Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 10, 2018

Small state-level impacts of potential China import tariffs – for now

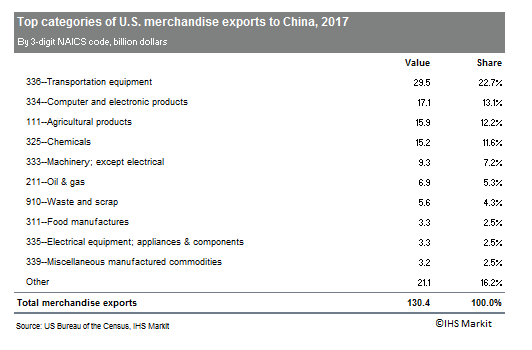

The trade sanctions duel between the United States and China has been escalating over the past couple of weeks, with some tariffs already enacted and a much larger list threatened to come. At the end of March, China imposed tariffs on imports from the United States on aluminum scrap, steel pipe, and a variety of agricultural products including pork products, many types of fruits and nuts, ethanol, and wine. The new tariffs cover goods that amounted to roughly $3 billion in US exports to China last year. These measures are in response to tariffs announced by the Trump administration on US imports of steel and aluminum, as well as US threats to implement an even broader set of tariffs on imports from China in an effort to reduce the bilateral trade deficit and to better protect intellectual property rights. Both sides upped the ante during the first week of April, with announcements of broader lists of threatened sanctions on items accounting for around $50 billion worth of annual trade flowing each way. China’s list of threatened tariffs on imports from the United States includes certain commercial aircraft, automobiles, soybeans, and many other items at the top of the list of US exports to China. Those tariffs are not yet in force, but would take effect by late May pending negotiations.

China is the second-largest economy in the world, so any trade actions it takes are noteworthy. China has also emerged as the third-largest export market for the United States, behind only Canada and Mexico. In 2017, China imported $130.4 billion worth of merchandise from the United States, accounting for 8.4% of total US exports.

Agricultural products a common trade target Since the list of actual and potential tariffs includes pork, soybeans, sorghum, beef, and other agricultural products, much has been made of the idea that China is targeting products from states that tended to vote for President Trump in the 2016 presidential election. Regardless, agricultural products have historically been a focal point of trade disputes. Many countries face internal pressure to support their domestic farm sectors, even if the end result is higher food prices for their own consumers.

The announced tariffs on agricultural products are not welcome news for US farmers, especially amid a multiyear slump in farm incomes. The economic impact in the United States of the sanctions currently in place, including 25% on pork and 10% on a list of fruits and tree nuts, is likely to be minor. The bigger issue for US farmers will arise if the prospective 25% tariff on soybeans is enacted. US soybean exports to China have grown rapidly in recent years and totaled $12.4 billion in 2017, accounting for over 75% of total US exports of agricultural products to China and nearly 10% of total US merchandise exports to China last year. In recent years China has been the destination for around 60% of total US soybean exports, accounting for around 30% of annual US soybean production. Looked at from the other side, US imports accounted for more than one-third of China’s total soybean usage during the last marketing year.

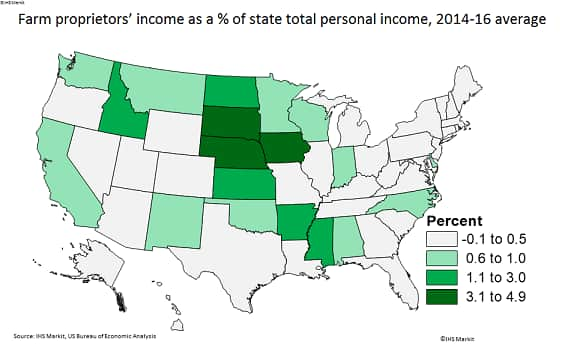

Any action that reduces demand for US agricultural products would reduce prices received by farmers for their output, and diminish farm incomes. The US farm economy has already dealt with several years of low income, leaving balance sheets weaker than they were five years ago. Not surprisingly, states in the midsection of the country would be hit the hardest. Nebraska, South Dakota, and Iowa have the most exposure, with farm income accounting for at least 3% of total personal income in the state from 2014 to 2016. Some states with very large agricultural industries, such as Illinois, have small shares of farm income as a percent of total personal income because of their large metro areas. Outside of the middle of the country, California and Washington will see tariff impacts as they are major producers of fruits and tree nuts that are on the initial tariffs list.

Other potential state impacts of China import tariffs Trade in aircraft also has been mentioned as a possible future target of trade sanctions by China. US exports of civilian aircraft, engines, and parts to China totaled $16.3 billion in 2017, and made up the single biggest category within the Harmonized Schedule of exports. Washington and South Carolina are major producers of aircraft and are among the states with the most reliance on China as an export market; in fact, aircraft are the top export item from each of those states. Alaska and Louisiana also are among the states most economically reliant upon exports to China, thanks to shipments of petroleum and its products.

Bottom line

As things stand in mid-April, trade actions already taken by the United States and China are causing market unease, but the overall economic impact on states would be relatively low. If the broader set of sanctions on around $50 billion worth of US exports to China goes into effect, however, then the impacts will be more economically significant. In the interim, the policy uncertainty will continue to roil the business plans of manufacturers, farmers, and other capital-intensive industry segments that feature long-term planning horizons. Our US regional analysts will continue to monitor events and adjust the state and metro outlooks accordingly.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fSmall-state-level-impacts-potential-China-import-tariffs-for-now.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fSmall-state-level-impacts-potential-China-import-tariffs-for-now.html&text=Small+state-level+impacts+of+potential+China+import+tariffs+%e2%80%93+for+now","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fSmall-state-level-impacts-potential-China-import-tariffs-for-now.html","enabled":true},{"name":"email","url":"?subject=Small state-level impacts of potential China import tariffs – for now&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fSmall-state-level-impacts-potential-China-import-tariffs-for-now.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Small+state-level+impacts+of+potential+China+import+tariffs+%e2%80%93+for+now http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fSmall-state-level-impacts-potential-China-import-tariffs-for-now.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}