Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 24, 2018

What does the Tax Cuts and Jobs Act mean for commodity prices?

Congress passed the Tax Cuts and Jobs Act (TCJA) on Wednesday, 20 December, sending the bill to President Trump, who has now signed it into law. It will incentivize investment, boosting aggregate demand for commodities; however, it will also strengthen the dollar, which will be a headwind to commodity prices. TCJA certainly has implications for the US economy; however, when considering its effects on commodity prices within the context of the global economy, we believe it will have only a marginal impact.

Growth

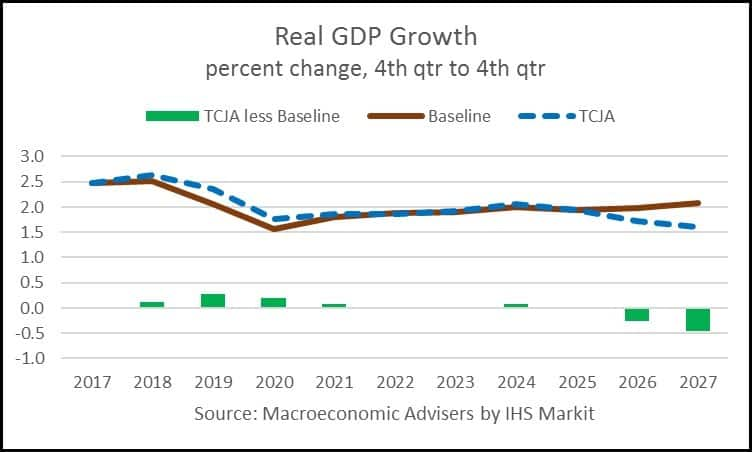

TCJA will have a moderately simulative effect on the US economy. Relative to our current baseline projection, we expect US GDP growth will be 0.1 percentage point higher in 2018 at 2.9%, with the unemployment rate dipping to 3.7%. Further out, our outlook for real GDP has been revised up by 0.2% in 2019 and 2020. The projected increase in growth is due in part to an increase in capital expenditures, as several provisions in TCJA incentivize new investments. These new rules impacting investment spending will have the biggest impact on commodity prices, boosting demand.

Investment

The highlight of TCJA is a corporate tax cut of the top rate from 35% to 21%, which will free up a sizable amount of cash for corporations. TCJA also shifts the United States from an international tax system to a territorial tax system, meaning US corporations will no longer be taxed on profits made by foreign subsidiaries. For corporations who decide to repatriate profits, a onetime transition tax will be imposed of 15.5% for liquid assets and 8.0% for physical assets. US corporations are holding more than $2.5 trillion in cash overseas—the new lower transition tax rate will incentivize corporations to repatriate at least some of these funds.

TCJA increases bonus depreciation to 100% for the next five years on qualifying assets, before phasing it out over the subsequent five years, providing a strong incentive to taxpayers to increase capital expenditures. Private businesses got a tax break as well with TCJA; the new law added a deduction for pass-through business income. Like their corporate counterparts, private owners will use part of this windfall for new investment.

Due to increased investment activity, we anticipate the amount of capital produced in the United States will be about 0.9% higher than prior expectations over the next 10 years—a modest revision upward. This will contribute to a higher aggregate demand, putting moderate upward pressure on commodity prices. However, other factors will eclipse the moderate impact that investment incentivized by TCJA will have on commodity prices.

The dollar and inflation

TCJA will further strengthen the dollar, which will prove to be a headwind for commodity prices in 2018. If the economy appears to begin overheating, the Federal Reserve may choose to hike interest rates four times in 2018 as opposed to three; however, we still expect three interest rate hikes for 2018. After the Federal Open Market Committee (FOMC) meeting this December, Chairwomen Yellen said she believed TCJA would provide a "modest" boost to growth (not enough to justify another rate hike), indicating the Fed remains on track for three interest rate hikes next year. If a fourth interest rate hike were to be added in 2018, this would further strengthen the dollar, putting more downward pressure on commodity prices.

Commodity prices

Passage of TCJA has not changed our outlook of range-bound commodity prices in 2018. The stimulus provided by the tax bill to the US economy does mean marginally stronger aggregate global demand, which places moderate upward pressure on commodity prices; however, the corresponding strengthening of the US dollar will also create a headwind. Commodity markets are currently pricing in the stimulus of the tax cut, making further upside risk less likely. China, not the United States, will be the driver of commodity prices over the near term. Tighter credit markets in China, which may be forced to act more aggressively because of a faster normalization of US interest rates, will slow growth over the near term. Slower growth in China, given its footprint in commodity markets, will more than offset the stimulative effects TCJA will have on US growth and consumption.

Bottom line: Despite the moderate stimulus to the US economy and the impacts different industries will see due to TCJA, we have not changed our outlook for commodity prices in 2018: we still see them range bound. Other factors—a slowing Chinese economy, tightening credit markets, a strengthening dollar, and stable/falling oil prices—will check any sustained price gains in 2018.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fWhat-does-the-Tax-Cuts-and-Jobs-Act-mean-for-commodity-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fWhat-does-the-Tax-Cuts-and-Jobs-Act-mean-for-commodity-prices.html&text=What+does+the+Tax+Cuts+and+Jobs+Act+mean+for+commodity+prices%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fWhat-does-the-Tax-Cuts-and-Jobs-Act-mean-for-commodity-prices.html","enabled":true},{"name":"email","url":"?subject=What does the Tax Cuts and Jobs Act mean for commodity prices?&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fWhat-does-the-Tax-Cuts-and-Jobs-Act-mean-for-commodity-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=What+does+the+Tax+Cuts+and+Jobs+Act+mean+for+commodity+prices%3f http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fWhat-does-the-Tax-Cuts-and-Jobs-Act-mean-for-commodity-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}