Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Dec 18, 2019

APAC dividends to hit record high in 2020

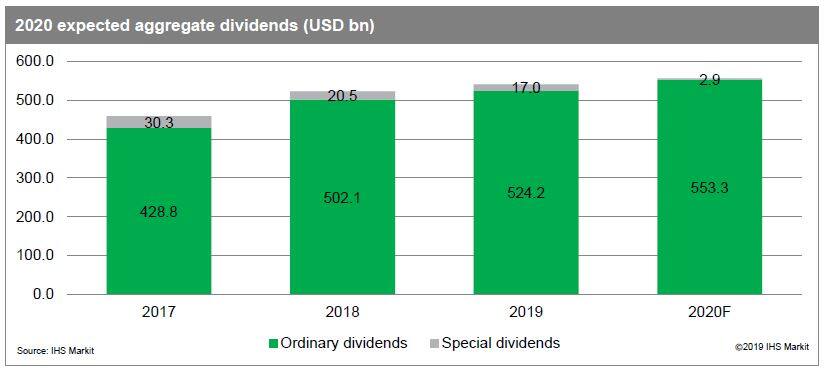

Ordinary dividends paid by companies in Asia Pacific are set to end the year at a record of USD 524.2bn. Despite headwinds stemming from various factors such as trade uncertainties, we remain sanguine about the dividend outlook over the short term and are projecting regular payouts to increase 5.6% to USD 553.3bn in 2020. Including specials, total dividends are expected to come in at USD 556.2bn in the same year. The strengthening of the US Dollar against a few key Asian currencies such as Chinese Yuan, Australian Dollar and South Korean Won suggests that this growth could be higher if measured on a constant currency basis.

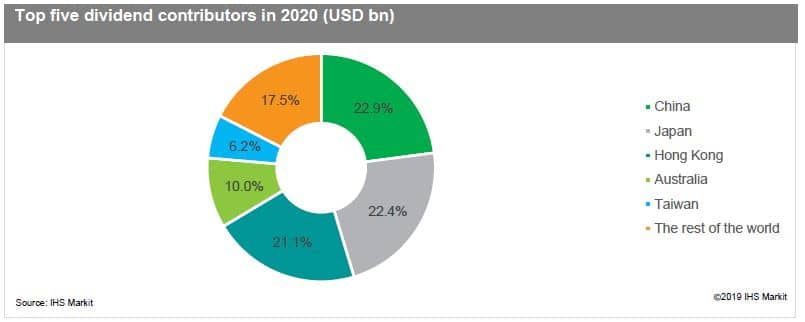

Consistent with the pattern in previous years, China, Japan and Hong Kong continue to be the top three dividend payers around the region. On aggregate, the expected increase of their dividends account for around 86% of the projected growth in payouts in 2020. Projected growth demonstrated by China (12.2%) and Hong Kong (9.4%) suggest that companies in both mainland China and the Special Administrative Region remain unfazed by the ongoing trade war and social unrest that lasted for around six months.

Traditional finance theory implies that record high dividends reported this year could suggest that companies are still generally upbeat on their short-term outlook. We highlight that there is no unifying theme to explain this show of confidence as dividends from different countries are influenced by different factors. The trade war however, is mounting pressure on the profitability of companies in export-driven economies such as South Korea and Taiwan, posing a threat to dividends. Our estimates show that South Korea and Taiwan are estimated to cut their payouts by 6.4% and 10.7% respectively in 2020 when measured in dollar terms.

To access the report, please contact dividendsupport@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-dividends-hit-record-high-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-dividends-hit-record-high-2020.html&text=APAC+dividends+to+hit+record+high+in+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-dividends-hit-record-high-2020.html","enabled":true},{"name":"email","url":"?subject=APAC dividends to hit record high in 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-dividends-hit-record-high-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=APAC+dividends+to+hit+record+high+in+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-dividends-hit-record-high-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}