Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 09, 2023

AMC, the best show in town

An upcoming vote to merge the preference and ordinary shares of AMC stock push securities lending fees higher

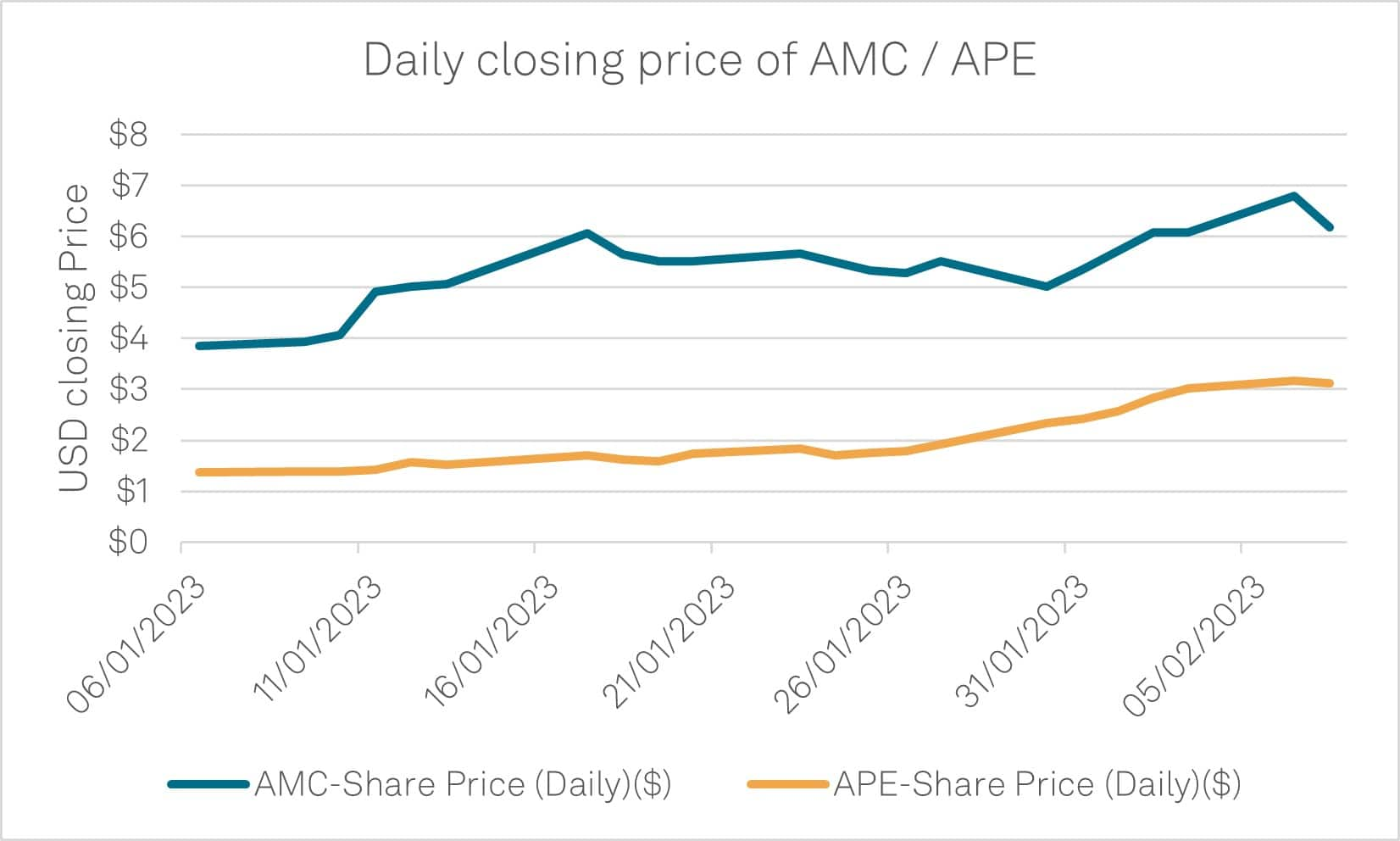

Borrowing activity in AMC continues to increase following market expectation that an upcoming vote will give permission for a 1:1 share offer to take place between the ordinary line (AMC) and its preference shares line (APE), as part of an ongoing cash raising and refinancing program. On the 7th February 2023, AMC shares were valued at $6.80, APE shares were valued at $3.11. The price gap is still significant ($3.69) but has been closing over the last few weeks.

During a 1:1 share offer, market participants seek to arbitrage the difference in price between two lines of stock. Investors in this case would buy APE shares (whilst also buying protection in case of the vote collapsing) and borrow AMC shares. The AMC shares would then be sold in the market at the current price. Upon completion of the share conversion, the new share line would be expected to trade at a price between the two original lines of stock. Investors would buy the new line at the lower price and return these to the lender, keeping the difference between the original sale price of the AMC shares and the repurchase price of the new consolidated line.

Borrowing AMC shares was already challenging before the appearance of this opportunity. Not only have borrowing fees increased dramatically since mid-December but utilization has now also risen to over 99%. This transaction may be being referred to as a "home run" in the press but given the challenge to source the stock in the securities finance markets, it appears that many investors will have watch from the sidelines in the dugout.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2famc-the-best-show-in-town.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2famc-the-best-show-in-town.html&text=AMC%2c+the+best+show+in+town+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2famc-the-best-show-in-town.html","enabled":true},{"name":"email","url":"?subject=AMC, the best show in town | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2famc-the-best-show-in-town.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=AMC%2c+the+best+show+in+town+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2famc-the-best-show-in-town.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}