stringency of global policy response is highly and statistically significantly correlated with the current (contemporaneous) number of reported deaths. What can we observe in the chart beneath is that the average contingency index started to increase in the last weeks of 2021 already, and this is likely to go on in the first weeks of 2022 if the spread of the Omicron variant leads to a grave increase in the number of hospitalizations/the corresponding number of deaths due to the incapability of the health systems of countries to deal with the wave or to the threat of it. The trade reacts to the seriousness of the containment efforts undertaken by individual states. Thus, it could potentially affect global trade in Q1 of 2022. It could not be included in the Q4 release of our forecasting model. Still, it will be considered in the Q1 release of our model.

Transport costs

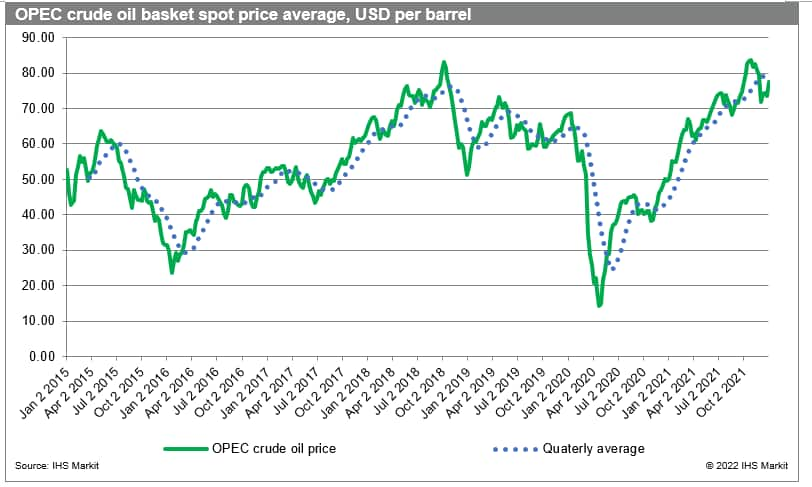

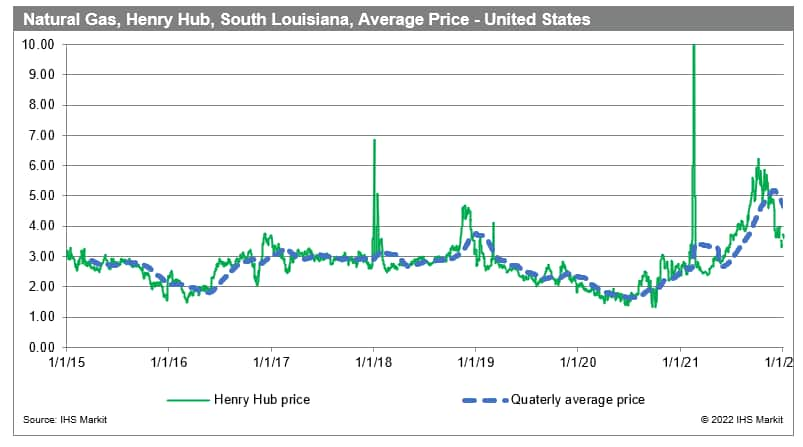

In our GTAS forecasting model, crude oil and natural gas prices approximate transport costs. The prices in H2 2021 reached the highest levels in the last seven years, thus rising overall transport costs. Despite the decrease in natural gas prices in December, they are still high.

The rising cost can put negative pressure on global trade, further aggravating disruptions in the global value chains. The hike in prices is due to reduced supply and enormously increasing demand in the recovery phase from COVID-19.

Natural gas prices are unlikely to decrease further in the winter season in the northern hemisphere due to the increased demand in the heating season. The problem is particularly visible in Europe, with geopolitical tensions with Russia playing a crucial role. Several scenarios, including an adverse one, are still possible in case of escalation of conflict with Ukraine.

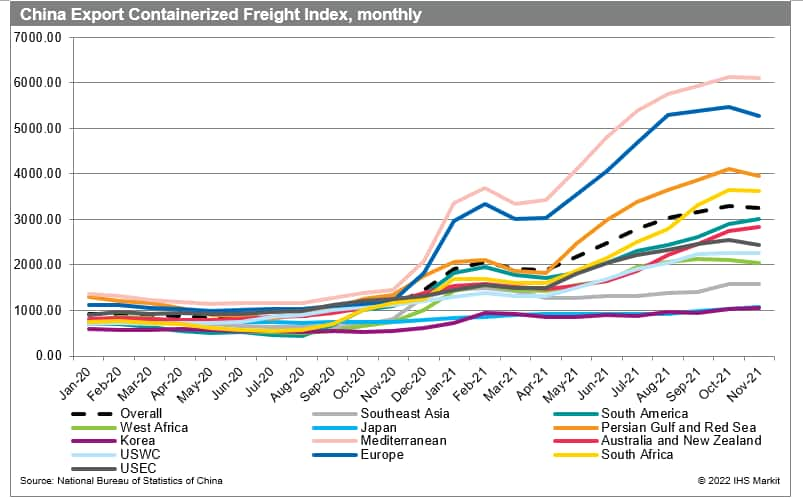

As shown by China Statistics, the containerized freight index from China to different destinations globally clearly points to skyrocketing costs of containerized shipments. We present the transports costs (average price in USD/TEU) to various destinations (from January 2015).

For the example of transport costs to the Persian Gulf and Red Sea regions, it is clear the cost of containerized transport climbed sharply compared to the pre-COVID-19 period. They are unlikely to return to moderate levels in the foreseeable future. The prices went up the most in the case of transports to Europe (more than four times) and the Persian Gulf & Red Sea, South America, Australia, and New Zealand (more than 3.5 times). The least affected are the routes to Korea and the East Coast of the United States (increase below 200%). With moderating GDP and trade growth rates, costs will gradually moderate but are unlikely to fall to pre-pandemic levels.

Let's have a look at the most recent data. The composite index of freight costs by the Shanghai Shipping Exchange moderated to 3344 points (USD/TEU) by the last week of December, thus going up by 3.0% m/m and 1.3% w/w. It can moderate a bit after the Christmas/New Year season, and in the Q1 of 2022; Month-on-month, it increased the most on routes to Southeast Asia, Korea, and East Coast of America and fell the most on routes to South Africa, W/E Africa & Europe.

The rise in container transport costs is partially related to rising fuel prices. It is also due to problems with supply for containers (global shortage of containers), continuing significant congestion in many seaports, particularly in China and USA, extended restrictions in many parts of the world due to COVID-19, and growing global demand in the recovery phase from the pandemic with the shift to consumption of manufactured goods from services. The present delays in transport with increased transport costs will further adversely affect many already stretched global value chains. The longer the problem lasts, the more likely are more severe adjustments to the existing value chains concerning both trade routes and production location (more backshoring and more nearshoring could be expected).

The sustained high transport costs, together with crude/natural gas prices, will put further pressure on global prices, leading to more contractionary (hawkish) monetary policies. The increasing number of central banks have acknowledged that the hike in inflation is not a temporary phenomenon and is likely to remain for a more extended period (rise in core inflation levels and inflationary expectations) thus will require policy adjustments to bring the situation under control in the medium term.

IHS Markit Growth Scenario

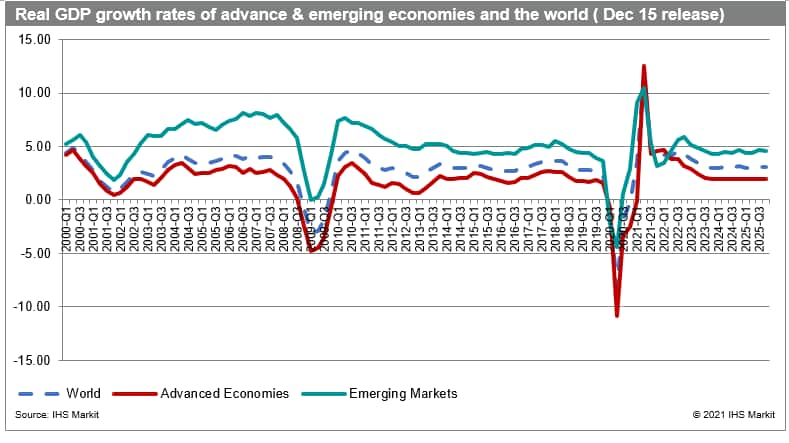

The most recent real GDP growth forecasts from IHS Markit were published on 15 December 2021 and are based on the baseline scenario of the impact of COVID-19 on the global economy (it did not incorporate the Omicron outbreak).

After a 3.4% decline in 2020, world real GDP will increase 5.6% in 2021 and 4.3% in 2022. The growth rates are expected to vary between 5.0% (3.9% in 2022) for advanced, 6.6% (4.9%) for emerging, and 4.0% (4.8%) for developing states; the growth rates are still predicted to moderate to around 3% in 2026.

From a quarterly perspective, real global GDP contracted every quarter of 2020, with Q2 being the worst quarter for the global economy in decades (-8.2%).

IHS Markit ECR team stresses that the global economytransitioned from recovery to expansion in 2021 amid ongoing turbulence from the COVID-19 pandemic. An uneven economic expansion generated supply/demand imbalances, leading to significant supply chain disruptions and rising inflation. In 2022, businesses will navigate multiple transitions in the global economy. These include the transition from pandemic to endemic COVID-19, the shift from fiscal policy stimulus to restraint, rising interest rates and tightening credit conditions, and a bumpy energy transition from hydrocarbons to renewables. Amid these transitions, global economic growth will likely slow in 2022 as some significant economies approach or reach full employment. Geopolitical conflicts, such as an escalation of tensions between the US and mainland China, will continue to pose risks to the outlook.

Overall, global economic expansion is unevenly progressing, as the pandemic has uneven distribution across regions. The inhibiting effects of regional outbreaks (subsequent waves) are transmitted globally through trade relations. With expansionary fiscal and monetary policies supporting demand, the implications are widespread supply shortages and escalating prices (inflation readouts are the highest in decades in many parts of the world).

The now estimated growth rate in Q1 2021 was 3.5%. In Q2 2021, real global GDP is estimated to have grown by 11.7%, with the growth impulse more vital for advanced (12.5%) than emerging economies (10.5%). In Q3 growth rate moderated to 4.6% globally (4.3% and 5.2% respectively) and is going to moderate further in Q4, reaching 4.0% globally (4.6% for advanced and 3.2% for emerging economies); the growth rate for Q1 2022 is expected to be 4.2% and be higher in advanced states (4.7%) than in emerging economies (3.5%); starting from Q2 2022, growth in emerging states should start continuously exceeding the growth in the group of advanced states thus catching-up is likely to occur.

PMI New Export Orders point to a positive outlook for both global manufacturing and trade in services

PMI New Export Orders (adjusted) by IHS Markit is an excellent predictor of the situation in trade over the coming quarter. The 50.0 points is a benchmark value with a value above pointing to recovery and below indicative of contraction. The analyses were performed to show a high correlation between PMI NExO and changes in IHS Markit GTA monthly data reported by states over the coming quarter (mostly the following month).

The adjusted PMI new exports orders (PMI NExO) readouts for the global manufacturing industry in November 2021 were above the benchmark value of 50.0 points (51.37) the 15th month in a row proving the sustained nature of recovery and still pointing to a positive short-term outlook for global trade; in comparison to October readouts, they were higher by 0.76.

The values for November were pointing to a positive short-term outlook for exports in eight out of the top 10 economies with the highest importance for the EU (54.42), Canada (53.65), Japan (52.78), India (51.73) above the global average); the values were below of 50.0 for the UK (49.00) & China (49.85); Russia scored a result above of 50.0 for the first time in 11 months.

PMI NExO in November 2021 for global manufacturing (50.60) and global services (51.44) were above the 50.0 points benchmark (49.31); PMI NExO for global services went up month-on-month for the second time in a row.

Readouts of PMI NExO for November are likely to reflect the developing Omicron crisis partially, and only the December readouts are likely to fully reflect the shift in market expectations (they are not available yet).

COVID-19 affected the services sector to a more considerable extent than manufacturing and created a shift in demand from services to manufacturing goods, one of the most important reasons for observed supply chain disruption and a hike in global price levels.

Qualitative factors that could affect global trade in 2022

As of 2 November 2021, the ASEAN Secretariat has received Instruments of Ratification/Acceptance of the Regional Comprehensive Economic Partnership (RCEP) Agreement from six ASEAN Member States - Brunei Darussalam, Cambodia, Lao PDR, Singapore, Thailand, and Vietnam - as well as from four non-ASEAN signatory States - Australia, China, Japan, and New Zealand. South Korea ratified the agreement on 2 December. As provided by the RCEP Agreement, the RCEP enters into force sixty days after the date at which the minimum number of IOR/A is achieved. This means that the RCEP Agreement entered into force on 1 January 2022. Four countries haven't ratified the agreement yet: Indonesia, Malaysia, Myanmar, and the Philippines. RCEP is the world's most significant regional trade agreement regarding GDP & population. RCEP's countries currently account for about 29% (USD 25.8 trillion) of global gross domestic product and approx. 29% (2.3 billion) of the world's population. RCEP can, due to its size and intended scope, create significant quantitative and qualitative effects regionally and globally both in the short and the long run (considerable static and dynamic effects are very likely). It could strengthen the region's economic position as the primary locus of economic activity, spurring the region's growth globally. RCEP increases the likelihood of establishing the world's largest regional value chain with the growing role of intra-regional economic activity.

As was stressed last year, the block's cultural, social, economic, and political heterogeneity will challenge its functioning, and progress will depend on the balance of costs and benefits for all participating states. Realizing the potential benefits of this mega-regional FTA will crucially depend on addressing the significant challenges, in particular, divergent political and economic interests of this diverse group.

As of 15 October 2021, 350 RTAs were in force globally. These corresponded to 568 notifications from WTO members, counting goods, services, and accessions separately. Over several decades, the global trade system is likely to develop into a system of several large RIAs or mega-regional trade agreements (e.g., European, Pan-American & Asian) with a significant role in the global trading system and potentially large tensions between them. The launching of RCEP can be considered an essential step in this process.

It will also be interesting to observe the impact of RCEP and its trade rules on the multilateral system and the potential erosion of the WTO dominance in global trade governance despite the statements made by the signatories of the agreement on the complementarity of both approaches.

Recent years in global trade were affected by rising trade tensions, particularly between the US and China, due to the Trump administration's policies (America First). The new Biden administration modified the course, and in general, the US now pursues a broader, more multilateral trade policy. Nonetheless, a more assertive stance on China remained. The day President Biden took office (20 January 2021), he signed 17 executive orders, reversing many of the most unpopular actions of the Trump administration. The US policy toward China (mainland), however, has not shifted as was expected. The prior tensions have not diminished but instead escalated with more Chinese technology companies placed on the so-called "blacklist" of the US Commerce Department. In October, US Trade Representative Katherine Tai mentioned that only selective and limited in scope rollback in tariffs could be expected. Concerns on the US-China tensions (two key economies of the world are thus growing). The escalating tensions in the Taiwan Strait between China (mainland) and Taiwan, supported by the US, are not helping.

Considering the launch of RCEP, the new US administration's trade agenda is likely to gravitate towards Asia. We can thus expect a shift in US trade policy towards Asia, which is expected to bring effect in the mid to long-term.

Overall, with the arrival of Biden's administration, the US trade policy uncertainty has fallen to a long-term trend characterized by limited uncertainty.

EU-UK Trade and Cooperation Agreement (TCA), negotiated and ratified at the last possible moment, took effect provisionally from 1 January 2021, before formally entering into force on 1 May 2021, after the ratification processes were completed. According to TCA, trade in goods between the EU and UK shall not be subject to tariffs or quotas. Traders can self-certify compliance with agreed rules of origin. However, because the UK left the EU customs area, customs formalities were reintroduced between the two parties, and VAT and specific other duties started to apply upon import. TCA holds provisions intended to limit technical barriers to trade (TBT), building on the WTO TBT Agreement. Special provisions apply for Northern Ireland and Ireland-specific cases. The agreement has many imperfections and could create problems for both parties in the medium to long run.

On 8 December 2021, social Democrat Olaf Scholz was sworn in as Germany's new chancellor, thus ending 16 years of conservative rule under Angela Merkel. It paved the way for a pro-European coalition government that vowed to boost green investment.

Some countries will hold important presidential and parliamentary elections in 2021. From the EU perspective, the elections in France will be of particular significance. The French presidential elections will be held on 10 and 24 April 2022, and legislative elections on 12 and 19 June. The current president Macron is currently indicated as a winner in the polls but only in the second round. A potential loss to Le Pen or Pécresse could constitute a significant shift in French policy with global impact.

The euro-linked ERM II includes the currencies of Bulgaria, Croatia, and Denmark. The Bulgarian lev joined ERM II on 10 July 2020 and observes a central rate of 1.95583 to the euro. Bulgaria also committed unilaterally to continue its currency board arrangement within the ERM II. By mid of 2022, a decision should be made on the potential extension of the eurozone by Croatia by 1 January 2023. Croatia may introduce a double quotation upon the approval to join already in 2022. The above step could affect both the internal trade within the EU but also strengthen the position of the eurozone and EU, weakened after Brexit.

COP26 summit resulted in the Glasgow Climate Pact (GCP) — agreed to by all participating countries and led to various pledges by countries. The results of GCP will affect the global economy in the medium to long-run, should not, however, affect the global trade immediately in 2022. Interestingly, the United States committed to lifting tariffs on aluminum and steel produced in the EU, less carbon-intensive than similar products made in China. Tariffs remain for other producers, including China (mainland), reflecting the Biden Administration's desire to incorporate climate policy in international trade. It is an exciting development as the trade policy could be increasingly greener.

In addition, several potential hotspots could be named:

- Potential military conflict between Russia and Ukraine with a massive buildup of forces on the borders in place, realistic after the annexation of Crimea and the ongoing conflict in Donbas - NATO, EU, and the US have stressed that this could lead to massive additional sanctions being placed on Russian Federation

- Tensions on the EU-Belarus border with a regime-led escalation in the migrant crisis

- The natural gas crisis in Europe related to global developments and problems with Nord Stream 2 gas link

- Escalation in instability in Lebanon & Syria could affect the Middle East

- Uprising in Kazakhstan that could destabilize the situation in other Central Asian states and even further

The unresolved issue of Iran's nuclear program, the unresolved conflicts between Armenia & Azerbaijan, and potential terrorist attacks globally and in the Persian Gulf regions are a few factors to be closely observed as they could quickly impact the global economy if they escalate.

IHS Markit GTAS Forecasting Q4 release - 2021 results and forecasts for 2022

The Q4 2021 release of the GTAS Forecasting model accommodated the most recent macroeconomic estimates from IHS Markit Global Link Model, Q2 data for 2021 from the Global Trade Atlas (GTA) for monthly reporting states, and updated COVID-19-response factors.

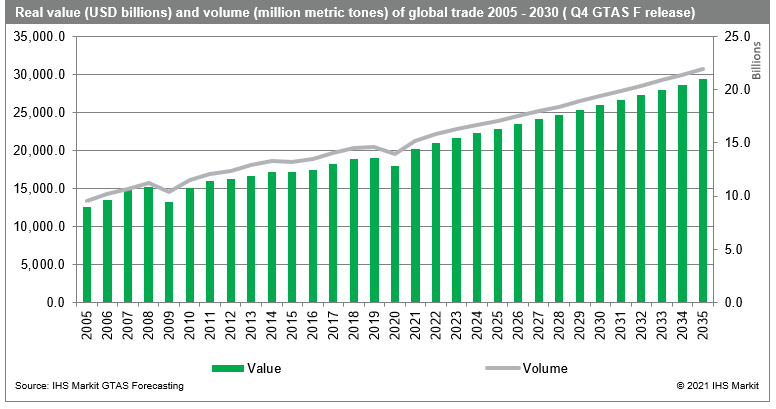

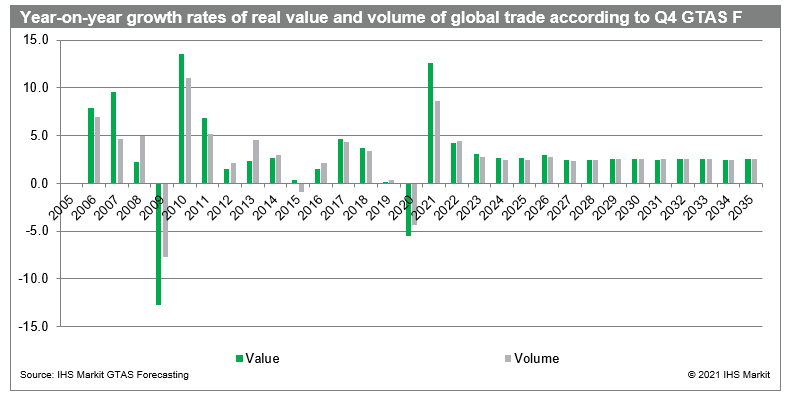

The model predicts the real value of global trade to go up to USD 20,175 billion in 2021 and USD 21,038 billion in 2022. Therefore, IHS Markit anticipates a year-on-year increase in the real value of global trade by 12.6% in 2021 (prior, it was +8.5%) and by 4.3% in 2022.

It accommodates both the recovery in global GDP already in the second half of 2020 and a robust growth impulse in Q2 of 2021. The recovery peak was reached in Q2021 and then moderated in Q3 and Q4 2021 and will gradually continue in the forthcoming quarters of 2022.

The predicted CAGR for the period 2021-2030 equals 2.8% and for 2022-2035 equals 2.7% (an increase by +0.2% and +0.1% respectively on the Q3 release results). It represents an upward adjustment in CAGR compared to the prior release, driven mainly by adjustments of GDP forecasts in the GLM model and better than initially expected results for the first three quarters of 2021.

The global merchandise trade volume forecast will grow to 15.2 billion metric tons in 2021 and 15.8 billion metric tons in 2022 (significantly higher than our prior forecasts for 2020). It points to a recovery in the forthcoming years with year-on-year growth rates of 8.7% in 2021 and 2.4% in 2022 (an adjustment by + 2.1% and 2.0%, respectively). This is mainly due to better-than-expected global flows in Q2 and Q3 - more vigorous and sustainable recovery.

The forecasted CAGR for global trade volume stands at 2.8% in 2021-30 and 2.7% over 2022-35 (an increase by +0.4% and +0.5%, respectively, on prior release results).

For comparison, the CAGR for volumes averaged 3.1% in 2005-19, and an impressive 5.5% in 2005-08 in the period directly preceding the global financial crisis of 2007-2009. The CAGR for the period 2011-19 was 2.3%. Therefore, the predicted growth rates over 2021-2030(5) are noticeably faster than those of 2011-19 (higher trajectory of global trade) predating the pandemic but significantly lower than the growth rates observed in the preceding financial crisis.

The estimated contraction in global trade volume in 2020 (-4.2%) is lower than that in the global financial crisis (-7.8%). On the other hand, the recovery in 2021 is weaker (+8.7%) than the expansion post the global financial crisis in 2010 (+11.0%).

The estimated recovery is strong enough to allow international trade to reach its pre-pandemic levels already in 2021 and presently predicted higher CAGR over the period 2021-2035 is strong enough for global trade to achieve a higher trajectory path of the pre-pandemic trend (2011-2019) in the forecasted time horizon. By 2035 the real value of international trade should exceed the 2019 levels by +55%).

It was also interesting to compare the Q4 forecasts relative to trends in the historical data.

Quarterly perspective

The quarterly seasonality of global trade is apparent. We observe, however, more complex seasonal patterns at origin-destination-GTAS Forecasting commodity levels. The depth of the Q2 2020 crisis due to the COVID-19 outbreak can be seen in the quarterly data after a weak Q1 2020 already and sluggish 2019. The recovery started in Q3 and continued in Q4; thus, we obtain a classic V-shape-crisis pattern. Furthermore, it is essential to note that we are above the values in terms of levels and trends (growth rates) observed before the pandemics.

The full version of the quarterly perspective is available to our Global Trade Analytics Suites (GTAS) clients only on Connect platform. Contacts IHS Markit Customer Care Customer.Care@ihsmarkit.com for details.

GTAS Forecasting predictions vis-à-vis the forecasts by other organizations

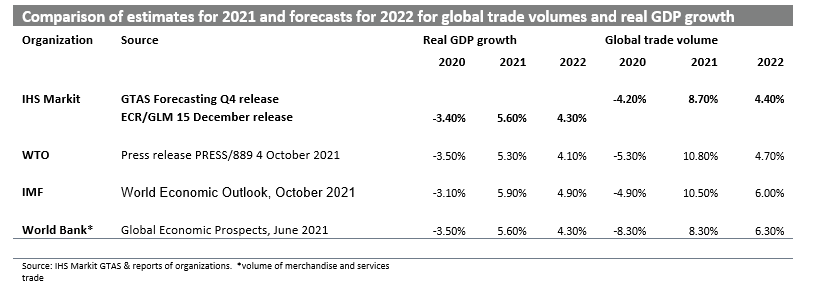

Let's compare GTAS Forecasting results to the baseline scenarios of three other organizations, namely WTO, IMF, and the World Bank. Please bear in mind that we are comparing our current forecast to the forecast provided by the organizations in the period between June and October 2021.

For real GDP growth, the estimated contraction in 2020 globally is between minus 3.2% and minus 3.5%. The growth in 2021 is estimated to be in the range of 5.3 percent to 6% in the case of IMF. The prospects for 2022 vary between 4.1 percent by WTO and 4.9% by IMF. The forecast from IHS Markit is in-between.

The estimated contraction in 2020 varies between - 8.3% from IMF and World Bank to - 4.2% by GTAS Forecasting for global trade volumes. Please bear in mind that the World Bank forecast considers the trade in services.

The estimates for 2021 vary between 8.3% for the World Bank (including the trade in services) and a 10.80% increase from WTO. We estimate the growth at 8.70% (and a 12.6% increase in terms of the real value of trade). The difference between organizations can be attributed to the difference in data collection, transformation, processing methodology, and different types of forecasting models utilized. Please remember that the GTAS Forecasting constructs a cleaned & balanced trade data set as a starting point for running the forecasting models using a ranking system of reporting states, eliminating the outliers, and filling in the missing observations (e.g., on quantities).

As to the forecast for 2022, all four organizations predict more moderate growth levels compared to 2021, varying between 4.4% (4.3% in real value terms) from GTAS Forecasting, 4.7% from WTO, 6.0% from IMF, and 6.3 from the World Bank. Overall, in comparison to other major organizations, our estimates are optimistic for 2021 and closer to estimates by the World Bank, and more conservative for 2022. Likely, the very positive outlook on growth rates in volumes for 2022 will be adjusted in the forthcoming releases of the forecasts.

For obvious reasons (significant unpredictability of the pandemic, unknown direction of the Omicron wave), the forecasts should be treated with caution. They could be modified by incorporating the incoming trade and macroeconomic data and additional qualitative factors outlined in prior sections.

This column is based on IHS Markit Maritime & Trade Global Trade Analytics Suite (GTAS) data.

The full version of the article is available for our clients on Connect platform. For more details about GTAS, please visit the product page

https://ihsmarkit.com/products/maritime-global-trade-analytics-suite.html

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fGlobal-Trade-Outlook-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fGlobal-Trade-Outlook-2022.html&text=Global+Trade+Outlook+2022.+High+global+trade+volume+growth+in+2021+and+significant+moderation+in+2022.+Supply+chains+disruption+is+likely+to+continue+in+the+first+half+of+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fGlobal-Trade-Outlook-2022.html","enabled":true},{"name":"email","url":"?subject=Global Trade Outlook 2022. High global trade volume growth in 2021 and significant moderation in 2022. Supply chains disruption is likely to continue in the first half of 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fGlobal-Trade-Outlook-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+Trade+Outlook+2022.+High+global+trade+volume+growth+in+2021+and+significant+moderation+in+2022.+Supply+chains+disruption+is+likely+to+continue+in+the+first+half+of+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fGlobal-Trade-Outlook-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}